Accountants Broxbourne: Does filling out your self-assessment tax form give you a headache every year? You, along with lots of others who are self-employed in Broxbourne, face this annual trauma. Of course, you could always get yourself a local Broxbourne accountant to do this job instead. If you find self-assessment too taxing, this could be much better for you. A run of the mill accountant or bookkeeper in Broxbourne will likely charge you in the region of £200-£300 for completing your self-assessment form. If you don't have a problem with online services you'll be able to get it done for a lower figure than this.

So, what type of accounting service should you search for and how much should you pay? A substantial list of prospective Broxbourne accountants may be identified with just a few minutes searching on the internet. However, which of these Broxbourne accountants is best for you and which one can be trusted? The fact that almost anybody in Broxbourne can claim to be an accountant is a thing that you need to bear in mind. They are able to offer accounting services in Broxbourne whether they have got qualifications or not. Which, like me, you might find astounding.

You would be best advised to find a fully qualified Broxbourne accountant to do your tax returns. Your minimum requirement should be an AAT qualified accountant. It is worth paying a little more for that extra peace of mind. Your accountant will add his/her fees as tax deductable.

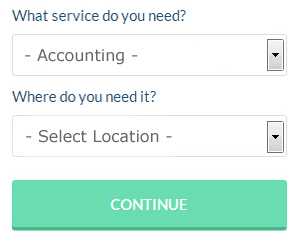

You could use an online service like Bark who will help you find an accountant. With Bark it is simply a process of ticking a few boxes and submitting a form. Your requirements will be distributed to accountants in the Broxbourne area and they will be in touch with you directly.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. Services like this are convenient and cost effective. Some of these companies are more reputable than others. Study online reviews so that you can get an overview of the services available.

Although filling in your own tax return may seem too complicated, it is not actually that hard. You could even use a software program like GoSimple, Xero, Ablegatio, Andica, TaxCalc, BTCSoftware, Gbooks, Taxfiler, Forbes, CalCal, 123 e-Filing, Ajaccts, Nomisma, Taxshield, Capium, Keytime, Absolute Topup, ACCTAX, Basetax, Sage or Taxforward to make life even easier. Whichever service you use your tax returns will need to be in on time to avoid penalties.

Actuaries Broxbourne

An actuary is a business expert who analyses the management and measurement of risk and uncertainty. An actuary applies statistical and financial concepts to evaluate the probability of a certain event happening and its possible monetary ramifications. To work as an actuary it is important to have a statistical, mathematical and economic consciousness of everyday scenarios in the financial world.

Auditors Broxbourne

An auditor is an individual or a firm appointed by an organisation or company to conduct an audit, which is the official evaluation of an organisation's accounts, normally by an impartial body. They sometimes also undertake an advisory role to encourage potential risk prevention measures and the implementation of cost efficiency. To act as an auditor, an individual has to be approved by the regulating body of accounting and auditing and have earned certain specific qualifications. (Tags: Auditors Broxbourne, Auditor Broxbourne, Auditing Broxbourne)

Payroll Services Broxbourne

Payrolls for staff can be a complicated part of running a company in Broxbourne, no matter its size. The laws on payrolls and the legal obligations for transparency and accuracy means that dealing with a business's payroll can be an intimidating task.

All small businesses don't have the help that a dedicated financial specialist can provide, and the easiest way to manage employee pay is to retain the services of an independent Broxbourne accountant. Your chosen payroll accounting company can provide accurate BACS payments to your staff, as well as working together with any pension scheme administrators that your company may have, and follow the latest HMRC regulations for tax deductions and NI contributions.

It will also be a requirement for a professional payroll management accountant in Broxbourne to prepare a P60 declaration for each worker at the end of the financial year (by May 31st). A P45 tax form should also be given to any employee who stops working for your business, in accordance with current legislations. (Tags: Payroll Outsourcing Broxbourne, Payroll Accountants Broxbourne, Payroll Services Broxbourne).

Broxbourne accountants will help with workplace pensions, cash flow Broxbourne, litigation support Broxbourne, self-employed registration, investment reviews, taxation accounting services, VAT returns Broxbourne, National Insurance numbers, double entry accounting Broxbourne, sole traders, accounting services for the construction industry, charities in Broxbourne, partnership registrations Broxbourne, year end accounts in Broxbourne, business outsourcing Broxbourne, corporate finance, payslips in Broxbourne, VAT registrations, self-assessment tax returns, company formations, bookkeeping, capital gains tax, employment law, accounting support services, financial statements, HMRC liaison, business support and planning, limited company accounting, audit and auditing, debt recovery, business acquisition and disposal, tax investigations and other accounting services in Broxbourne, Hertfordshire. These are just some of the duties that are accomplished by local accountants. Broxbourne companies will let you know their full range of accounting services.

Broxbourne Accounting Services

- Broxbourne Bookkeepers

- Broxbourne Self-Assessment

- Broxbourne Forensic Accounting

- Broxbourne Debt Recovery

- Broxbourne Bookkeeping Healthchecks

- Broxbourne Tax Returns

- Broxbourne Business Accounting

- Broxbourne Personal Taxation

- Broxbourne VAT Returns

- Broxbourne PAYE Healthchecks

- Broxbourne Tax Planning

- Broxbourne Account Management

- Broxbourne Financial Advice

- Broxbourne Payroll Management

Also find accountants in: Flamstead, Standon, Sawbridgeworth, Great Hormead, Hare Street, Bulls Green, Stanstead Abbots, Furneux Pelham, Hadham Cross, Hailey, Rushden, Wheathampstead, Hammond Street, Barley, Patmore Heath, Cromer Hyde, Blackmore End, Rye Park, Benington, Hastoe, Elstree, Buckland, Green Tye, Wigginton, Cockernhoe, South Mimms, Wadesmill, Bushey, Norton, Broadwater, Hay Street, Northaw, Peters Green, The Node, Heronsgate and more.

Accountant Broxbourne

Accountant Broxbourne Accountants Near Me

Accountants Near Me Accountants Broxbourne

Accountants BroxbourneMore Hertfordshire Accountants: Ware, Cheshunt, Hitchin, Bushey, Broxbourne, Tring, Hertford, Hemel Hempstead, Watford, Welwyn Garden City, Royston, St Albans, Hatfield, Stevenage, Potters Bar, Abbots Langley, Berkhamsted, Borehamwood, Rickmansworth, Hoddesdon, Harpenden, Bishops Stortford and Letchworth.

TOP - Accountants Broxbourne - Financial Advisers

Investment Accountant Broxbourne - Self-Assessments Broxbourne - Bookkeeping Broxbourne - Financial Advice Broxbourne - Auditors Broxbourne - Tax Advice Broxbourne - Small Business Accountants Broxbourne - Chartered Accountants Broxbourne - Online Accounting Broxbourne