Accountants Staplehurst: Very few people will deny that if you operate a business or are a self-employed person in Staplehurst, having an accountant to do your books, brings a number of positive rewards. By handling some mundane financial jobs like bookkeeping and tax returns you accountant should be able to free up extra time for you to concentrate your attention on your main business. Being able to access professional financial advice is even more crucial for new businesses. As you grow, you'll need increasingly more help.

But what might you get for your hard earned money, how much will you have to pay and where can you obtain the best Staplehurst accountant for your requirements? Any decent internet search engine will quickly supply you with a substantial shortlist of local Staplehurst accountants, who will be happy to help with your books. But, are they all trustworthy? The sad truth is that anyone in Staplehurst can advertise their services as an accountant. They do not even have to hold any qualifications such as BTEC's or A Levels. Which, considering the importance of the work would appear a tad strange.

Finding an accountant in Staplehurst who is qualified is generally advisable. The recommended minimum qualification you should look for is an AAT. Qualified accountants in Staplehurst might cost more but they will do a proper job. It should go without saying that accountants fees are tax deductable.

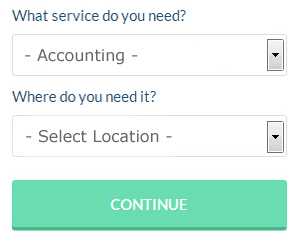

One online service which helps people like you find an accountant is Bark. In no time at all you can fill out the job form and submit it with a single click. Just sit back and wait for the responses to roll in. You will not be charged for this service.

For those of you who would prefer to pay less for this service you could simply opt for one of the online tax returns services. You might find that this is simpler and more convenient for you. You still need to do your homework to pick out a company you can trust. Be sure to study customer reviews and testimonials. We cannot endorse or recommend any of the available services here.

The most qualified of all are chartered accountants, they have the most training and the most expertise. These people are financial experts and are more commonly used by bigger companies. So, at the end of the day the choice is yours.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. Software is also available to make doing your self-assessment even easier. Some of the best ones include 123 e-Filing, Sage, Keytime, TaxCalc, Basetax, Gbooks, ACCTAX, Absolute Topup, Taxshield, Ajaccts, Taxfiler, CalCal, Xero, GoSimple, Nomisma, Capium, Andica, Forbes, Taxforward, BTCSoftware and Ablegatio. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns. You�ll get a penalty of £100 if your tax return is up to 3 months late.

How to Be a Better Money Manager for Your Business

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. At the same time, however, many people get overwhelmed when it comes to managing the funds for their business. Fortunately, you can do some things that will make it so much easier on you to manage your business finances. Keep reading to learn how to be better at managing your money when you are in business for yourself.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. This can certainly help your memory because you only have one payment to make each month instead of several. Still, there's the risk that with a credit card, you'll be paying interest if you carry a balance each month. If this happens regularly, you'll be better off paying each of your monthly expenditures directly from your business bank account. You can continue using your credit card to make it easier on you to pay your bills, but make sure you don't carry a balance on your card to avoid accruing interest charges. In addition to making it simpler for you to pay your expenses and avoid paying interest, you're building your credit rating.

You can help yourself by finding out how to keep your books. Don't neglect the importance of having a system set up for both your personal and business finances. You can either use an Excel spreadsheet or invest in bookkeeping software such as QuickBooks and Quicken. There are also other online tools you can use, like Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. It's crucial that you keep your books in order because they provide you a clear picture of what your finances (both personal and business) look like. It won't hurt if you take a class or two on basic bookkeeping and accounting, as this could prove helpful to you especially if you don't think you can afford to hire a professional to manage your books.

Do not forget to pay your taxes on time. In general, small businesses pay taxes on a quarterly basis. Taxes are among the most confusing things, so it's best if you check with the IRS or the small business center in your area to get accurate information. Additionally, you can have a professional set up a payment plan for you to ensure that you're paying your taxes promptly and that you're meeting all your business obligation as required by the law. It's not at all a pleasant experience having the IRS chasing after you for tax evasion.

Proper money management is one of the best things you can learn both for your own self improvement and for self improvement in your business. You've read just three money management tips that you can use to help you manage your finances better. When you have that under control, the sky is the limit!

Small Business Accountants Staplehurst

Doing the accounts can be a fairly stress-filled experience for any small business owner in Staplehurst. If your accounts are getting the better of you and tax returns and VAT issues are causing you sleepless nights, it would be a good idea to use a small business accountant in Staplehurst.

Giving advice, ensuring that your business follows the optimum financial practices and suggesting ways to help your business reach its full potential, are just a sample of the responsibilities of an honest small business accountant in Staplehurst. An accountancy firm in Staplehurst should provide an assigned small business accountant and consultant who will clear away the haze that veils business taxation, in order to maximise your tax efficiences.

It is also essential that you explain the structure of your business, your current financial circumstances and your future plans accurately to your small business accountant. (Tags: Small Business Accounting Staplehurst, Small Business Accountants Staplehurst, Small Business Accountant Staplehurst).

Auditors Staplehurst

Auditors are specialists who review the accounts of organisations and companies to check the legality and validity of their financial reports. They may also adopt a consultative role to suggest possible risk prevention measures and the application of financial savings. To work as an auditor, an individual has to be authorised by the regulatory body for accounting and auditing or have specified qualifications. (Tags: Auditors Staplehurst, Auditing Staplehurst, Auditor Staplehurst)

Forensic Accountant Staplehurst

When you happen to be trying to find an accountant in Staplehurst you'll possibly run into the expression "forensic accounting" and be curious about what the difference is between a normal accountant and a forensic accountant. The actual word 'forensic' is the thing that gives you an idea, meaning basically "relating to or denoting the application of scientific techniques and methods to the investigation of a crime." Sometimes also known as 'forensic accountancy' or 'financial forensics', it uses accounting, investigative skills and auditing to sift through financial accounts so as to detect criminal activity and fraud. Some of the larger accounting firms in the Staplehurst area may even have specialist forensic accounting departments with forensic accountants focusing on particular kinds of fraud, and could be dealing with tax fraud, insolvency, falsified insurance claims, personal injury claims, money laundering, professional negligence and bankruptcy.

Staplehurst accountants will help with litigation support, contractor accounts, tax investigations, VAT registration, business acquisition and disposal, payslips, management accounts, estate planning, cashflow projections, HMRC submissions, consulting services, small business accounting, business outsourcing Staplehurst, assurance services, accounting services for start-ups, charities Staplehurst, tax preparation Staplehurst, employment law, corporation tax, general accounting services, mergers and acquisitions, taxation accounting services, accounting services for buy to let rentals, debt recovery in Staplehurst, HMRC submissions, accounting services for the construction industry, consultancy and systems advice, financial and accounting advice, limited company accounting Staplehurst, personal tax in Staplehurst, auditing and accounting, double entry accounting and other kinds of accounting in Staplehurst, Kent. These are just a small portion of the duties that are accomplished by nearby accountants. Staplehurst providers will be delighted to keep you abreast of their whole range of services.

You actually have the perfect resource right at your fingertips in the form of the net. There's such a lot of inspiration and information readily available online for such things as personal tax assistance, accounting & auditing, self-assessment help and small business accounting, that you will very soon be awash with ideas for your accounting needs. One example could be this super article detailing how to track down an accountant to complete your tax return.

Staplehurst Accounting Services

- Staplehurst PAYE Healthchecks

- Staplehurst Tax Planning

- Staplehurst Financial Advice

- Staplehurst VAT Returns

- Staplehurst Account Management

- Staplehurst Tax Services

- Staplehurst Business Accounting

- Staplehurst Tax Returns

- Staplehurst Debt Recovery

- Staplehurst Bookkeeping Healthchecks

- Staplehurst Tax Refunds

- Staplehurst Auditing

- Staplehurst Personal Taxation

- Staplehurst Forensic Accounting

Also find accountants in: Marden Thorn, Hastingleigh, Frinsted, Boughton Street, Shepway, Sole Street, Tonbridge, Poundsbridge, Halstead, Smarden, Bearsted, Nettlestead, Walmer, West Street, Upper Upnor, Chestfield, Woollage Green, Tyler Hill, Whetsted, Rhodes Minnis, Istead Rise, Yalding, Wick Hill, Hartlip, Highstead, Woodnesborough, Court At Street, Plaxtol, Eastchurch, Coxheath, Doddington, Speldhurst, Patrixbourne, Barfreston, Stoke and more.

Accountant Staplehurst

Accountant Staplehurst Accountants Near Me

Accountants Near Me Accountants Staplehurst

Accountants StaplehurstMore Kent Accountants: Sturry, Strood, Margate, Gravesend, Sittingbourne, Cranbrook, Westerham, Rochester, Canterbury, Tunbridge Wells, Snodland, Boxley, Hartley, Lydd, West Kingsdown, Pembury, Whitstable, Staplehurst, Gillingham, Westgate-on-Sea, Dover, Sheerness, Aylesford, East Malling, Kingsnorth, Faversham, Biggin Hill, Swanscombe, Northfleet, Sandwich, Birchington-on-Sea, New Romney, Southborough, Maidstone, Wilmington, Deal, Sevenoaks, Broadstairs, Tonbridge, Edenbridge, Bearsted, Ashford, Paddock Wood, Meopham, Swanley, Chatham, Folkestone, Minster, Dartford, Ramsgate, Walmer, Tenterden and Herne Bay.

TOP - Accountants Staplehurst - Financial Advisers

Investment Accountant Staplehurst - Small Business Accountant Staplehurst - Chartered Accountant Staplehurst - Financial Accountants Staplehurst - Auditing Staplehurst - Tax Accountants Staplehurst - Cheap Accountant Staplehurst - Financial Advice Staplehurst - Online Accounting Staplehurst