Accountants Scarborough: Do you find that filling out your annual self-assessment form is nothing but a headache? Many other people in Scarborough have to overcome this very predicament. Is finding a local Scarborough accountant to do this for you a better option? Do you simply find self-assessment too challenging to do on your own? You should expect to pay out about £200-£300 when using the services of a regular Scarborough accountant or bookkeeper. If this sounds like a lot to you, then look at using an online service.

Accountants don't solely handle tax returns, there are different types of accountant. Therefore, ensure you choose one that suits your requirements perfectly. You'll have to choose between an accountant working alone or one who's associated with an established accountancy firm. The advantage of accounting companies is that they have many areas of expertise under one roof. You should be able to locate an accountancy company offering actuaries, cost accountants, chartered accountants, bookkeepers, tax preparation accountants, auditors, investment accountants, accounting technicians, management accountants, forensic accountants and financial accountants.

To get the job done correctly you should search for a local accountant in Scarborough who has the right qualifications. The AAT qualification is the minimum you should look for. You can then have peace of mind knowing that your tax affairs are being handled professionally. Your accountant will add his/her fees as tax deductable.

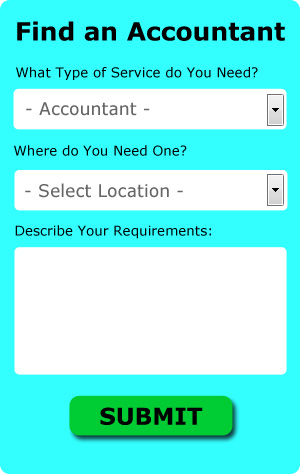

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. You will quickly be able to complete the form and your search will begin. Your details will be sent out to potential accountants and they will contact you directly with details and prices.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. Over the last few years many more of these services have been appearing. You still need to pick out a company offering a reliable and professional service. The better ones can soon be singled out by carefully studying reviews online.

The cheapest option of all is to do your own self-assessment form. To make life even easier there is some intuitive software that you can use. Including Forbes, Taxforward, Capium, CalCal, Ajaccts, 123 e-Filing, BTCSoftware, Andica, Ablegatio, Gbooks, Absolute Topup, Basetax, ACCTAX, Sage, Taxfiler, Keytime, Xero, Taxshield, GoSimple, TaxCalc and Nomisma. The most important thing is to make sure your self-assessment is sent in promptly. You can expect a fine of £100 if your assessment is in even 1 day late.

Forensic Accounting Scarborough

Whilst conducting your search for an experienced accountant in Scarborough there's a good chance that you'll happen on the term "forensic accounting" and be wondering what that is, and how it differs from normal accounting. With the word 'forensic' meaning literally "suitable for use in a law court", you ought to get an idea as to what is involved. Occasionally also known as 'financial forensics' or 'forensic accountancy', it uses accounting, auditing and investigative skills to dig through financial accounts so as to discover fraud and criminal activity. Some of the bigger accountancy companies in and near Scarborough even have specialised departments dealing with tax fraud, bankruptcy, insolvency, false insurance claims, professional negligence, personal injury claims and money laundering. (Tags: Forensic Accountant Scarborough, Forensic Accountants Scarborough, Forensic Accounting Scarborough)

Payroll Services Scarborough

For any business in Scarborough, from large scale organisations down to independent contractors, payrolls for staff can be stressful. Dealing with staff payrolls requires that all legal requirements regarding their openness, timing and accuracy are observed in all cases.

A small business may well not have the luxury of its own financial expert and the best way to cope with employee payrolls is to hire an outside accountant in Scarborough. Your payroll accounting company will manage accurate BACS payments to your personnel, as well as working along with any pension providers that your business might have, and use the latest HMRC legislation for NI contributions and tax deductions.

A dedicated payroll accountant in Scarborough will also, in accordance with the current legislation, provide P60's after the end of the financial year for every employee. They'll also provide P45 tax forms at the end of an employee's contract. (Tags: Payroll Accountants Scarborough, Payroll Services Scarborough, Payroll Companies Scarborough).

Auditors Scarborough

An auditor is a person or company brought in to assess and authenticate the reliability of accounts to ensure that organisations observe tax legislation. They may also act as advisors to advocate potential risk prevention measures and the application of cost savings. To become an auditor, a person has to be authorised by the regulating authority for accounting and auditing and have achieved specified qualifications.

Scarborough accountants will help with workplace pensions, estate planning in Scarborough, bookkeeping Scarborough, mergers and acquisitions in Scarborough, accounting services for media companies, small business accounting in Scarborough, audit and compliance reporting, accounting support services, payroll accounting in Scarborough, VAT payer registration, company formations, self-assessment tax returns in Scarborough, business start-ups, management accounts, company secretarial services, accounting and auditing Scarborough, contractor accounts, year end accounts, National Insurance numbers in Scarborough, financial statements, payslips, limited company accounting, sole traders, partnership accounts, corporate finance, corporate tax in Scarborough, consultancy and systems advice, HMRC submissions Scarborough, HMRC submissions, personal tax, financial planning, business outsourcing and other types of accounting in Scarborough, North Yorkshire. These are just a few of the duties that are accomplished by local accountants. Scarborough specialists will tell you about their whole range of accountancy services.

Scarborough Accounting Services

- Scarborough Chartered Accountants

- Scarborough Auditing

- Scarborough VAT Returns

- Scarborough Financial Audits

- Scarborough Bookkeeping

- Scarborough Personal Taxation

- Scarborough Forensic Accounting

- Scarborough Specialist Tax

- Scarborough Tax Returns

- Scarborough Tax Services

- Scarborough Payroll Management

- Scarborough Account Management

- Scarborough Tax Refunds

- Scarborough Self-Assessment

Also find accountants in: Kirby Grindalythe, Wrelton, Leathley, High Harrogate, Menethorpe, Bellerby, Skirwith, Low Hawkser, West Lilling, Ivelet, Goldsborough, Ingerthorpe, Tunstall, Oulston, Hampsthwaite, Settrington, South Otterington, Kiplin, Bolton Bridge, Coneysthorpe, Lund, Thrintoft, Cowesby, Moor Monkton, Helmsley Sproxton, Hessay, Carperby, Ruston, Cross Hills, Carthorpe, Burnsall, Scackleton, Silpho, Whaw, Newsham and more.

Accountant Scarborough

Accountant Scarborough Accountants Near Scarborough

Accountants Near Scarborough Accountants Scarborough

Accountants ScarboroughMore North Yorkshire Accountants: Redcar, Scarborough, Selby, Northallerton, Guisborough, Knaresborough, Skipton, Yarm, York, Harrogate, Whitby, Ripon, Thornaby and Middlesbrough.

TOP - Accountants Scarborough - Financial Advisers

Investment Accounting Scarborough - Cheap Accountant Scarborough - Self-Assessments Scarborough - Chartered Accountants Scarborough - Online Accounting Scarborough - Auditors Scarborough - Small Business Accountants Scarborough - Tax Advice Scarborough - Financial Accountants Scarborough