Payroll Services Livingston Scotland (EH53): Employee motivation and satisfaction rely heavily on the punctual payment of wages every month, underscoring its significance. However, for small businesses in Livingston struggling to ensure a reliable payroll service amidst changing tax laws, deadlines, and personnel changes, exploring the options provided by outsourced payroll companies in the Livingston area is worth considering.

Did you know that handling payroll internally can lead to audits and penalties for miscalculations in over 30 percent of UK businesses? If you're looking to simplify payroll processing and enhance its efficiency, wouldn't it be advantageous to free yourself from these challenges? Reputed service providers in Livingston can substantially reduce the costs associated with payroll processing. Read on to uncover the seven habits that set apart highly effective payroll providers in the Livingston area.

Flexible Billing: In Livingston, you can find numerous reputable payroll service providers offering various fee structures. While most providers levy setup fees and a flat fee per employee per payroll cycle, some Livingston payroll processing companies introduce alternative fee structures that include additional charges, over and above the yearly flat fee per employee, for supplementary services.

Accountability: Reputable firms shoulder responsibility and accountability for any payroll errors, promptly addressing and rectifying mistakes. Effective payroll service providers incorporate an error checking system within their processes to detect errors before checks and money transfers are issued.

Compliance: Compliance with pertinent tax laws is a hallmark of effective providers. By enforcing stringent checks and balances, reputable payroll providers substantially reduce or eliminate audits and penalties arising from non-compliance during payroll processing or payroll tax processing.

Online Data Transfer: Timely and convenient delivery of payroll data to your provider is a fundamental requirement for seamless payroll processing. In Livingston, effective payroll service providers facilitate online data transfer, allowing for the necessary payroll processing information. Additionally, they offer online systems accessible through web interfaces, removing the need for costly software installation and maintenance.

Online Tools: Payroll services in Livingston offer a range of online tools to benefit your staff, such as tools to view, print, and make deductions changes to payroll stubs and tax forms. Additionally, payroll providers provide various online tools for business owners, including functionalities to enter time card information for hourly staff and monitor payroll expenditures and deductions, allowing you to assess and regulate your finances effectively.

Customer Service: An effective payroll processing company in Livingston will provide you with excellent customer service characterised by quick responsiveness to your queries. It is of utmost importance that your provider offer you a short turnaround time for rectifying mistakes in paychecks, creating new accounts for new employees and addressing other payroll related issues.

Advanced Services: In Livingston, advanced services offered by effective payroll service providers enable you to further alleviate payroll issues and enhance efficiency. When it comes to retirement plans, they collaborate with financial advisers to assist your staff in making informed investment decisions. Additional services encompass conducting background checks, distributing crucial communications to staff members as needed, and managing the enrollment and monitoring of employee benefits programs such as healthcare and life insurance.

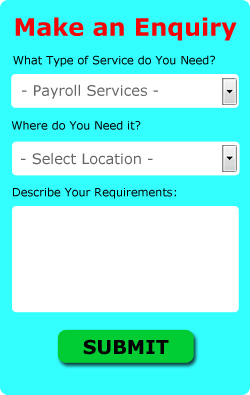

To make an informed decision, it is recommended to survey several payroll providers in Livingston, examining the services offered and the fees charged. To ensure quality and reliability, obtain references and research the performance and market reputation of your preferred providers. Lastly, consult your solicitor and accountant to review all contracts before signing.

What to Look for in a Payroll Service in Livingston

The task of choosing a payroll company in Livingston can be made simpler and less confusing. By asking a few short questions and comparing payroll companies, businesses can easily determine the option that fits them best.

When considering a payroll company, one of the initial decisions to be made is regarding their scope. Is the payroll service national or local? Given that many businesses frequently change locations, opting for a national payroll service becomes vital. National-level payroll providers possess a larger staff and extensive expertise in payroll regulations. Regardless of the areas covered, the chosen payroll provider should assist companies in maintaining compliance with national employment laws through the use of compliance software or employee classification audits. Therefore, the first step in selecting a payroll company in Livingston is to ascertain their operational level.

Before making a selection, it is essential to ascertain the party accountable for any payroll mistakes. A reputable and dependable payroll service in Livingston should always commit to taking responsibility for such errors. Whether it involves a late payment or an inaccurate calculation, the payroll company should bear the responsibility of rectifying these issues.

An additional aspect to consider is the requirement for web accessibility in a payroll service. The ability to access payroll anytime and anywhere provides immense convenience for businesses. Instead of being bound by specific timeframes, web access offers greater flexibility in managing the payroll schedule. Moreover, it enhances user-friendliness, allowing employers to thoroughly review payroll information before submitting it. When opting for a web-based interface, it is vital to ensure the system is not overly complicated. A payroll system should be straightforward, clear, and concise.

The company should, finally, determine how the payroll provider calculates fees. Is the charge based on the number of times payroll is processed each month? Are fees accrued based on the number of employees included in the payroll? Are there any additional monthly fees? These are all questions that need to be addressed prior to selecting a payroll company in Livingston.

Coming Soon:

Employee payslips.

Payroll Services Near Livingston

Also find: Winchburgh payroll services, Polbeth payroll services, Kirknewton payroll services, Kirkton Campus payroll services, East Calder payroll services, Dechmont payroll services, Pumpherston payroll services, Uphall payroll services, Seafield payroll services, Deans payroll services, Livingston Village payroll services and more.

Livingston Payroll Services Tasks

Local Livingston payroll service companies will be able to help you with customised payslips, innovative payroll solutions, payroll for small businesses, cost analysis of employees, credit control, employee payslips, small business payroll services, international payroll in Livingston, statutory accounts Livingston, electronic payslips, sole trader payroll services in Livingston, group reporting, statutory sick pay, dedicated account managers in Livingston, statutory maternity pay, company secretarial Livingston, VAT compliance, payroll support services in Livingston, SAGE payroll services, cashflow management, contract payroll services Livingston, and plenty more.

TOP - Payroll Services Livingston

Payroll Services Near Livingston - Credit Control Livingston - Cashflow Management Livingston - Payroll Services Livingston - Outsourced Payroll Livingston - Bookkeeping Services Livingston - Managed Payroll Livingston - Payroll Livingston - Company Secretarial Livingston