Payroll Services Tring Hertfordshire (HP23): Punctual payment of wages each month is crucial for preserving employee motivation and satisfaction. However, small businesses in Tring may encounter challenges in delivering a reliable payroll service due to ever-changing tax laws, deadlines, and personnel shifts. In such circumstances, exploring the available choices with outsourced payroll companies in the Tring area may be worthwhile.

In Tring, have you considered the fact that more than 30 percent of UK businesses that handle payroll internally face audits and penalties due to miscalculations? If you wish to streamline payroll processing and improve efficiency, would you like to be relieved of these burdens? Did you know that established service providers can significantly lower the costs associated with payroll processing? Discover the distinguishing traits of highly effective payroll providers in the Tring area as we delve into the seven habits.

Online Tools: In Tring, a variety of online tools are provided by payroll services for your staff, enabling them to view and print payroll stubs and tax forms, as well as make deductions changes. Additionally, payroll providers offer online tools for business owners, including features for inputting time card information for hourly staff and monitoring payroll expenditures and deductions, empowering you to evaluate and manage your finances effectively.

Accountability: Reputable firms demonstrate responsibility and accountability for any payroll errors, promptly identifying and rectifying mistakes. Through the use of an in-built error checking system, effective payroll service providers catch errors before issuing checks and money transfers.

Customer Service: Excellent customer service, marked by prompt responsiveness to your inquiries, is a key feature of an effective payroll processing company in Tring. Your provider's ability to swiftly rectify mistakes in paychecks, create new accounts for employees, and address various payroll-related matters is of utmost importance.

Compliance: Effective providers ensure full compliance with relevant tax laws. Through the implementation of rigorous checks and balances, reputed payroll providers greatly diminish or eliminate audits and penalties stemming from violations during payroll processing or payroll tax processing.

Online Data Transfer: To ensure smooth payroll processing, it is essential to deliver payroll data to your provider in a timely and convenient manner. Effective payroll service providers in Tring offer online data transfer options for essential payroll processing information. They also provide web-based systems accessible through interfaces, eliminating the need for expensive software installation and upkeep.

Flexible Billing: Tring is home to excellent payroll service providers who offer diverse fee structures. While the majority of providers implement initial setup fees and charge a flat fee per employee per payroll cycle, specific payroll processing companies in Tring present distinct fee structures that involve additional charges, beyond the yearly flat fee per employee, for supplementary services.

Advanced Services: Effective payroll service providers in Tring present a range of advanced services that effectively reduce payroll problems and enhance efficiency. They partner with financial advisers to assist your staff in making appropriate investment decisions for retirement plans. Other services include conducting background checks, distributing key communications to staff members when necessary, and managing the enrollment and monitoring of employee benefits programs, such as healthcare and life insurance.

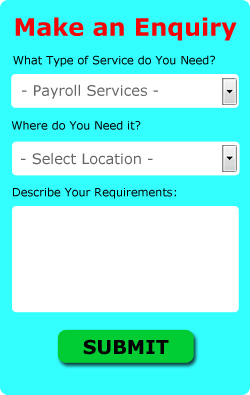

Before finalizing your decision, it is advisable to survey a number of payroll providers in Tring, evaluating the range of services offered and the fees charged. To ensure reliable and quality service, obtain references and conduct research on the performance and market reputation of your preferred providers. Lastly, consult your solicitor and accountant for contract review before signing on the dotted line.

What to Look for in a Payroll Service in Tring

Simplifying the process of selecting a payroll company in Tring, it doesn't have to be complicated or confusing. By asking a few concise questions and comparing different payroll companies, businesses can easily determine the option that suits them best.

When evaluating a payroll company, one of the initial decisions to consider is their scope. Is the payroll service provided on a national or local level? Since businesses frequently change locations, it becomes crucial to select a national payroll service. National-level providers boast a larger staff and possess significant expertise in payroll regulations. Regardless of the covered areas, the chosen payroll provider should assist companies in maintaining compliance with national employment laws through compliance software or employee classification audits. Therefore, the first step in choosing a payroll company in Tring is to ascertain their operational level.

Prior to making a selection, it is crucial to establish who assumes responsibility for any payroll mistakes. A reputable and dependable payroll service in Tring should always guarantee that they will take on liability for such errors. Whether it involves a late payment or an inaccurate calculation, the responsibility for rectifying these issues should solely rest with the payroll company.

Web accessibility is a crucial aspect to consider for a payroll service. The ability to access payroll at any time and from any place provides significant convenience for businesses. Instead of being constrained by specific times and dates, web access allows for greater control over the payroll schedule. Moreover, it enhances user-friendliness, enabling employers to thoroughly review payroll information before submission. When opting for a web-based interface, it is vital to ensure the system is not overly complicated. A payroll system should be straightforward, clear, and concise.

The last consideration is for the company to ascertain the method by which the payroll provider calculates fees. Does the provider charge based on the frequency of payroll completion within a month? Are fees determined by the number of employees for whom payroll is processed? Are there any supplementary monthly charges? These are all inquiries that should be addressed before finalizing a payroll company in Tring.

Coming Soon:

Employee payslips.

Tring Payroll Services Tasks

Local Tring payroll service companies will be able to help you with payroll support services, RTI submissions, emergency payments, self-assessment, credit control, SAGE payroll services, accounting payroll sevices, statutory accounts, cheap payroll services, innovative payroll solutions, payroll administration in Tring, customised payslips in Tring, cashflow management, custom reporting, company secretarial, tax consulting in Tring, electronic payslips, auto-enrolment, outsourced payroll Tring, CIS returns Tring, employee payslips, and plenty more.

Payroll Services Near Tring

Also find: Dancers End payroll services, Chivery payroll services, Marsworth payroll services, New Mill payroll services, Wigginton payroll services, Aldbury payroll services, Bulbourne payroll services, Northfield payroll services, Drayton Beauchamp payroll services, Church End payroll services, Cow Roast payroll services, Tringford payroll services and more.

Company Secretarial Tring - Credit Control Tring - Payroll Services Near Tring - Cashflow Management Tring - Payroll Administration Tring - VAT Compliance Tring - Payroll Services Tring - Group Reporting Tring - Bookkeeping Services Tring