Accountants Southampton: If you've got your own business or are a sole trader in Southampton, Hampshire, you'll soon discover that there are lots of advantages to be gained from using a qualified accountant. At the very least your accountant can handle important tasks like doing your tax returns and keeping your books up to date, giving you more time to concentrate on running your business. The importance of having a qualified accountant by your side cannot be exaggerated.

So, precisely what should you be looking for in an accountant and how much should you expect to pay for this kind of service? Not so long ago the Yellow Pages or local newspaper would have been the first place to look, but today the internet is much more popular. But, how do you know who to trust? Don't forget that anybody who is so inclined can go into business as an accountant in Southampton. They have no legal obligation to gain any qualifications for this type of work. Which you may think is rather bizarre.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. For basic tax returns an AAT qualified accountant should be sufficient. A qualified accountant may cost a little more but in return give you peace of mind. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction. Local Southampton bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

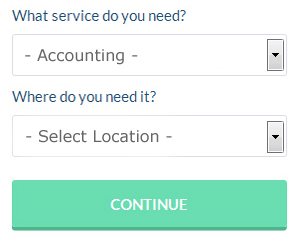

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. You will quickly be able to complete the form and your search will begin. Your details will be sent out to potential accountants and they will contact you directly with details and prices.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. Services like this are convenient and cost effective. Choose a company with a history of good service. A quick browse through some reviews online should give you an idea of the best and worse services.

If you really want the best you could go with a chartered accountant. Larger limited companies must use a chartered accountant, smaller businesses do not need to. This widens your choice of accountants.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are Taxforward, Xero, Keytime, Taxshield, TaxCalc, Sage, CalCal, BTCSoftware, Andica, Forbes, ACCTAX, Nomisma, GoSimple, Absolute Topup, Gbooks, 123 e-Filing, Ablegatio, Taxfiler, Basetax, Ajaccts and Capium. You'll receive a fine if your self-assessment is late. The standard fine for being up to three months late is £100.

Auditors Southampton

An auditor is a person or company selected by a firm or organisation to undertake an audit, which is an official assessment of the accounts, generally by an unbiased body. They offer businesses from fraud, point out inconsistencies in accounting strategies and, from time to time, operate on a consultancy basis, helping firms to find solutions to increase operational efficiency. To become an auditor, an individual must be accredited by the regulatory body of auditing and accounting or possess specified qualifications. (Tags: Auditors Southampton, Auditing Southampton, Auditor Southampton)

Financial Actuaries Southampton

Actuaries and analysts are business professionals in the management of risk. An actuary employs financial and statistical theories to analyse the chances of a certain event occurring and the possible monetary implications. To work as an actuary it is essential to have a mathematical, statistical and economic awareness of everyday situations in the financial world. (Tags: Actuaries Southampton, Financial Actuaries Southampton, Actuary Southampton)

Forensic Accounting Southampton

When you are searching for an accountant in Southampton you will maybe run into the term "forensic accounting" and wonder what the differences are between a regular accountant and a forensic accountant. With the word 'forensic' literally meaning "relating to or denoting the application of scientific methods and techniques for the investigation of crime", you will get an idea as to what's involved. Also known as 'financial forensics' or 'forensic accountancy', it uses accounting, investigative skills and auditing to detect inaccuracies in financial accounts which have contributed to theft or fraud. Some larger accounting companies in the Southampton area may have specialist forensic accounting divisions with forensic accountants targeting certain types of fraud, and might be dealing with tax fraud, insolvency, money laundering, falsified insurance claims, bankruptcy, professional negligence and personal injury claims.

Southampton accountants will help with sole traders, accounting support services, financial planning, small business accounting in Southampton, business planning and support, debt recovery, double entry accounting in Southampton, accounting services for buy to let landlords, litigation support Southampton, pension forecasts, accounting and financial advice, company formations, HMRC submissions, employment law, compliance and audit reporting, contractor accounts, partnership registration Southampton, personal tax, mergers and acquisitions, bureau payroll services Southampton, consulting services, business advisory in Southampton, assurance services, self-employed registrations, inheritance tax, company secretarial services, management accounts, charities, limited company accounting, VAT returns, PAYE Southampton, workplace pensions Southampton and other accounting services in Southampton, Hampshire. These are just some of the duties that are handled by nearby accountants. Southampton specialists will be happy to inform you of their full range of accountancy services.

You do, in fact have the very best resource close at hand in the shape of the internet. There is such a lot of inspiration and information available online for stuff like accounting & auditing, personal tax assistance, accounting for small businesses and self-assessment help, that you'll soon be bursting with suggestions for your accounting needs. An illustration could be this engaging article about choosing the right accountant.

Southampton Accounting Services

- Southampton VAT Returns

- Southampton Tax Planning

- Southampton Financial Audits

- Southampton Financial Advice

- Southampton Forensic Accounting

- Southampton Chartered Accountants

- Southampton Self-Assessment

- Southampton Bookkeeping

- Southampton Business Accounting

- Southampton Tax Advice

- Southampton Payroll Services

- Southampton Tax Refunds

- Southampton Debt Recovery

- Southampton Bookkeeping Healthchecks

Also find accountants in: North Stoneham, Fawley, Coldrey, Stroud, Battramsley, Meonstoke, Hungerford, Binley, Canada, Whiteley, Horton Heath, Egypt, Wickham, Upper Clatford, Quarley, Ashe, Forton, Stoney Cross, Anthill Common, Ball Hill, West Green, Arford, Dogmersfield, Itchen, Crowdhill, Southampton, Michelmersh, Gundleton, Stubbington, Wyck, Hazeley, Church End, Faccombe, Bramshill, Northington and more.

Accountant Southampton

Accountant Southampton Accountants Near Southampton

Accountants Near Southampton Accountants Southampton

Accountants SouthamptonMore Hampshire Accountants: Eastleigh, Gosport, Fareham, Waterlooville, Horndean, Southsea, Hedge End, Stubbington, Winchester, Hythe, Southampton, Havant, Aldershot, Basingstoke, Portsmouth, Alton, Farnborough, Yateley, Totton, Fleet, Andover, Emsworth and New Milton.

TOP - Accountants Southampton - Financial Advisers

Chartered Accountant Southampton - Small Business Accountants Southampton - Self-Assessments Southampton - Bookkeeping Southampton - Investment Accounting Southampton - Online Accounting Southampton - Tax Accountants Southampton - Financial Accountants Southampton - Tax Preparation Southampton