Accountants Maesteg: Very few will deny that if you operate a business or are a self-employed person in Maesteg, having an accountant to do your books, brings a number of positive benefits. By handling your bookkeeping and self-assessment tax returns your accountant can free up a bit of time so that you can focus on the things you do best. The importance of getting this kind of financial help cannot be overstated, particularly for start-ups and fledgling businesses that are not yet established. As you grow, you'll need more and more help.

Locating an accountant in Maesteg isn't always that simple with various kinds of accountants available. Therefore, it's crucial that you pick one that matches your specific needs. Whether you use an accountant working within a larger firm or one who is working on their own is your choice. Each field of accounting will probably have their own specialists within an accounting company. Among the principal accountancy jobs are: tax preparation accountants, chartered accountants, financial accountants, management accountants, actuaries, accounting technicians, forensic accountants, investment accountants, auditors, cost accountants and bookkeepers.

It is advisable for you to find an accountant in Maesteg who is properly qualified. The AAT qualification is the minimum you should look for. Qualified Maesteg accountants might charge a bit more but they may also get you the maximum tax savings. Remember that a percentage of your accounting costs can be claimed back on the tax return. Small businesses and sole traders can use a bookkeeper rather than an accountant.

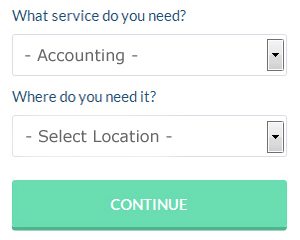

There is a unique online website called Bark which will actually find you a choice of accountants in the Maesteg area. Tick a few boxes on their form and submit it in minutes. Sometimes in as little as a couple of hours you will hear from prospective Maesteg accountants who are keen to get to work for you.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. It could be that this solution will be more appropriate for you. Don't simply go with the first company you find on Google, take time to do some research. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable. This is something you need to do yourself as we do not wish to favour any particular service here.

The most cost effective method of all is to do it yourself. You can take much of the hard graft out of this procedure by using a software program such as CalCal, BTCSoftware, Capium, TaxCalc, GoSimple, Forbes, Xero, Nomisma, Taxforward, Ajaccts, Ablegatio, Taxfiler, Andica, Taxshield, Sage, Gbooks, Basetax, Keytime, Absolute Topup, ACCTAX or 123 e-Filing. You will get a penalty if your tax return isn't in on time.

How Managing Your Money Better Makes You a Better Business Owner

Whether you're starting up an online or offline business, it can be one of the most exciting things you'd ever do. You are finally in charge of yourself, you are finally in charge of your income -- you are in charge of everything! That sounds a little scary, doesn't it? However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. Thus, it can be very helpful if you know a few self-improvement strategies like managing your finances properly. Keep reading this article to learn how to correctly manage your money.

In case you're paying many business expenses on a regular basis, you may find it easier to charge them on your credit card. This can make your life easier because each month, you just make one payment to your credit card company instead of making out payments to several different companies. Of course, credit cards are tricky things, and if you let yourself carry a balance, the interest charges could make you pay a lot more money than you would have spent by simply paying the fees straight out of your bank account. To avoid this, make sure you pay your credit card balance in full every month. When you do this, you streamline your process and not have to pay interest. Your credit rating will get a boost in the process.

Consider offering clients payment plans. Besides making it more appealing for potential clients to do business with you, this strategy will have money coming in on a regular basis. Having payments come in regularly even if they aren't in huge amounts is certainly so much better than getting big payments irregularly. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. This can certainly boost your self-confidence.

Do you receive cash payments regularly in your business? It may be a good idea to deposit money at the end of the day or as soon as possible. This will minimize the temptation of having money available that you can easily spend. It could be that you need cash when you're out for lunch and you end up getting money from your register and telling yourself you'll return the money later. When you do this, however, it's very possible that you'll forget all about the money you took out and then when you're doing your books, you're going to wonder why you're short. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

Proper money management is one of the best things you can learn both for your own self improvement and for self improvement in your business. Try to implement these tips we've shared because you stand to benefit in the long run. You're much more likely to experience business and personal success when you have your finances under control.

Maesteg accountants will help with tax investigations, sole traders Maesteg, company formations, payslips, employment law, corporate finance, business advisory, litigation support in Maesteg, VAT payer registration, accounting services for start-ups in Maesteg, bookkeeping, VAT returns, payroll accounting, general accounting services Maesteg, audit and compliance issues, HMRC liaison, HMRC submissions, charities, tax returns, contractor accounts, limited company accounting Maesteg, cashflow projections, business support and planning in Maesteg, personal tax in Maesteg, National Insurance numbers, business acquisition and disposal, accounting services for buy to let property rentals in Maesteg, auditing and accounting Maesteg, taxation accounting services, assurance services in Maesteg, self-employed registration, debt recovery and other professional accounting services in Maesteg, Wales. Listed are just a selection of the duties that are undertaken by nearby accountants. Maesteg providers will be happy to inform you of their entire range of services.

Maesteg Accounting Services

- Maesteg Chartered Accountants

- Maesteg Tax Planning

- Maesteg Bookkeeping

- Maesteg Payroll Management

- Maesteg PAYE Healthchecks

- Maesteg Specialist Tax

- Maesteg Taxation Advice

- Maesteg Bookkeeping Healthchecks

- Maesteg Self-Assessment

- Maesteg Personal Taxation

- Maesteg VAT Returns

- Maesteg Tax Refunds

- Maesteg Account Management

- Maesteg Business Accounting

Also find accountants in: Holywell, Ebbw Vale, Bedwas, Llanrwst, Treharris, Ystrad Mynach, Rhoose, Llandudno, Abercynon, Gelligaer, Caergwrle, Fishguard, Pontycymer, Glyncoch, Swansea, Caldicot, Taff's Well, Tonypandy, Bishopston, St Asaph, Flint, Haverfordwest, Ewloe, Blackwood, Blaina, Cardiff, Cowbridge, Rhosllannerchrugog, Llangennech, Beddau, Conwy, Tonyrefail, Rhondda, Coedpoeth, Ogmore Vale and more.

Accountant Maesteg

Accountant Maesteg Accountants Near Maesteg

Accountants Near Maesteg Accountants Maesteg

Accountants MaestegMore Wales Accountants: Ebbw Vale, Caerphilly, Prestatyn, Rhyl, Gorseinon, Port Talbot, Bridgend, Barry, Flint, Llandudno, Aberystwyth, Llanelli, Aberdare, Cwmbran, Carmarthen, Pontypridd, Swansea, Neath, Cardiff, Porthcawl, Colwyn Bay, Tonypandy, Wrexham, Penarth, Merthyr Tydfil, Newport and Maesteg.

TOP - Accountants Maesteg - Financial Advisers

Tax Preparation Maesteg - Auditors Maesteg - Financial Accountants Maesteg - Self-Assessments Maesteg - Bookkeeping Maesteg - Investment Accounting Maesteg - Tax Advice Maesteg - Online Accounting Maesteg - Cheap Accountant Maesteg