Accountants Port Talbot: Does completing your yearly self-assessment form give you a headache? This can be a challenge for you and many other Port Talbot folks in self-employment. Is it easy to track down a local professional in Port Talbot to handle this for you? Maybe self-assessment is just too challenging for you? This ought to cost you about £200-£300 if you use the services of an average Port Talbot accountant. You can certainly get it done cheaper by using online services.

But which accounting service is best for your needs and how might you go about locating it? The internet seems to be the most popular place to look these days, so that would probably be a good place to start. Knowing exactly who you can trust is of course not quite so easy. The fact that somebody in Port Talbot claims to be an accountant is no real guarantee of quality. No formal qualifications are required in order to do this.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. At the very least you should look for somebody with an AAT qualification. You can then have peace of mind knowing that your tax affairs are being handled professionally. Remember that a percentage of your accounting costs can be claimed back on the tax return.

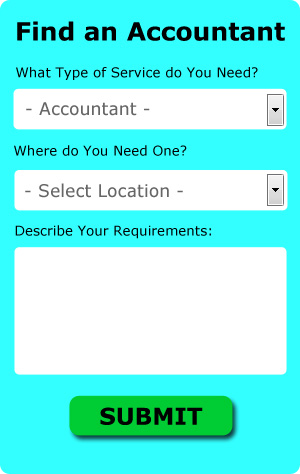

To save yourself a bit of time when searching for a reliable Port Talbot accountant online, you might like to try a service called Bark. You'll be presented with a simple form which can be completed in a minute or two. Within a few hours you should hear from some local accountants who are willing to help you.

If you prefer the cheaper option of using an online tax returns service there are several available. The popularity of these services has been increasing in recent years. Some of these companies are more reputable than others. Carefully read reviews online in order to find the best available.

The most highly qualified and generally most expensive within this profession are chartered accountants. These high achievers will hold qualifications like an ACA or an ICAEW. Some people might say, you should hire the best you can afford.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. There is also lots of software available to help you with your returns. These include Gbooks, BTCSoftware, Absolute Topup, Sage, CalCal, 123 e-Filing, GoSimple, Xero, Taxforward, Basetax, Taxshield, TaxCalc, Forbes, Nomisma, ACCTAX, Capium, Ajaccts, Taxfiler, Andica, Keytime and Ablegatio. Make sure your tax returns are sent off promptly to avoid getting a penalty fine. You will receive a fine of £100 if you are up to three months late with your tax return.

Small Business Accountants Port Talbot

Company accounting can be a fairly stressful experience for any owner of a small business in Port Talbot. A dedicated small business accountant in Port Talbot will provide you with a stress free means to keep your VAT, tax returns and annual accounts in perfect order.

Giving guidance, making sure that your business adheres to the optimum financial practices and suggesting ways to help your business to achieve its full potential, are just a sample of the duties of an experienced small business accountant in Port Talbot. The fluctuating and sometimes complex world of business taxation will be clearly laid out for you in order to lower your business expenses, while improving tax efficiency.

It is also critical that you explain your future plans, your business structure and your company's financial circumstances truthfully to your small business accountant.

Payroll Services Port Talbot

An important aspect of any business enterprise in Port Talbot, big or small, is having a reliable payroll system for its employees. The laws regarding payrolls and the legal obligations for accuracy and transparency means that handling a business's payroll can be an intimidating task.

Using a reliable accountant in Port Talbot, to deal with your payroll needs is the simple way to lessen the workload of your own financial department. A managed payroll service accountant will work alongside HMRC, with pensions scheme administrators and set up BACS payments to ensure that your staff are always paid on time, and all mandatory deductions are correct.

Abiding by the current regulations, a decent payroll management accountant in Port Talbot will also provide every one of your workers with a P60 at the conclusion of each financial year. A P45 form should also be given to any employee who stops working for your business, in accordance with current regulations.

Tips to Help You Manage Your Money Better

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. However, proper management of business finances isn't always easy, and many people tend to get overwhelmed with this aspect of the business. Fortunately, you can do some things that will make it so much easier on you to manage your business finances. If you'd like to be able to manage your business funds, keep reading.

Implement a numbering system for your invoices. This is something that a lot of business owners don't really think about but it can save you a lot of hassle down the road. When you've got your invoices numbered, you can easily track your transactions. It doesn't just help you track who owes you what, it helps you track who has paid you what as well. There are going to come times when a client will insist that he has paid you and having a numbered invoice to look up can be very helpful in that situation. Errors can happen in business too and if you've got your invoices numbered, it makes it easy for you to find those mistakes.

Track both your personal and business expenses down to the last penny. Sure, it's annoying to have to track everything you spend money on but doing this actually has a lot of benefits. When you keep a detailed record of where you're spending your money, you'll be able to get a clear picture of your spending habits. Nobody likes that feeling of "I know I'm earning money, where is it going?" If you keep a record of all your expenditures, you know exactly where you're spending your money. If your budget is a little too tight, you'll be able to identify expenditures that you can cut back on to save money. You're also streamlining things when you're completing your tax forms when you have a complete, detailed record of your business and personal expenditures.

Be a prompt tax payer. Typically, small businesses must pay taxes every quarter. Taxes can be quite confusing so you might want to make an appointment with your local small business center or even at the IRS so you can get accurate information. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. The only way you won't get that dreaded visit from the IRS is if you're paying your taxes.

Learning how to manage your finances properly will help not just your business but yourself as well. Try to implement these tips we've shared because you stand to benefit in the long run. You're in a much better position for business and personal success when you know how to manage your finances better.

Port Talbot accountants will help with corporation tax, HMRC submissions Port Talbot, corporate finance, mergers and acquisitions Port Talbot, accounting and auditing, accounting services for the construction sector, VAT registrations Port Talbot, consulting services, business start-ups, estate planning Port Talbot, consultancy and systems advice, business disposal and acquisition, accounting support services, self-employed registration, annual tax returns, accounting services for media companies Port Talbot, contractor accounts in Port Talbot, partnership registration, small business accounting, year end accounts, inheritance tax, VAT returns, financial statements, cash flow Port Talbot, payslips in Port Talbot, limited company accounting, charities, double entry accounting, tax investigations Port Talbot, sole traders, taxation accounting services Port Talbot, debt recovery and other kinds of accounting in Port Talbot, Wales. Listed are just a small portion of the duties that are handled by nearby accountants. Port Talbot companies will inform you of their full range of accounting services.

Port Talbot Accounting Services

- Port Talbot Tax Refunds

- Port Talbot Bookkeeping Healthchecks

- Port Talbot Payroll Services

- Port Talbot Tax Advice

- Port Talbot Personal Taxation

- Port Talbot Bookkeeping

- Port Talbot VAT Returns

- Port Talbot Self-Assessment

- Port Talbot Audits

- Port Talbot Financial Audits

- Port Talbot Business Accounting

- Port Talbot Financial Advice

- Port Talbot Tax Returns

- Port Talbot Tax Planning

Also find accountants in: Port Talbot, Aberavon, Glyn-Neath, Llandudno Junction, Monmouth, Llay, Caldicot, Abercynon, Ogmore Vale, Glyncoch, Beddau, Buckley, Tycroes, Swansea, Tonyrefail, Blaina, Blaenavon, Briton Ferry, Newtown, Bethesda, Conwy, Bridgend, Ebbw Vale, Rhondda, Llangefni, Ystrad Mynach, Bagillt, Pontarddulais, Penygroes, Holywell, Church Village, Caernarfon, Llandudno, Haverfordwest, Abertridwr and more.

Accountant Port Talbot

Accountant Port Talbot Accountants Near Port Talbot

Accountants Near Port Talbot Accountants Port Talbot

Accountants Port TalbotMore Wales Accountants: Gorseinon, Aberystwyth, Colwyn Bay, Cwmbran, Barry, Newport, Porthcawl, Flint, Maesteg, Aberdare, Pontypridd, Cardiff, Rhyl, Tonypandy, Llandudno, Prestatyn, Penarth, Ebbw Vale, Port Talbot, Bridgend, Carmarthen, Caerphilly, Wrexham, Llanelli, Neath, Swansea and Merthyr Tydfil.

TOP - Accountants Port Talbot - Financial Advisers

Investment Accounting Port Talbot - Financial Accountants Port Talbot - Chartered Accountants Port Talbot - Financial Advice Port Talbot - Bookkeeping Port Talbot - Tax Return Preparation Port Talbot - Affordable Accountant Port Talbot - Self-Assessments Port Talbot - Small Business Accountant Port Talbot