Accountants South Ockendon: Do you seem to get little else but a headache when you fill out your annual self-assessment form? You, along with lots of others who are self-employed in South Ockendon, face this yearly predicament. You may prefer to find a local South Ockendon accountant to do it for you. This may be the best option if you consider self-assessment just too taxing. You can usually get this done by South Ockendon High Street accountants for something in the region of £200-£300. If you're looking for a cheap option you might find the solution online.

With various different kinds of accountants advertising in South Ockendon it can be confusing. Therefore, it's vital that you pick the appropriate one for your business. It's not unusual for South Ockendon accountants to work independently, others prefer being part of an accountancy firm. An accountancy firm will comprise accountants with varying fields of expertise. You should be able to locate an accounting firm offering bookkeepers, management accountants, auditors, financial accountants, chartered accountants, tax accountants, actuaries, forensic accountants, investment accountants, accounting technicians and cost accountants.

Finding an accountant in South Ockendon who is qualified is generally advisable. For simple self-assessment work an AAT qualification is what you need to look for. A certified South Ockendon accountant might be more costly than an untrained one, but should be worth the extra expense. It should go without saying that accountants fees are tax deductable. A lot of smaller businesses in South Ockendon choose to use bookkeepers rather than accountants.

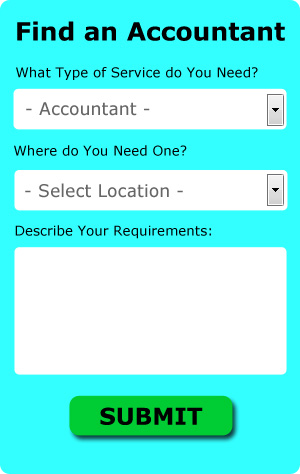

One online service which helps people like you find an accountant is Bark. You just have to fill in a simple form and answer some basic questions. Accountants in your local area will be sent your details, and if they are interested in doing the work will contact you shortly. Why not give Bark a try since there is no charge for this useful service.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. It could be that this solution will be more appropriate for you. Make a short list of such companies and do your homework to find the most reputable. Be sure to study customer reviews and testimonials.

Chartered accountants are the most qualified and highly trained individuals within the profession. Their expertise is better suited to high finance and bigger businesses. You will certainly be hiring the best if you do choose one of these.

Of course, completing and sending in your own self-assessment form is the cheapest solution. Using accounting software like Taxfiler, Basetax, Ajaccts, Capium, Gbooks, Sage, CalCal, BTCSoftware, 123 e-Filing, GoSimple, Nomisma, Forbes, Taxforward, Keytime, TaxCalc, Taxshield, Andica, ACCTAX, Absolute Topup, Xero or Ablegatio will make it even simpler to do yourself. You will get a penalty if your tax return isn't in on time.

Actuaries South Ockendon

An actuary is a professional who analyses the measurement and managing of risk and uncertainty. These risks can impact on both sides of a company's balance sheet and require valuation, asset management and liability management skills. An actuary uses statistics and math concepts to appraise the fiscal impact of uncertainties and help their clientele cut down on potential risks.

How Managing Your Money Better Makes You a Better Business Owner

One of the things that every small business owner struggles with is managing money properly, and this is especially true in the beginning, when you are just trying to find your feet as a business runner and proprietor. These struggles can affect your confidence and if you're having financial problems with your business, the idea of quitting and going back to your old 9-to-5 job becomes more appealing. You won't reach the level of success you're aiming to reach when this happens. Below are a few tips that will help manage your business finances better.

Start numbering your invoice. You may not think that this simple tactic of keeping your invoices numbered is a big deal but wait till your business has grown. Numbering your invoices helps you keep track of them. Not only will it help you find out quickly enough who has already paid their invoices, it will help you find out who still owes you and how much. Expect to have clients who will say they have already paid you. If you've got an invoicing system, you can quickly verify their statement or show proof that no payment has been made. Errors can happen in business too and if you've got your invoices numbered, it makes it easy for you to find those mistakes.

You may be your own boss, but it's still a good idea to give yourself a regular paycheck. Paying yourself like you would a regular employee would make your business accounting so much easier. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. You decide the salary for yourself. Your salary can be an hourly rate or a portion of your business income.

Just as you should track every penny you spend, you should track every penny that goes in as well. Each time you're paid by a client or customer for a service you provided or a product you sold them, record that amount. This way you know the amount of money your business is generating and you can also track the people who has already paid you and identify those whose payments are still pending. This also helps you determine how much taxes you should pay, what salary you should pay yourself, and so on.

Learning how to manage your finances properly will help not just your business but yourself as well. Try to implement these tips we've shared because you stand to benefit in the long run. Keep your finances under control and you can look forward to a better, more successful personal life and business life.

South Ockendon accountants will help with business planning and support in South Ockendon, business acquisition and disposal, bookkeeping, contractor accounts in South Ockendon, financial planning, accounting support services in South Ockendon, personal tax, company formations in South Ockendon, litigation support, sole traders, pension planning in South Ockendon, accounting and financial advice, company secretarial services, accounting services for the construction sector, workplace pensions, accounting services for start-ups in South Ockendon, charities, debt recovery, tax preparation, capital gains tax, employment law, assurance services South Ockendon, monthly payroll, accounting services for property rentals, corporate tax in South Ockendon, double entry accounting South Ockendon, general accounting services in South Ockendon, National Insurance numbers, corporate finance in South Ockendon, compliance and audit reporting, management accounts, cash flow and other forms of accounting in South Ockendon, Essex. These are just a selection of the duties that are accomplished by local accountants. South Ockendon specialists will keep you informed about their entire range of services.

With the world wide web as a useful resource it is extremely easy to uncover a host of valuable ideas and information regarding accounting & auditing, self-assessment help, accounting for small businesses and personal tax assistance. To illustrate, with a very quick search we found this compelling article on the subject of how to find a decent accountant.

South Ockendon Accounting Services

- South Ockendon PAYE Healthchecks

- South Ockendon Tax Advice

- South Ockendon Chartered Accountants

- South Ockendon Payroll Services

- South Ockendon Debt Recovery

- South Ockendon Audits

- South Ockendon Tax Refunds

- South Ockendon Tax Planning

- South Ockendon Business Planning

- South Ockendon Business Accounting

- South Ockendon Bookkeeping Healthchecks

- South Ockendon Self-Assessment

- South Ockendon Tax Services

- South Ockendon VAT Returns

Also find accountants in: Great Henny, Saffron Walden, Frating Green, Causeway End, Knowl Green, Henny Street, Rochford, Elsenham, Oxen End, High Ongar, Southend On Sea, Canvey Island, South Benfleet, Dry Street, Woodham Ferrers, Rawreth, Childerditch, Tollesbury, Blackmore End, Beazley End, Shalford Green, Pilgrims Hatch, Manuden, Peldon, Fuller Street, Littlebury Green, Bumbles Green, Wethersfield, Little Dunmow, Upper Green, Wix, Great Bromley, Purfleet, Takeley, Great Warley and more.

Accountant South Ockendon

Accountant South Ockendon Accountants Near Me

Accountants Near Me Accountants South Ockendon

Accountants South OckendonMore Essex Accountants: Hullbridge, Wickford, Laindon, Hockley, Witham, Great Dunmow, Brentwood, Burnham-on-Crouch, Waltham Abbey, Heybridge, Rochford, Epping, Purfleet, Harwich, Tilbury, Billericay, Ingatestone, Holland-on-Sea, Hornchurch, Hawkwell, Chigwell, Southminster, South Woodham Ferrers, Rayleigh, Walton-on-the-Naze, Romford, West Mersea, Canvey Island, Ilford, Writtle, Chafford Hundred, Stansted Mountfitchet, Upminster, Braintree, Shoeburyness, Colchester, Hadleigh, Chipping Ongar, Maldon, Tiptree, Grays, Saffron Walden, Galleywood, Southchurch, Pitsea, Harlow, Loughton, Brightlingsea, North Weald Bassett, Barking, Southend-on-Sea, Manningtree, Clacton-on-Sea, Stanford-le-Hope, Langdon Hills, South Benfleet, Halstead, West Thurrock, Danbury, Great Baddow, Frinton-on-Sea, Parkeston, Basildon, South Ockendon, Chingford, Wivenhoe, Buckhurst Hill, Coggeshall, Stanway, Westcliff-on-Sea, Chelmsford, Great Wakering, Leigh-on-Sea, Rainham, Dagenham and Corringham.

TOP - Accountants South Ockendon - Financial Advisers

Self-Assessments South Ockendon - Auditing South Ockendon - Online Accounting South Ockendon - Affordable Accountant South Ockendon - Chartered Accountants South Ockendon - Bookkeeping South Ockendon - Small Business Accountant South Ockendon - Financial Accountants South Ockendon - Tax Advice South Ockendon