Accountants Tring: For Tring individuals who are running a business or self-employed, there are a number of benefits to be had from retaining the professional services of an accountant. By handling essential tasks like payroll, tax returns and bookkeeping your accountant can at the very least free up some time for you to concentrate on your core business. Being able to access professional financial advice is even more vital for newer businesses.

So, what should you be expecting to pay for this service and what do you get for your money? The internet is definitely the "in" place to look nowadays, so that would certainly be an excellent place to start. However, which of these candidates will you be able to put your trust in? The truth of the matter is that in Great Britain anyone can start up in business as an accountant or bookkeeper. There is no legal requirement that says they must have formal qualifications or certifications.

Finding an accountant in Tring who is qualified is generally advisable. Ask if they at least have an AAT qualification or higher. Qualified Tring accountants might charge a bit more but they may also get you the maximum tax savings. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs.

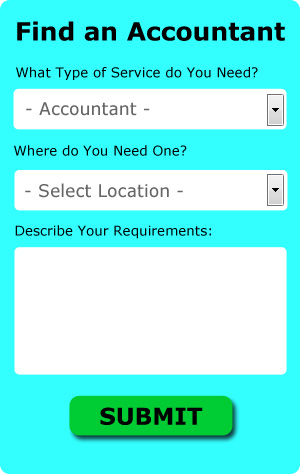

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. Filling in a clear and simple form is all that you need to do to set the process in motion. Accountants in your local area will be sent your details, and if they are interested in doing the work will contact you shortly.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. A number of self-employed people in Tring prefer to use this simple and convenient alternative. If you decide to go with this method, pick a company with a decent reputation. Study online reviews so that you can get an overview of the services available. We prefer not to recommend any particular online accounting company here.

Of course, completing and sending in your own self-assessment form is the cheapest solution. To make life even easier there is some intuitive software that you can use. Including Taxfiler, CalCal, Andica, ACCTAX, Sage, BTCSoftware, Absolute Topup, Nomisma, Gbooks, 123 e-Filing, Capium, Ajaccts, TaxCalc, GoSimple, Keytime, Taxshield, Xero, Ablegatio, Taxforward, Forbes and Basetax. In any event the most important thing is to get your self-assessment set in before the deadline. You can expect to pay a minimum penalty of £100 for being late.

Small Business Accountants Tring

Operating a small business in Tring is stressful enough, without needing to fret about preparing your accounts and other bookkeeping chores. Hiring the services of a small business accountant in Tring will enable you to run your business knowing that your VAT, tax returns and annual accounts, amongst many other business tax requirements, are being met.

Helping you improve your business, and providing sound financial advice relating to your particular circumstances, are just two of the ways that a small business accountant in Tring can benefit you. A quality accounting firm in Tring will give practical small business guidance to optimise your tax efficiency while at the same time reducing business costs; essential in the sometimes murky world of business taxation.

It is also vital that you explain your current financial circumstances, your plans for the future and the structure of your business truthfully to your small business accountant. (Tags: Small Business Accountant Tring, Small Business Accounting Tring, Small Business Accountants Tring).

Auditors Tring

An auditor is a person or a firm appointed by a company to carry out an audit, which is an official evaluation of the accounts, typically by an unbiased entity. Auditors examine the fiscal activities of the company which appoints them to ensure the constant functioning of the organisation. For anyone to start working as an auditor they have to have specific qualifications and be approved by the regulatory authority for auditing and accounting. (Tags: Auditor Tring, Auditing Tring, Auditors Tring)

Tring accountants will help with double entry accounting, business start-ups, assurance services Tring, small business accounting, bureau payroll services, litigation support, limited company accounting, financial statements, management accounts, mergers and acquisitions, consulting services, accounting services for buy to let property rentals, sole traders, debt recovery, tax investigations, financial planning, payslips, monthly payroll, company formations Tring, business outsourcing in Tring, workplace pensions, National Insurance numbers Tring, accounting services for the construction industry, audit and compliance reports, partnership accounts Tring, personal tax Tring, employment law Tring, corporation tax, inheritance tax, accounting services for media companies, general accounting services, accounting and financial advice and other accounting related services in Tring, Hertfordshire. These are just a small portion of the duties that are conducted by nearby accountants. Tring specialists will inform you of their entire range of accounting services.

Tring Accounting Services

- Tring Tax Returns

- Tring Personal Taxation

- Tring Chartered Accountants

- Tring Payroll Management

- Tring VAT Returns

- Tring Auditing Services

- Tring Specialist Tax

- Tring Tax Services

- Tring Account Management

- Tring PAYE Healthchecks

- Tring Business Accounting

- Tring Tax Refunds

- Tring Debt Recovery

- Tring Tax Planning

Also find accountants in: Abbots Langley, Eastwick, Welham Green, Bucks Hill, Sacombe, Bricket Wood, Colney Street, Gilston Park, West Hyde, Albury, Watton At Stone, Sawbridgeworth, East End, South Mimms, Great Wymondley, Kinsbourne Green, Whelpley Hill, Holwell, Hatching Green, Gaddesden Row, Charlton, Rickmansworth, Boxmoor, Piccotts End, Wadesmill, Aston End, Bedmond, Northaw, Long Marston, Bourne End, Wood End, Waterford, Little Gaddesden, Hertford Heath, Flamstead and more.

Accountant Tring

Accountant Tring Accountants Near Tring

Accountants Near Tring Accountants Tring

Accountants TringMore Hertfordshire Accountants: Cheshunt, Harpenden, Tring, Hertford, Abbots Langley, Broxbourne, Letchworth, Welwyn Garden City, Hemel Hempstead, St Albans, Hitchin, Royston, Watford, Bishops Stortford, Rickmansworth, Borehamwood, Hoddesdon, Hatfield, Potters Bar, Stevenage, Ware, Bushey and Berkhamsted.

TOP - Accountants Tring - Financial Advisers

Cheap Accountant Tring - Chartered Accountant Tring - Tax Advice Tring - Small Business Accountant Tring - Auditing Tring - Investment Accounting Tring - Self-Assessments Tring - Financial Accountants Tring - Financial Advice Tring