Accountants Farnham: Filling in your self-assessment form year after year can really give you a headache. This can be challenging for you and a multitude of other Farnham people in self-employment. You may prefer to track down a local Farnham accountant to do it for you. Is self-assessment just a tad too complicated for you? A regular accountant in Farnham is likely to charge you about £200-£300 for the privilege. You will be able to get this done significantly cheaper by making use of one of the various online services.

When looking for an accountant in Farnham, you'll find that there are various kinds. Check that any prospective Farnham accountant is suitable for what you need. Certain accountants work as part of an accountancy business, whilst some work independently. An accounting practice may offer a broader range of services, while an independent accountant will provide a more personal service. Most accountancy firms will be able to offer: financial accountants, tax preparation accountants, management accountants, investment accountants, auditors, chartered accountants, actuaries, forensic accountants, cost accountants, accounting technicians and bookkeepers.

Find yourself a properly qualified one and don't take any chances. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. Accounting fees are of course a business expense and can be included as such on your tax return. Only larger Limited Companies are actually required by law to use a trained accountant.

To save yourself a bit of time when searching for a reliable Farnham accountant online, you might like to try a service called Bark. All that is required is the ticking of a few boxes so that they can understand your exact needs. Just sit back and wait for the responses to roll in. When this article was written Bark was free to use.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. It could be that this solution will be more appropriate for you. If you decide to go with this method, pick a company with a decent reputation. Carefully read reviews online in order to find the best available.

Although filling in your own tax return may seem too complicated, it is not actually that hard. You could even use a software program like 123 e-Filing, GoSimple, Xero, TaxCalc, CalCal, Capium, Gbooks, Taxshield, Ablegatio, Sage, Nomisma, Absolute Topup, Forbes, Ajaccts, Taxforward, ACCTAX, Taxfiler, Andica, Keytime, Basetax or BTCSoftware to make life even easier. You will get a penalty if your tax return isn't in on time. You can expect a fine of £100 if your assessment is in even 1 day late.

Actuaries Farnham

An actuary is a business expert who deals with the measurement and management of uncertainty and risk. They employ their mathematical skills to calculate the probability and risk of future happenings and to predict their financial ramifications for a business. Actuaries present evaluations of fiscal security systems, with a focus on their complexity, their mathematics, and their mechanisms. (Tags: Actuaries Farnham, Actuary Farnham, Financial Actuaries Farnham)

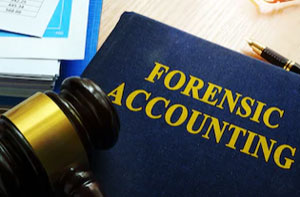

Forensic Accounting Farnham

When you're hunting for an accountant in Farnham you will maybe run across the expression "forensic accounting" and wonder what the difference is between a regular accountant and a forensic accountant. The actual word 'forensic' is the thing that gives it away, meaning basically "suitable for use in a court of law." Sometimes also called 'financial forensics' or 'forensic accountancy', it uses auditing, accounting and investigative skills to examine financial accounts so as to identify fraud and criminal activity. Some of the larger accounting firms in the Farnham area may have independent forensic accounting departments with forensic accountants focusing on certain types of fraud, and might be dealing with personal injury claims, professional negligence, falsified insurance claims, tax fraud, bankruptcy, money laundering and insolvency.

How Managing Your Money Better Makes You a Better Business Owner

If you're a new business owner, you'll discover that managing your money properly is one of those things you will struggle with sooner or later. These struggles can affect your confidence and if you're having financial problems with your business, the idea of quitting and going back to your old 9-to-5 job becomes more appealing. This is going to keep you from succeeding in your business. To help you in properly managing your money, follow these tips.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. You can save yourself the headache by putting a portion of each payment you get in a separate account. This is a good strategy because when your taxes come due every quarter, you've already got money set aside and you won't be forced to take money out from your current earnings. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

Even if you are a sole proprietor, you can still give yourself a salary and a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. You can decide how much you should pay yourself. You can set an hourly rate and then pay yourself the amount equivalent to how many hours you put into your business each month. You can also pay yourself based on how much income your business generated for that month.

Control your spending. It's understandable that now you've got money coming in, you'll want to start spending money on things you were never able to afford in the past. You should, however, spend money on things that will benefit your business. It's better to build up your business savings so that you can handle unexpected expenses than it is to splurge every time you have the chance. You should also try buying your business supplies in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. As for your entertainment expenses, you need to be smart about it as well.

Proper money management involves a number of different things. You might assume that proper money management is a skill that isn't hard to acquire, but the reality is that it's a complicated process, especially when you're a small business owner. The tips we've shared should help you get started in managing your finances properly. It's crucial that you stay on top of your business finances.

Auditors Farnham

An auditor is a company or individual sanctioned to assess and validate the accuracy of accounts and make sure that organisations or businesses comply with tax laws. They may also act in an advisory role to recommend potential the prevention of risk and the introduction of cost reductions. To work as an auditor, an individual must be accredited by the regulatory authority of auditing and accounting and have specified qualifications.

Payroll Services Farnham

For any business in Farnham, from large scale organisations down to independent contractors, staff payrolls can be tricky. Controlling company payrolls requires that all legal obligations in relation to their openness, timings and accuracy are observed in all cases.

A small business may well not have the advantage of an in-house financial specialist and the easiest way to work with staff payrolls is to hire an external accounting company in Farnham. A payroll accountant will work along with HMRC, with pensions schemes and set up BACS payments to make sure that your personnel are paid promptly, and that all required deductions are accurate.

Working to the current regulations, a decent payroll accountant in Farnham will also provide each of your employees with a P60 tax form after the end of each fiscal year. A P45 tax form must also be given to any member of staff who finishes working for the company, in keeping with current regulations. (Tags: Payroll Services Farnham, Payroll Administrator Farnham, Payroll Accountants Farnham).

Farnham accountants will help with annual tax returns, workplace pensions Farnham, accounting services for landlords Farnham, audit and auditing, investment reviews, small business accounting, management accounts, business planning and support, business outsourcing in Farnham, employment law in Farnham, capital gains tax, litigation support, inheritance tax, self-employed registration, PAYE, tax investigations in Farnham, business advisory services, company formations, financial statements, cashflow projections in Farnham, general accounting services, VAT returns, accounting support services in Farnham, HMRC submissions, compliance and audit issues in Farnham, assurance services, payslips Farnham, bookkeeping, limited company accounting, personal tax, business acquisition and disposal, monthly payroll and other kinds of accounting in Farnham, Surrey. These are just an example of the activities that are accomplished by nearby accountants. Farnham providers will keep you informed about their entire range of accountancy services.

Farnham Accounting Services

- Farnham Tax Advice

- Farnham Tax Returns

- Farnham Debt Recovery

- Farnham Auditing

- Farnham Financial Audits

- Farnham PAYE Healthchecks

- Farnham Bookkeeping Healthchecks

- Farnham Tax Services

- Farnham Account Management

- Farnham Bookkeepers

- Farnham VAT Returns

- Farnham Payroll Management

- Farnham Chartered Accountants

- Farnham Financial Advice

Also find accountants in: Redhill, Hurst Green, Ripley, Chaldon, Dippenhall, Thorncombe Street, Shere, Godstone, Camelsdale, Cranleigh, Churt, Send, Eashing, Blindley Heath, Titsey, Guildford, Haslemere, Hale, Worplesdon, Pitch Place, Bisley, Effingham, Thames Ditton, Warlingham, Thursley, Sutton Green, Haxted, Egham, Woldingham, Downside, Woking, Walton On The Hill, Grafham, Horsell, Flexford and more.

Accountant Farnham

Accountant Farnham Accountants Near Me

Accountants Near Me Accountants Farnham

Accountants FarnhamMore Surrey Accountants: Epsom, Leatherhead, Hersham, Molesey, Staines, Weybridge, Chertsey, Haslemere, Woking, Reigate, Ewell, Horley, Dorking, Farnham, Caterham, Banstead, Cranleigh, Walton-on-Thames, Windlesham, Redhill, Sunbury-on-Thames, Godalming, Esher, Ash, Camberley, Addlestone and Guildford.

TOP - Accountants Farnham - Financial Advisers

Investment Accounting Farnham - Cheap Accountant Farnham - Small Business Accountants Farnham - Auditors Farnham - Financial Accountants Farnham - Bookkeeping Farnham - Tax Preparation Farnham - Self-Assessments Farnham - Financial Advice Farnham