Accountants Nelson: Do you find that filling in your annual self-assessment form gives you a headache? Don't worry, you aren't the only one, lots of others in Nelson face the same problems. Is it easy to track down a local professional in Nelson to manage this for you? If you find self-assessment too taxing, this could be far better for you. Expect to pay roughly two to three hundred pounds for a regular small business accountant. If this seems like a lot to you, then think about using an online service.

Different kinds of accountant will be marketing their services in and around Nelson. Choosing the right one for your company is critical. Certain accountants work as part of an accountancy practice, while some work solo. A company will employ a number of accountants, each specialising in different areas of accounting. The kinds of accountant that you're likely to find within a practice may include: management accountants, financial accountants, investment accountants, bookkeepers, auditors, chartered accountants, actuaries, accounting technicians, cost accountants, tax preparation accountants and forensic accountants.

Finding a properly qualified Nelson accountant should be your priority. For simple self-assessment work an AAT qualification is what you need to look for. You can then be sure your tax returns are done correctly. Your accountant will add his/her fees as tax deductable.

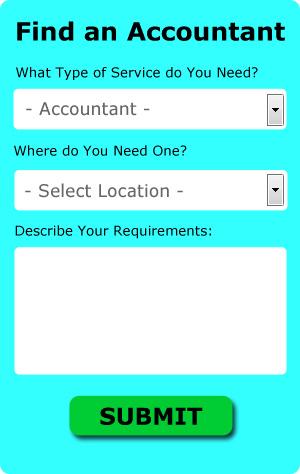

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. A couple of minutes is all that is needed to complete their simple and straighforward search form. Sometimes in as little as a couple of hours you will hear from prospective Nelson accountants who are keen to get to work for you.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. While not recommended in every case, it could be the ideal solution for you. Picking a reputable company is important if you choose to go with this option. Carefully read reviews online in order to find the best available. We prefer not to recommend any particular online accounting company here.

The most highly qualified and generally most expensive within this profession are chartered accountants. Their services are normally required by larger limited companies and big business. You will certainly be hiring the best if you do choose one of these.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example GoSimple, Taxfiler, BTCSoftware, Taxforward, Ablegatio, Keytime, TaxCalc, ACCTAX, Forbes, Basetax, Absolute Topup, Ajaccts, Xero, Capium, Taxshield, Andica, CalCal, Nomisma, Sage, Gbooks and 123 e-Filing. If you don't get your self-assessment in on time you will get fined by HMRC.

The Best Money Management Techniques for Business Self Improvement

Many people find that putting up a business is very exciting. You're your own boss and you're in control of how much you make. Well, you're basically in charge of everything! Now that can be a little scary! Truly, while exhilarating, starting your own business is also quite intimidating because it can be quite difficult to find your feet. This is where you'll find it very helpful to know a few self-improvement techniques such as properly managing your finances. In this article, we'll share a few tips proper money management.

Find yourself an accountant who's competent. This is one of those expenses that is absolutely worth it, as an accountant will manage your books full time. She will help you keep track of the money you have coming in and the money you are sending out, help you pay yourself, and help you meet your tax obligations. What's more, she'll deal with all of the paperwork that is associated with those things. What happens is that you can focus more on building your business, including marketing and getting more clients. When you've got an accountant working for you, you won't end up wasting hours or even days working your finances every week or every month.

Offer your clients payment plans. Besides making it more appealing for potential clients to do business with you, this strategy will have money coming in on a regular basis. It's certainly a lot easier than having money coming in irregularly and you've got long, dry spells. Overall, you can properly manage your business finances when your income is a lot more reliable. It's because you can plan your budget, pay your bills on time, and basically keep your books up-to-date. If you're in control of your business finances, you'll feel more self-confident.

Save every receipt. You'll save yourself a lot of grief if you've got your receipts with you if ever the IRS wants to see where you've been spending your money on. For another, they act as a record of all of your expenditures. It's better if you keep all your receipts in one drawer. This way, if you're wondering why your bank account is showing an expenditure for a certain amount, and you forgot to write it down, you can go through your receipts to find evidence of the purchase. Keep all your receipts in an accordion file in your desk drawer.

When it comes to managing your money properly, there are so many things that go into it. It's a lot more than simply keeping a list of your expenditures. You have other things to track and many ways to do so. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. As you become more skilled in managing your business finances, you'll be able to implement other things that will help make the process easier for you.

Payroll Services Nelson

Staff payrolls can be a challenging part of running a business enterprise in Nelson, no matter its size. The legislation regarding payroll for accuracy and openness mean that processing a business's payroll can be a formidable task.

A small business may well not have the luxury of a dedicated financial expert and an easy way to cope with employee payrolls is to retain the services of an independent payroll company in Nelson. A managed payroll service accountant will work with HMRC, with pensions schemes and set up BACS payments to ensure that your employees are paid on time, and all mandatory deductions are accurate.

Following current regulations, a dedicated payroll management accountant in Nelson will also provide every one of your workers with a P60 at the end of each financial year. A P45 form should also be provided for any member of staff who finishes working for the business, as outlined by current legislations. (Tags: Company Payrolls Nelson, Payroll Accountant Nelson, Payroll Services Nelson).

Nelson accountants will help with litigation support, estate planning, self-employed registration Nelson, company secretarial services, business outsourcing, partnership accounts, accounting services for media companies, capital gains tax Nelson, PAYE Nelson, tax investigations Nelson, limited company accounting in Nelson, National Insurance numbers, corporate tax, VAT registrations in Nelson, financial statements, self-assessment tax returns, management accounts in Nelson, accounting and auditing, double entry accounting, investment reviews in Nelson, small business accounting, company formations Nelson, business advisory services Nelson, bookkeeping, inheritance tax Nelson, assurance services, compliance and audit issues, cashflow projections Nelson, debt recovery, bureau payroll services, accounting services for buy to let rentals, HMRC liaison in Nelson and other accounting related services in Nelson, Lancashire. Listed are just a selection of the tasks that are performed by nearby accountants. Nelson providers will let you know their entire range of services.

You actually have the very best resource close at hand in the form of the web. There's so much inspiration and information available online for things like accounting for small businesses, personal tax assistance, accounting & auditing and self-assessment help, that you'll very quickly be brimming with suggestions for your accounting needs. An illustration may be this engaging article detailing 5 tips for finding a quality accountant.

Nelson Accounting Services

- Nelson Personal Taxation

- Nelson Financial Advice

- Nelson Taxation Advice

- Nelson Tax Services

- Nelson Debt Recovery

- Nelson Tax Planning

- Nelson Self-Assessment

- Nelson Account Management

- Nelson Tax Returns

- Nelson PAYE Healthchecks

- Nelson Tax Refunds

- Nelson Specialist Tax

- Nelson Bookkeeping Healthchecks

- Nelson Business Accounting

Also find accountants in: Eagland Hill, Leyland, Capernwray, Squires Gate, Staining, Mellor Brook, Priest Hutton, Cottam, New Longton, Dunsop Bridge, Worston, Accrington, Roughlee, Limbrick, Overton, Wheelton, Tosside, Chatburn, Mellor, Elston, Ormskirk, Brierfield, Weeton, Dalton, Cuddy Hill, Lower Thurnham, Out Rawcliffe, Tatham, Weir, Bolton Le Sands, Pilling Lane, Claughton, Barnoldswick, Padiham, Yealand Conyers and more.

Accountant Nelson

Accountant Nelson Accountants Near Me

Accountants Near Me Accountants Nelson

Accountants NelsonMore Lancashire Accountants: Morecambe, Lancaster, Nelson, Fulwood, Colne, Rawtenstall, Bacup, Poulton, Accrington, Leyland, Preston, Clitheroe, Haslingden, Burnley, Penwortham, Blackburn, Lytham St Annes, Heysham, Skelmersdale, Fleetwood, Blackpool, Darwen, Chorley and Ormskirk.

TOP - Accountants Nelson - Financial Advisers

Financial Advice Nelson - Cheap Accountant Nelson - Chartered Accountant Nelson - Tax Preparation Nelson - Small Business Accountants Nelson - Financial Accountants Nelson - Self-Assessments Nelson - Online Accounting Nelson - Bookkeeping Nelson