Accountants Burntwood: Very few people will argue that if you are a self-employed person or run a small business in Burntwood, getting an accountant to do your books, brings a number of positive benefits. One of the key advantages will be that with your accountant taking care of the routine paperwork and bookkeeping, you should have a lot more free time to devote to what you do best, the actual operation of your business. Businesses of all sizes and types can benefit from an accountant's expertise but for newer businesses it can be even more crucial.

There are a number of different branches of accounting. So, determine your precise requirements and choose an accountant that meets those needs. Some Burntwood accountants work alone, some within larger practices. An accountancy practice may offer a broader range of services, while a lone accountant will offer a more personal service. Among the primary accountancy positions are: forensic accountants, tax preparation accountants, bookkeepers, auditors, cost accountants, accounting technicians, investment accountants, actuaries, management accountants, chartered accountants and financial accountants.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. It is worth paying a little more for that extra peace of mind. Your accountant will add his/her fees as tax deductable.

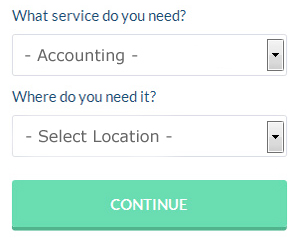

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. Filling in a clear and simple form is all that you need to do to set the process in motion. It is then simply a case of waiting for some suitable responses.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. Nowadays more and more people are using this kind of service. Make a short list of such companies and do your homework to find the most reputable. Reading through reviews for any potential online services is a good way to get a feel for what is out there. Sorry but we cannot recommend any individual service on this website.

Chartered accountants are the most qualified and highly trained individuals within the profession. Larger companies in the Burntwood area may choose to use their expert services. Hiring the services of a chartered accountant means you will have the best that money can buy.

At the end of the day you could always do it yourself and it will cost you nothing but time. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Ablegatio, Taxfiler, Taxshield, Nomisma, Xero, 123 e-Filing, BTCSoftware, Absolute Topup, Taxforward, ACCTAX, Basetax, Keytime, CalCal, Gbooks, TaxCalc, Ajaccts, GoSimple, Andica, Capium, Sage and Forbes. Whichever service you use your tax returns will need to be in on time to avoid penalties. The fine for late submissions (up to 3 months) is £100.

Auditors Burntwood

Auditors are professionals who review the accounts of businesses and organisations to ensure the validity and legality of their current financial reports. Auditors analyze the fiscal behaviour of the firm which hires them and make certain of the unwavering functioning of the organisation. For anybody to become an auditor they should have certain specified qualifications and be certified by the regulating authority for accounting and auditing. (Tags: Auditor Burntwood, Auditing Burntwood, Auditors Burntwood)

How Managing Your Money Better Makes You a Better Business Owner

Many people find that putting up a business is very exciting. When you're your own boss, you get to be in charge of basically everything. It's a bit scary, isn't it? Truly, while exhilarating, starting your own business is also quite intimidating because it can be quite difficult to find your feet. It then pays to be aware of a few self-improvement strategies like knowing how to manage finances the proper way. Keep reading this article to learn how to correctly manage your money.

You shouldn't wait for the due date to pay your taxes. It may be that you won't have the funds you need to pay your taxes if your money management skills are poor. You can save yourself the headache by putting a portion of each payment you get in a separate account. When you do this, you're going to have the money needed to pay your taxes for the quarter. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

Think about setting up payment plans for your clients. This isn't just a good idea for your business in terms of landing more clients, it's a good idea for your finances because it means that you will have money coming in regularly. It's certainly a lot easier than having money coming in irregularly and you've got long, dry spells. When you have reliable income, you're better able to budget, pay your bills, and manage your money overall. If you're in control of your business finances, you'll feel more self-confident.

Be a responsible business owner by paying your taxes when they're due. Small business generally have to pay taxes every three months. Taxes can be quite confusing so you might want to make an appointment with your local small business center or even at the IRS so you can get accurate information. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. Having the IRS at your doorstep isn't something you'd want, believe me!

Not only does learning how to properly manage your money help you improve yourself, it helps improve your business too. Try to implement these tips we've shared because you stand to benefit in the long run. You're much more likely to experience business and personal success when you have your finances under control.

Burntwood accountants will help with business support and planning, HMRC submissions in Burntwood, capital gains tax, self-assessment tax returns, HMRC liaison in Burntwood, litigation support, inheritance tax Burntwood, financial planning, business outsourcing, contractor accounts, management accounts, accounting services for the construction sector, assurance services Burntwood, company formations, pension advice, small business accounting Burntwood, VAT payer registration, accounting services for buy to let property rentals Burntwood, company secretarial services in Burntwood, tax preparation in Burntwood, financial statements, charities, consultancy and systems advice, sole traders Burntwood, accounting services for media companies, payslips, limited company accounting, taxation accounting services, bookkeeping, cash flow, general accounting services, compliance and audit reporting and other forms of accounting in Burntwood, Staffordshire. Listed are just a few of the duties that are conducted by local accountants. Burntwood professionals will keep you informed about their whole range of accountancy services.

By using the world wide web as a powerful resource it is extremely simple to uncover a whole host of valuable inspiration and ideas concerning auditing & accounting, personal tax assistance, small business accounting and self-assessment help. For instance, with a very quick search we located this enlightening article about choosing an accountant for your business.

Burntwood Accounting Services

- Burntwood Auditing

- Burntwood Self-Assessment

- Burntwood Payroll Services

- Burntwood Bookkeepers

- Burntwood VAT Returns

- Burntwood Account Management

- Burntwood PAYE Healthchecks

- Burntwood Debt Recovery

- Burntwood Tax Services

- Burntwood Bookkeeping Healthchecks

- Burntwood Business Accounting

- Burntwood Financial Advice

- Burntwood Taxation Advice

- Burntwood Specialist Tax

Also find accountants in: Mitton, Lightwood, Cotwalton, Forsbrook, Swynnerton, Milton, Consall, Longsdon, Cheslyn Hay, Kingsley, Yoxall, Podmore, Horse Bridge, Haunton, Landywood, Bramshall, Hopton, Castle Bank, Glascote, Dilhorne, Wheaton Aston, Brocton, Dunston, Silverdale, Endon, Walton, Upper Hulme, Betley, Blythe Bridge, Two Gates, Church Eaton, Horninglow, Stafford, Church Leigh, Clifton Campville and more.

Accountant Burntwood

Accountant Burntwood Accountants Near Me

Accountants Near Me Accountants Burntwood

Accountants BurntwoodMore Staffordshire Accountants: Rugeley, Tamworth, Burton-upon-Trent, Lichfield, Hanley, Wombourne, Stoke-on-Trent, Leek, Burntwood, Heath Hayes, Hednesford, Fenton, Cannock, Longton, Stone, Biddulph, Kidsgrove, Newcastle-under-Lyme, Burslem, Uttoxeter and Stafford.

TOP - Accountants Burntwood - Financial Advisers

Investment Accountant Burntwood - Auditing Burntwood - Financial Advice Burntwood - Tax Accountants Burntwood - Financial Accountants Burntwood - Cheap Accountant Burntwood - Small Business Accountant Burntwood - Tax Return Preparation Burntwood - Self-Assessments Burntwood