Accountants Cwmbran: Does completing your yearly self-assessment form cause you a lot of frustration? You and innumerable other self-employed Cwmbran people will have to deal with this every twelve months. The obvious solution would be to pay a reliable Cwmbran accountant to tackle this job instead. Do you find self-assessment simply too taxing to tackle by yourself? This sort of service will generally cost about £200-£300 if you use a High Street accountant in Cwmbran. If you are looking for a cheap option you might find the answer online.

You'll quickly discover that there are different forms of accountant. Take the time to uncover an accountant who meets your particular needs. Whether you use an accountant working within a larger accountancy practice or one who's working on their own is your choice. Accountancy firms will have specialists in each particular accounting sector. You will probably find tax preparation accountants, chartered accountants, investment accountants, financial accountants, accounting technicians, auditors, costing accountants, forensic accountants, bookkeepers, actuaries and management accountants in a good sized accountancy practice.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. Membership of the AAT shows that they hold the minimum recommended qualification. A qualified accountant may cost a little more but in return give you peace of mind. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. Local Cwmbran bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

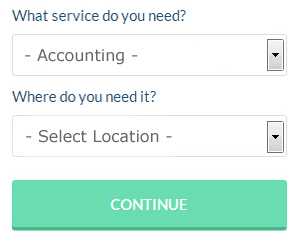

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. Filling in a clear and simple form is all that you need to do to set the process in motion. You should start getting responses from local Cwmbran accountants within the next 24 hours. Bark offer this service free of charge.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. A number of self-employed people in Cwmbran prefer to use this simple and convenient alternative. Make a short list of such companies and do your homework to find the most reputable. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable.

The very best in this profession are chartered accountants, they will also be the most expensive. Accountants must be members of the ICAEW (or ICAS in Scotland) to work as a chartered accountant. You will certainly be hiring the best if you do choose one of these.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example 123 e-Filing, Keytime, CalCal, Taxshield, GoSimple, Ajaccts, ACCTAX, Basetax, Capium, Andica, Nomisma, Ablegatio, Gbooks, TaxCalc, BTCSoftware, Taxfiler, Xero, Absolute Topup, Forbes, Sage and Taxforward. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time.

Forensic Accounting Cwmbran

You may well notice the expression "forensic accounting" when you're on the lookout for an accountant in Cwmbran, and will perhaps be interested to learn about the distinction between forensic accounting and standard accounting. The clue for this is the word 'forensic', which essentially means "appropriate for use in a law court." Occasionally also known as 'financial forensics' or 'forensic accountancy', it uses investigative skills, accounting and auditing to search through financial accounts in order to discover criminal activity and fraud. There are several bigger accountants firms throughout Wales who have dedicated departments for forensic accounting, addressing professional negligence, personal injury claims, tax fraud, insolvency, money laundering, false insurance claims and bankruptcy. (Tags: Forensic Accounting Cwmbran, Forensic Accountants Cwmbran, Forensic Accountant Cwmbran)

Actuaries Cwmbran

An actuary is a business specialist who assesses the managing and measurement of risk and uncertainty. Actuaries use their mathematical expertise to gauge the probability and risk of future happenings and to predict their impact (financially) on a business and their clientele. Actuaries present evaluations of financial security systems, with an emphasis on their mathematics, mechanisms and complexity. (Tags: Actuary Cwmbran, Financial Actuaries Cwmbran, Actuaries Cwmbran)

Payroll Services Cwmbran

For any business in Cwmbran, from large scale organisations down to independent contractors, dealing with staff payrolls can be stressful. The laws on payrolls and the legal requirements for transparency and accuracy means that handling a business's payroll can be a daunting task.

All small businesses don't have their own in-house financial specialists, and the best way to manage employee pay is to employ an independent Cwmbran accounting company. Working with HMRC and pension providers, a managed payroll service accountant will also manage BACS payments to staff, make certain they're paid on time each month, and that all required deductions are done accurately.

Working to current regulations, a dedicated payroll management accountant in Cwmbran will also provide each of your staff members with a P60 after the end of each financial year. At the end of an employee's contract with your company, the payroll accountant should also provide an updated P45 form relating to the tax paid in the last financial period.

Auditors Cwmbran

Auditors are experts who evaluate the accounts of organisations and companies to substantiate the validity and legality of their financial reports. They offer businesses from fraud, discover inaccuracies in accounting procedures and, from time to time, work as consultants, helping firms to identify solutions to boost efficiency. Auditors must be approved by the regulating authority for accounting and auditing and have the necessary accounting qualifications.

Cwmbran accountants will help with personal tax, workplace pensions, consulting services, accounting services for media companies, PAYE, bookkeeping in Cwmbran, business outsourcing, business disposal and acquisition, HMRC liaison, investment reviews, annual tax returns, accounting and auditing, business advisory, employment law, accounting support services in Cwmbran, accounting services for buy to let landlords, payslips, corporate finance, monthly payroll, partnership accounts, business planning and support, limited company accounting, corporate tax, contractor accounts, financial planning, double entry accounting, small business accounting, partnership registrations, HMRC submissions, tax preparation, accounting and financial advice, charities in Cwmbran and other accounting services in Cwmbran, Wales. These are just an example of the duties that are accomplished by local accountants. Cwmbran professionals will keep you informed about their full range of services.

By using the internet as a powerful resource it is of course pretty easy to find lots of valuable ideas and information concerning accounting & auditing, accounting for small businesses, personal tax assistance and self-assessment help. To illustrate, with a brief search we found this illuminating article outlining five tips for choosing a top-notch accountant.

Cwmbran Accounting Services

- Cwmbran Financial Advice

- Cwmbran Auditing Services

- Cwmbran Bookkeeping

- Cwmbran Bookkeeping Healthchecks

- Cwmbran Tax Services

- Cwmbran Tax Returns

- Cwmbran Payroll Management

- Cwmbran Self-Assessment

- Cwmbran PAYE Healthchecks

- Cwmbran Account Management

- Cwmbran VAT Returns

- Cwmbran Forensic Accounting

- Cwmbran Tax Refunds

- Cwmbran Tax Advice

Also find accountants in: Aberavon, Llandudno Junction, Pontardawe, Abergavenny, Pontarddulais, Penparcau, Aberdare, Pwllheli, Ruabon, Cwmafan, Swansea, Flint, Dinas Powys, Crumlin, Cefn-mawr, Mountain Ash, Fishguard, Barry, Brynmawr, Bangor, Chirk, Llangefni, Pembroke Dock, Brecon, Blaina, Nantyglo, Pontycymer, New Tredegar, Sandycroft, Caergwrle, Tumble, Llanelli, Tonypandy, Abertillery, Rhyl and more.

Accountant Cwmbran

Accountant Cwmbran Accountants Near Cwmbran

Accountants Near Cwmbran Accountants Cwmbran

Accountants CwmbranMore Wales Accountants: Aberdare, Penarth, Prestatyn, Llanelli, Bridgend, Gorseinon, Colwyn Bay, Newport, Porthcawl, Flint, Maesteg, Pontypridd, Swansea, Cardiff, Ebbw Vale, Port Talbot, Barry, Llandudno, Carmarthen, Aberystwyth, Merthyr Tydfil, Cwmbran, Tonypandy, Caerphilly, Neath, Wrexham and Rhyl.

TOP - Accountants Cwmbran - Financial Advisers

Tax Accountants Cwmbran - Online Accounting Cwmbran - Financial Accountants Cwmbran - Self-Assessments Cwmbran - Investment Accountant Cwmbran - Auditing Cwmbran - Small Business Accountants Cwmbran - Financial Advice Cwmbran - Cheap Accountant Cwmbran