Accountants Great Yarmouth: It will come as no real surprise if you're self-employed or running your own business in Great Yarmouth, that having your own accountant can pay big dividends. Bookkeeping takes up valuable time that you cannot afford to waste, so having an accountant deal with this allows you to put more effort into your key business. Being able to access professional financial advice is even more crucial for new businesses.

So, exactly what should you be expecting to pay for this service and what do you get for your money? An internet search engine will pretty soon provide a substantial list of potential candidates in Great Yarmouth. However, how do you know who you can and can't trust with your annual tax returns? Always keep in mind that pretty much any individual in Great Yarmouth can go into business as an accountant. While, obviously qualifications are a benefit, they aren't legally required. Which to most people would seem rather strange.

Find yourself a properly qualified one and don't take any chances. You don't need a chartered accountant but should get one who is at least AAT qualified. Qualified accountants may come with higher costs but may also save you more tax. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent. For smaller businesses in Great Yarmouth, a qualified bookkeeper may well be adequate.

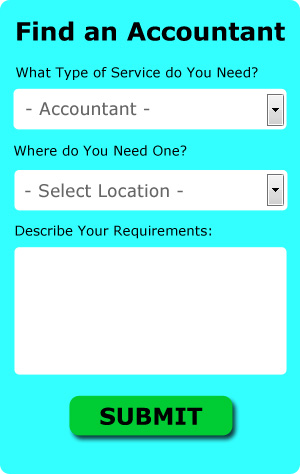

There is an online company called Bark who will do much of the work for you in finding an accountant in Great Yarmouth. Filling in a clear and simple form is all that you need to do to set the process in motion. In no time at all you will get messages from accountants in the Great Yarmouth area. At the time of writing this service was totally free.

Utilizing an online tax returns service will be your other option. It could be that this solution will be more appropriate for you. Don't simply go with the first company you find on Google, take time to do some research. It should be a simple task to find some online reviews to help you make your choice.

At the end of the day you could always do it yourself and it will cost you nothing but time. There is also lots of software available to help you with your returns. These include TaxCalc, GoSimple, Sage, Gbooks, Taxfiler, BTCSoftware, Taxshield, CalCal, ACCTAX, Ablegatio, Capium, Taxforward, Forbes, Xero, 123 e-Filing, Absolute Topup, Andica, Nomisma, Basetax, Keytime and Ajaccts. Whichever service you use your tax returns will need to be in on time to avoid penalties.

Self Improvement for Business Through Better Money Management

Starting your own business is exciting, and this is true whether you are starting this business online or offline. When you're your own boss, you get to be in charge of basically everything. How scary is that? However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. It then pays to be aware of a few self-improvement strategies like knowing how to manage finances the proper way. If you'd like to keep your finances in order, continue reading this article.

It can be tempting to wait to pay your taxes until they are due, but if you are not good at managing your money, you may not have the funds on hand to actually pay your estimated tax payments and other fees. Try saving a portion of your daily or even weekly earnings and depositing it in a separate bank account. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. You want to be able to pay taxes promptly and in full and being able to do so every quarter is a great feeling.

You may be your own boss, but it's still a good idea to give yourself a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. You decide the salary for yourself. You can pay yourself by billable hours or a portion of your business income for that month.

Keep a tight lid on your spending. It's certainly very tempting to start buying things you've always wanted when the money is coming in. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. When you need to purchase office supplies, purchase in bulk. When it comes to your business equipment, you will save more by investing in quality machines even if they may require a huge cash outlay from you in the beginning. The savings will come in the form of not having to buy a new one or replace parts frequently. Be smart about entertainment expenses, etc.

When it comes to properly managing your business finances, you'll find that there are a lot of things that go into doing so. Proper management of business finances isn't merely a basic skill. It's actually a complex process that you need to keep developing as a small business owner. Hopefully, the tips we've shared in this article will help you get started in managing your finances better. One of the secrets to having a successful business is learning proper money management.

Payroll Services Great Yarmouth

For any company in Great Yarmouth, from independent contractors to large scale organisations, payrolls for staff can be complicated. The laws relating to payroll for transparency and accuracy mean that processing a company's payroll can be an intimidating task for the uninitiated.

Small businesses may not have the help that a dedicated financial specialist can provide, and a good way to handle employee payrolls is to hire an external Great Yarmouth accountant. Your chosen payroll company will manage accurate BACS payments to your employees, as well as working with any pension providers that your company might have, and follow current HMRC legislation for deductions and NI contributions.

Following current regulations, a dedicated payroll accountant in Great Yarmouth will also present every one of your employees with a P60 tax form at the end of each fiscal year. Upon the termination of a staff member's contract with your company, the payroll accountant should also provide a current P45 form relating to the tax paid during the previous financial period. (Tags: Payroll Services Great Yarmouth, Company Payrolls Great Yarmouth, Payroll Accountants Great Yarmouth).

Great Yarmouth accountants will help with financial planning in Great Yarmouth, retirement planning, investment reviews, VAT registrations, contractor accounts, HMRC submissions, tax investigations, accounting support services, workplace pensions, litigation support, company secretarial services, general accounting services in Great Yarmouth, VAT returns, National Insurance numbers, business advisory, employment law, corporate tax, accounting services for buy to let landlords in Great Yarmouth, self-employed registration, double entry accounting, assurance services in Great Yarmouth, taxation accounting services in Great Yarmouth, management accounts, limited company accounting in Great Yarmouth, accounting and financial advice, year end accounts Great Yarmouth, bookkeeping, mergers and acquisitions, financial statements, debt recovery, capital gains tax Great Yarmouth, partnership registrations Great Yarmouth and other accounting related services in Great Yarmouth, Norfolk. These are just a few of the tasks that are handled by local accountants. Great Yarmouth specialists will inform you of their whole range of accounting services.

You actually have the best possible resource at your fingertips in the form of the world wide web. There's such a lot of information and inspiration readily available online for things like accounting & auditing, self-assessment help, accounting for small businesses and personal tax assistance, that you will pretty soon be bursting with suggestions for your accounting needs. An illustration may be this interesting article describing choosing the right accountant.

Great Yarmouth Accounting Services

- Great Yarmouth Personal Taxation

- Great Yarmouth Financial Advice

- Great Yarmouth Tax Services

- Great Yarmouth Taxation Advice

- Great Yarmouth VAT Returns

- Great Yarmouth Forensic Accounting

- Great Yarmouth Tax Planning

- Great Yarmouth Business Accounting

- Great Yarmouth Tax Refunds

- Great Yarmouth Auditing Services

- Great Yarmouth Bookkeepers

- Great Yarmouth Debt Recovery

- Great Yarmouth Chartered Accountants

- Great Yarmouth Bookkeeping Healthchecks

Also find accountants in: Stiffkey, Freethorpe, Marsham, Ashill, Attlebridge, Redenhall, West Winch, Tatterford, North Lopham, Barton Common, Horning, Sutton, Middle Harling, Thurlton, Little Hautbois, Little Melton, Spooner Row, Thornham, Briston, Kettlestone, Hardwick, Barton Bendish, Newport, Bircham Tofts, Gateley, Grimston, Intwood, Shernborne, Colkirk, Cromer, South Lopham, West Newton, Methwold Hythe, West Beckham, Hemsby and more.

Accountant Great Yarmouth

Accountant Great Yarmouth Accountants Near Me

Accountants Near Me Accountants Great Yarmouth

Accountants Great YarmouthMore Norfolk Accountants: Gorleston, Norwich, Thetford, Dereham, Kings Lynn, Great Yarmouth, Wymondham and Taverham.

TOP - Accountants Great Yarmouth - Financial Advisers

Tax Accountants Great Yarmouth - Investment Accountant Great Yarmouth - Financial Advice Great Yarmouth - Financial Accountants Great Yarmouth - Cheap Accountant Great Yarmouth - Tax Preparation Great Yarmouth - Bookkeeping Great Yarmouth - Auditors Great Yarmouth - Small Business Accountants Great Yarmouth