Accountants Liverpool: Does filling out your annual self-assessment form give you a headache? You and lots of other folks in Liverpool have to contend with this each and every year. Of course, you could always get yourself a local Liverpool accountant to do this task instead. If you find self-assessment too taxing, this could be much better for you. A run of the mill bookkeeper or accountant in Liverpool is likely to charge you a ball park figure of £200-£300 for the completion of your self-assessment form. Online accounting services are available for considerably less than this.

But precisely what do you get for your cash, how much should you pay and where do you find the best Liverpool accountant for your requirements? Nowadays most people commence their hunt for an accountant or any other service on the world wide web. Yet, how do you identify which of these accountants are trustworthy? Don't forget that anybody that is so inclined can set themselves up as an accountant in Liverpool. There is no legal requirement that says they have to have particular qualifications or certifications. Which to many people would seem rather strange.

It is advisable for you to find an accountant in Liverpool who is properly qualified. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. Qualified Liverpool accountants might charge a bit more but they may also get you the maximum tax savings. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. Liverpool sole traders often opt to use bookkeeper rather than accountants for their tax returns.

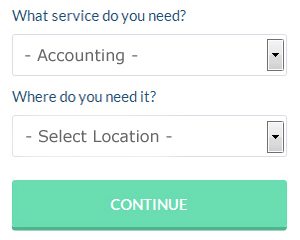

Though you may not have heard of them before there is an online service called Bark who can help you in your search. All that is required is the ticking of a few boxes so that they can understand your exact needs. In no time at all you will get messages from accountants in the Liverpool area. There is no fee for this service.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. This type of service is growing in popularity. Picking a reputable company is important if you choose to go with this option. Reading through reviews for any potential online services is a good way to get a feel for what is out there.

The most cost effective method of all is to do it yourself. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Gbooks, TaxCalc, Andica, Sage, CalCal, BTCSoftware, Absolute Topup, Xero, Taxforward, Capium, Keytime, Nomisma, GoSimple, Ablegatio, Basetax, 123 e-Filing, Taxfiler, Taxshield, Ajaccts, ACCTAX and Forbes. Whichever service you use your tax returns will need to be in on time to avoid penalties.

Self Improvement for Your Business Through Proper Money Management

Many business owners have discovered early on that it can be difficult to learn how to properly use money management techniques. Being able to manage money may seem like a skill you should already possess before you go into business. However, there is a huge difference between managing your personal finances and managing your business finances, although it can help if you've got some experience in the former. Very few things in life can kill your confidence quite like how unintentionally ruining your financial situation does. You can be better at money management and if you keep reading, you'll learn a few strategies to help you do so.

Implement a numbering system for your invoices. This is something that a lot of business owners don't really think about but it can save you a lot of hassle down the road. It makes it easy to track invoices if you have them numbered. It doesn't just help you track who owes you what, it helps you track who has paid you what as well. You'll have those times when a client will be insistent in saying he has already paid you and if you have your invoices numbered, you can easily look it up and resolve the matter. Remember, it is possible to make errors and numbering your invoices is a simple way to help find them when they happen.

Even if you are a sole proprietor, you can still give yourself a salary and a regular paycheck. This way, you won't have a hard time keeping track of your business and personal finances. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. How much should you pay yourself? It's up to you. Your salary can be a portion of how much your business brought in for the month or it can be based on how many hours you worked.

It's a good idea to keep your receipts. These receipts are going to be heaven-sent if the IRS ever come knocking at your door demanding to see proof of what you've been spending and where you've been spending your money on. These receipts are also a record of your business expenditures. Make sure you keep your receipts together in one place. Tracking your expenses becomes easy if you have all your receipts in one place. The best way to store your receipts is in an accordion file and then have this file in a drawer in your desk so you can easily go through your receipts if you need to.

When it comes to improving yourself and your business, proper money management is one of the most essential things you can learn. You'll benefit a great deal if you remember and put these tips we've shared to use. You're in a much better position for business and personal success when you know how to manage your finances better.

Payroll Services Liverpool

A crucial part of any company in Liverpool, small or large, is having an accurate payroll system for its workers. The legislation relating to payroll for accuracy and openness mean that running a company's payroll can be a formidable task for the uninitiated.

Using an experienced accountant in Liverpool, to handle your payroll requirements is the simple way to reduce the workload of your financial department. Your chosen payroll service company will manage accurate BACS payments to your personnel, as well as working together with any pension scheme administrators that your business may have, and use the latest HMRC legislation for tax deductions and NI contributions.

It will also be necessary for a qualified payroll accountant in Liverpool to prepare a P60 declaration for all staff members at the conclusion of the financial year (by May 31st). They'll also be responsible for providing P45 tax forms at the termination of a staff member's contract.

Small Business Accountants Liverpool

Doing the accounts and bookkeeping can be a stressful experience for any small business owner in Liverpool. Appointing a small business accountant in Liverpool will allow you to operate your business knowing that your VAT, annual accounts and tax returns, and various other business tax requirements, are being met.

A seasoned small business accountant in Liverpool will consider that it's their responsibility to develop your business, and offer you reliable financial guidance for security and peace of mind in your unique situation. A good accounting firm in Liverpool will offer you practical small business advice to optimise your tax efficiency while at the same time reducing expense; essential in the sometimes murky field of business taxation.

You should also be offered a dedicated accountancy manager who has a good understanding of your company's situation, your future plans and the structure of your business. (Tags: Small Business Accounting Liverpool, Small Business Accountants Liverpool, Small Business Accountant Liverpool).

Actuaries Liverpool

An actuary measures, manages and gives advice on financial risks. They employ their mathematical talents to quantify the risk and probability of future happenings and to calculate their effect on a business. An actuary uses mathematics and statistical concepts to assess the fiscal impact of uncertainties and help clients cut down on possible risks. (Tags: Actuaries Liverpool, Financial Actuary Liverpool, Actuary Liverpool)

Liverpool accountants will help with debt recovery, accounting services for the construction sector, capital gains tax in Liverpool, business support and planning, mergers and acquisitions Liverpool, accounting services for media companies in Liverpool, business advisory services, year end accounts, partnership registrations, tax preparation in Liverpool, partnership accounts in Liverpool, charities Liverpool, PAYE, corporation tax, VAT returns Liverpool, auditing and accounting in Liverpool, assurance services, self-employed registrations, accounting services for landlords, investment reviews in Liverpool, business disposal and acquisition, litigation support, VAT payer registration, taxation accounting services, HMRC submissions in Liverpool, company secretarial services, general accounting services, employment law, double entry accounting in Liverpool, payslips, inheritance tax Liverpool, bureau payroll services and other accounting related services in Liverpool, Merseyside. These are just some of the duties that are handled by nearby accountants. Liverpool professionals will tell you about their entire range of services.

Liverpool Accounting Services

- Liverpool Personal Taxation

- Liverpool Business Accounting

- Liverpool Debt Recovery

- Liverpool Bookkeepers

- Liverpool PAYE Healthchecks

- Liverpool Business Planning

- Liverpool Self-Assessment

- Liverpool Payroll Services

- Liverpool Forensic Accounting

- Liverpool Tax Advice

- Liverpool Specialist Tax

- Liverpool Account Management

- Liverpool Audits

- Liverpool Tax Refunds

Also find accountants in: Raby, New Ferry, Brimstage, Billinge, Crank, Caldy, Speke, Melling, Aintree, Thurstaston, Moreton, Oxton, Roby, Waterloo, Bootle, Woolton, Upton, Rock Ferry, Seacombe, Prescot, Lydiate, Eastham, Gayton, Liverpool, Thornton Hough, Ince Blundell, Knowsley, Hunts Cross, Barnston, Thornton, Bebington, Aigburth, Sutton Leach, Earlestown, Whiston and more.

Accountant Liverpool

Accountant Liverpool Accountants Near Me

Accountants Near Me Accountants Liverpool

Accountants LiverpoolMore Merseyside Accountants: Formby, Maghull, Haydock, Prescot, Southport, St Helens, Wallasey, Kirkby, Bebington, Heswall, Birkenhead, Litherland, Halewood, Liverpool, Crosby, Newton-le-Willows and Bootle.

TOP - Accountants Liverpool - Financial Advisers

Auditing Liverpool - Online Accounting Liverpool - Chartered Accountant Liverpool - Financial Advice Liverpool - Investment Accounting Liverpool - Tax Return Preparation Liverpool - Tax Advice Liverpool - Bookkeeping Liverpool - Affordable Accountant Liverpool