Mortgage Advice Laindon Essex (SS15): If you are in the market to purchase or sell a home in Laindon or if you wish to refinance or renew your existing mortgage then you need mortgage advice. Often, your first thought is to go to your local bank to get the advice you are looking for, but this may not be the best option for you.

Arranging mortgage financing used to be simple, but has become more and more complicated as the Government has changed rules and regulations governing the lenders who provide mortgage financing. When you need mortgage advice in Laindon you need a professional who deals with mortgages and mortgage lenders full time.

Mortgage advisors are basically financial advisers specialised in the mortgage market. The market has undergone so much change in recent years and is likely to see more to come, means that getting specialist advice may well be more important than ever before. Currently there seems only way that interest rates can go - up.

With this in mind picking the right mortgage is hugely important. The advantage of using the services of a mortgage advisor is simply that you have access to a professional who can search the market for you and find a deal that suits your circumstances now, as well as offering advice on how affordable the mortgage is likely to remain.

To choose the best mortgage broker in Laindon you must ask these three questions:

1. Ask your mortgage adviser how long he has been in business, and how much business he does each month. - If you are looking for mortgage advice in Laindon, then you are going to want to ask a professional who has been in the business for at least 5 years and has had experience with many different situations. The best mortgage advisor will be funding more than 8 - 10 mortgages each month.

2. How many lending institutions does the mortgage advisor work with & who are his/her top three? - You can choose to work with an individual who works with only one bank (or lender) or you can choose to work with a mortgage broker who deals with many banks (or lenders). The more lenders a mortgage broker works with, the more choice that he can offer to you and the more likely you will find a mortgage that best suites your specific needs. The best Laindon mortgage broker will deal with and have a strong relationship with at least 5-7 different banks or lenders. Many brokers advertise that they work with 30+ banks, however, most only send their clients to 2 or 3 of the 30 lenders available to them.

3. Does the mortgage advisor that you want to work with do this full time, or part time? - Though a simple question, the answer is very important. The best mortgage broker in Laindon is working for you on a full time basis. He is a professional who is knowledgable about all aspects of mortgage financing and is aware of changes in legislation and lender guidelines as they happen. He will be available to work for you when you need him.

The best mortgage advice specialists in Laindon develop relationships with each bank and they build these relationship by referring their clients to each bank. The more referrals that the mortgage broker sends to the bank the stronger the relationship that the mortgage broker develops. The better relationship a broker has with a bank, then the lower the rate the broker can often offer to his clients at that bank. Your best Laindon mortgage advice specialist will also have more flexibility to get mortgages approved if his clients need exceptions to the lender's policies.

The more business volume a mortgage brokerage sends to a bank the more flexibility he has with the rates and policies. Mortgage brokerage offices that don't have a huge volume of business can't develop enough relationships with banks to offer clients adequate choice.

To receive good mortgage advice you need to choose the best possible mortgage broker in Laindon. A full time professional who has a strong relationship with at least 5 to 7 lenders and who has the experience to help you with your specific and individual needs.

You can, of course, get mortgage advice from the bank direct. However, their advisors are limited to only the bank's own products. They will do their best to match a mortgage to your needs but have limited options when only dealing with their own products. Independent mortgage advisors will normally have access to a much bigger range of products available from different banks and building societies. Different advisors operate in different ways; mortgage advisors that are linked to a restricted number of lenders and can offer advice only the products supplied by those they are linked to. This is not a bad thing, but may limit the spread of mortgages they can advise upon. The main advantage to potential users is that tied mortgage advisors don't charge an upfront fee but will take a commission when you purchase a mortgage through them. Independent mortgage advisors will charge an upfront fee - however they will not be linked to mortgage companies and in most cases can offer a wider range of advice.

Whichever route you choose - dealing direct with the bank or using the services of a mortgage advisor getting the decision right is crucial. Despite great deals on offer from the banks - attempting to stimulate growth in the housing market - the best deals can most readily be sourced through mortgage advisors. Anyone stepping on to the property ladder or moving up a rung or two is well advised to consider finding a mortgage advisor who can give you the best overview of the products available. Getting the right mortgage advice on one of the biggest financial decisions you will make should be a priority for everybody in this uncertain financial climate.

Independent mortgage brokers in Laindon have specialist software that can scan the entire mortgage market in minutes, helping them to provide quality mortgage advice that will help you choose the right mortgage product for your individual circumstances.

In this day and age no two people have the same set of financial circumstances. This is one of the reasons why there is a wide range of mortgage products available on the market today.

This is why it is more important than ever before to receive expert mortgage advice before buying your first home or remortgaging an existing one.

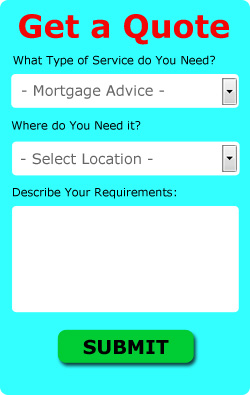

Finding a mortgage broker that can offer you mortgage advice has never been easier. There are thousands of registered mortgage brokers in the UK, many of whom advertise on the internet and in the local press.

There is also a wide range of online and offline directories that contain listings of mortgage brokers in most local areas. However, with the ease of communicating over long distances these days, it is not necessary to receive mortgage advice from a local mortgage broker.

Mortgage advice can be accessed in Laindon and also nearby in: Great Burstead, Little Burstead, Galmington, Basildon, South Fields, Dunton, Fobbing, North Benfleet, Bulphan, Corringham, Nevendon, Langdon Hills, Herongate, Crays Hill, Gardiners Way, together with these postcodes SS15 6BQ, SS15, SS15 5XG, SS15 6BH, SS15 5UZ, SS15 5GN, SS15 5PT, SS15 6BG, SS15 5XA, SS15 5DY. Locally based Laindon mortgage advisers will most likely have the dialling code 01268 and the postcode SS15.

Laindon Mortgage Advice Tasks

Local Laindon mortgage brokers will be able to help you with young adults mortgage advice, bad credit mortgage advice, mortgage advice for seniors, self-build mortgages, first time buyer advice, cheap mortgage advice, mortgage advice for the self-employed, mortgage advice for NHS, professional mortgage advice, mortgage advice for separated couples, bridging finance, mortgage advice for single mums, remortgages, poor credit mortgage advice, buy to rent mortgage advice Laindon, moving home advice Laindon, mortgage advice for over 60s, self-employed mortgage advice, secured loans, new build mortgage advice, and plenty more.

Mortgage Advice Essex

In Essex you will additionally discover: Frinton on Sea mortgage brokers, Silver End mortgage brokers, Elsenham mortgage advice, Fordham mortgage advisers, West Bergholt mortgage advice, Epping mortgage brokers, Chalkwell mortgage advice, Purfleet mortgage advisors, Great Wakering mortgage advisers, Langham mortgage broker, East Donyland mortgage brokers, Sheering mortgage brokers, Littlebury mortgage broker, Stanway mortgage advisers, Pitsea mortgage brokers, Little Baddow mortgage broker, Little Waltham mortgage brokers, Mayland mortgage brokers, Kelvedon Hatch mortgage advice, Bicknacre mortgage advisers, High Garrett mortgage brokers, Hornchurch mortgage advisers, Cold Norton mortgage broker, Abridge mortgage brokers, mortgage advice, Danbury mortgage brokers, Hook End mortgage brokers, Langham mortgage broker, West Mersea mortgage brokers.

Mortgage Advice Enquiries Essex

Current Essex mortgage advice projects: Ria Lee from Castle Hedingham, Essex asked "are there any mortgage brokers near me?". Markus Blythe in Alresford Essex needed right to buy mortgage advice. Kyron Blackburn from Althorne Essex needed over 60s mortgage advice. Alannah Duke from Blackmore needed bad credit mortgage advice. Jacob Chatterton from Heybridge Essex needed buy to let buyer mortgage advice. Jaden Whitehead from High Garrett, Essex was looking for a local mortgage broker. Andy Sutton was trying to find a mortgage broker near Tye Green. Khaleesi Burr was trying to find a mortgage adviser near Thaxted.

Mortgage Advice Near Laindon

Also find: Corringham mortgage advice, Bulphan mortgage advice, Dunton mortgage advice, South Fields mortgage advice, North Benfleet mortgage advice, Galmington mortgage advice, Fobbing mortgage advice, Langdon Hills mortgage advice, Basildon mortgage advice, Crays Hill mortgage advice, Herongate mortgage advice, Nevendon mortgage advice, Great Burstead mortgage advice, Gardiners Way mortgage advice, Little Burstead mortgage advice and more.

Mortgage Advice Laindon

- Laindon Bad Credit Mortgage Advice

- Laindon Right to Buy Advice

- Laindon Self-Employed Mortgage Advice

- Laindon Moving Home Mortgage Advice

- Laindon First Time Buyer Advice

- Laindon Mortgage Advice

- Laindon Remortgages

- Laindon First Time Buyer Mortgage Advice

- Laindon Remortgage Advice

- Laindon Buy to Let Advice

- Laindon Secured Loans

- Laindon Cheap Mortgage Advice

- Laindon Buy to Rent Mortgage Advice

- Laindon Poor Credit Mortgage Advice

Mortgage Advice Around Laindon: Folks who live in the following streets and roads have just recently asked for mortgage advice - Devonshire Road, Spinneywood, Hermitage Drive, Parsonage Lane, Carol Court, Elverston Close, Bramston Link, Seymour Close, Dickens Court, Robinia Close, Autumn Mews, Hedgerow Court, Doves Mews, Duke Place, Roosevelt Road, Nursery Gardens, Regent Court, Parish Way, Larch Close, Winter Folly, Sylvan Way, Lime Place, Ladysmith Way, Church Road, New Century Road, Trinity Close, Wraysbury Drive, Pilgrim Way, Sylvan Close, Alder Close, as well as these local Laindon postcodes: SS15 6BQ, SS15, SS15 5XG, SS15 6BH, SS15 5UZ, SS15 5GN, SS15 5PT, SS15 6BG, SS15 5XA, SS15 5DY.

Mortgage Advice Laindon

Mortgage Advice Laindon Mortgage Advice Near Laindon

Mortgage Advice Near Laindon Mortgage Brokers Laindon

Mortgage Brokers LaindonTo get local Laindon info check here

More Essex Mortgage Brokers: More Essex mortgage advice: North Weald Bassett, Waltham Abbey, Harlow, Tilbury, Holland-on-Sea, Hullbridge, Rochford, Purfleet, Laindon, Galleywood, Hadleigh, Rainham, Loughton, Great Dunmow, Great Wakering, Witham, Tiptree, West Mersea, Barking, Harwich, Dagenham, Southend-on-Sea, Chipping Ongar, Walton-on-the-Naze, Stansted Mountfitchet, Wickford, Frinton-on-Sea, Westcliff-on-Sea, Chafford Hundred, Heybridge, Leigh-on-Sea, Stanway, Writtle, Southminster, Canvey Island, Manningtree, Shoeburyness, South Benfleet, Danbury, Corringham, Burnham-on-Crouch, Southchurch, South Woodham Ferrers, West Thurrock, Hornchurch, Rayleigh, Stanford-le-Hope, Colchester, Ilford, Buckhurst Hill, Maldon, Braintree, Chigwell, Brightlingsea, Clacton-on-Sea, Ingatestone, Pitsea, South Ockendon, Wivenhoe, Romford, Halstead, Hawkwell, Great Baddow, Chelmsford, Parkeston, Hockley, Brentwood, Basildon, Epping, Chingford, Billericay, Saffron Walden, Upminster, Coggeshall, Langdon Hills and Grays.

Mortgage advice in SS15 area, and dialling code 01268.

Right to Buy Advice Laindon - SS15 - Mortgage Advisers Laindon - 01268 - First Time Buyer Advice Laindon - Buy to Let Advice Laindon - Remortgage Advice Laindon - Mortgage Advice Laindon - Mortgage Brokers Laindon