Accountants Dunstable: If you're running a business, are a sole trader or are otherwise self-employed in Dunstable, you'll find certain advantages to having access your own accountant. By handling crucial tasks like tax returns, payroll and bookkeeping your accountant can at the very least free up some time for you to concentrate on your core business. This form of financial help is crucial for any business, but is especially beneficial for start-up businesses.

So, exactly what should you be looking for in an accountant and how much should you expect to pay for this type of service? A shortlist of potential Dunstable accountants can be identified with just a few minutes searching on the internet. However, how do you know who you can and can't trust with your annual tax returns? The fact that somebody in Dunstable claims to be an accountant is no real guarantee of quality. They are able to offer bookkeeping and accounting services in Dunstable whether they have qualifications or not. Crazy as that sounds.

You would be best advised to find a fully qualified Dunstable accountant to do your tax returns. For simple self-assessment work an AAT qualification is what you need to look for. Qualified accountants may come with higher costs but may also save you more tax. Remember that a percentage of your accounting costs can be claimed back on the tax return.

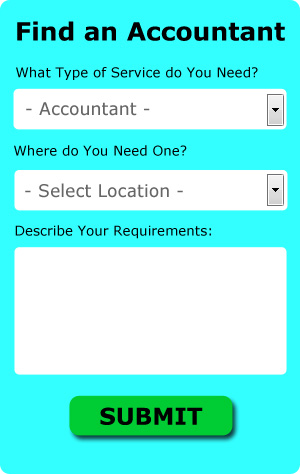

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. All that is required is the ticking of a few boxes so that they can understand your exact needs. Just sit back and wait for the responses to roll in.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. This kind of service may not suit everyone but could be the answer for your needs. It would be advisable to investigate that any online company you use is reputable. The easiest way to do this is by studying online reviews.

At the end of the day you could always do it yourself and it will cost you nothing but time. Software programs like BTCSoftware, Andica, Taxforward, Nomisma, Taxshield, Taxfiler, Sage, CalCal, Ablegatio, Gbooks, Forbes, Basetax, Ajaccts, Keytime, Xero, TaxCalc, 123 e-Filing, ACCTAX, GoSimple, Absolute Topup and Capium have been developed to help the self-employed do their own tax returns. You will get a penalty if your tax return isn't in on time.

Actuaries Dunstable

An actuary manages, measures and gives advice on monetary and financial risks. They use their mathematical knowledge to gauge the risk and probability of future happenings and to predict their impact (financially) on a business and it's customers. Actuaries deliver reviews of fiscal security systems, with an emphasis on their mechanisms, complexity and mathematics.

Payroll Services Dunstable

A vital element of any business in Dunstable, large or small, is having an accurate payroll system for its staff. The legislation relating to payroll for accuracy and openness mean that processing a company's staff payroll can be a formidable task for the uninitiated.

A small business may not have the advantage of its own financial expert and the easiest way to work with employee payrolls is to use an external accountant in Dunstable. A payroll service accountant will work alongside HMRC, work with pensions providers and set up BACS payments to guarantee that your personnel are always paid promptly, and that all mandatory deductions are accurate.

A genuine payroll accountant in Dunstable will also, as outlined by the current legislation, organise P60's at the end of the financial year for each of your employees. Upon the termination of a staff member's contract, the payroll accountant will provide an updated P45 form outlining what tax has been paid during the previous financial period.

Small Business Accountants Dunstable

Making certain that your accounts are accurate and up-to-date can be a stressful job for anyone running a small business in Dunstable. A dedicated small business accountant in Dunstable will provide you with a hassle-free method to keep your VAT, tax returns and annual accounts in the best possible order.

A qualified small business accountant in Dunstable will consider that it's their responsibility to help develop your business, and provide you with sound financial advice for security and peace of mind in your particular situation. The vagaries and sometimes complicated world of business taxation will be clearly explained to you so as to minimise your business costs, while at the same time improving tax efficiency.

It is critical that you clarify your current financial situation, your future plans and the structure of your business accurately to your small business accountant. (Tags: Small Business Accountants Dunstable, Small Business Accounting Dunstable, Small Business Accountant Dunstable).

Dunstable accountants will help with bureau payroll services, debt recovery Dunstable, HMRC submissions, accounting services for start-ups Dunstable, business disposal and acquisition in Dunstable, retirement advice, self-assessment tax returns Dunstable, accounting services for the construction industry, VAT payer registration, double entry accounting, audit and auditing, financial planning, business outsourcing, charities in Dunstable, investment reviews, sole traders, contractor accounts, payslips Dunstable, accounting and financial advice Dunstable, financial statements, accounting support services, PAYE, National Insurance numbers, compliance and audit reporting, self-employed registration, company secretarial services, accounting services for media companies in Dunstable, capital gains tax in Dunstable, employment law in Dunstable, estate planning Dunstable, inheritance tax Dunstable, limited company accounting and other accounting services in Dunstable, Bedfordshire. Listed are just a small portion of the tasks that are accomplished by local accountants. Dunstable companies will inform you of their full range of services.

Dunstable Accounting Services

- Dunstable Tax Refunds

- Dunstable Tax Advice

- Dunstable Financial Advice

- Dunstable Personal Taxation

- Dunstable Auditing

- Dunstable VAT Returns

- Dunstable Self-Assessment

- Dunstable Specialist Tax

- Dunstable Forensic Accounting

- Dunstable Account Management

- Dunstable Business Accounting

- Dunstable Payroll Services

- Dunstable Tax Returns

- Dunstable Tax Services

Also find accountants in: Hatch, Leighton Buzzard, Millbrook, Flitwick, Eaton Bray, Harrowden, Dunstable, Roxton, Kempston, Yielden, Bedford, Brogborough, Chawston, Hockliffe, Stopsley, Streatley, Willington, Duloe, Little Barford, Steppingley, New Mill End, Lower Shelton, Felmersham, Marston Moretaine, Clophill, Studham, Arlesey, Higham Gobion, Turvey, Bolnhurst, Old Warden, Luton, Wilstead, Wood End, Toddington and more.

Accountant Dunstable

Accountant Dunstable Accountants Near Dunstable

Accountants Near Dunstable Accountants Dunstable

Accountants DunstableMore Bedfordshire Accountants: Biggleswade, Houghton Regis, Bedford, Flitwick, Leighton Buzzard, Luton, Sandy and Dunstable.

TOP - Accountants Dunstable - Financial Advisers

Affordable Accountant Dunstable - Tax Accountants Dunstable - Self-Assessments Dunstable - Tax Return Preparation Dunstable - Online Accounting Dunstable - Financial Advice Dunstable - Small Business Accountant Dunstable - Auditing Dunstable - Bookkeeping Dunstable