Accountants Ealing: If you are a sole trader, are running a small business or are otherwise self-employed in Ealing, you will find great advantages to having your own accountant. You should at the very least have much more time to concentrate on your key business activities whilst the accountant manages the routine bookkeeping and paperwork. If you're only just getting started in business you will find the help of a qualified accountant indispensable. If you've got plans to grow your Ealing business you'll find an increasing need for expert financial advice.

There are plenty of accountants around, so you won't have too much difficulty finding a decent one. An internet search engine will pretty swiftly provide a substantial list of possible candidates in Ealing. But, it is hard to spot the gems from the scoundrels. You need to understand that there are no regulations regarding who in Ealing can promote accounting services. They can offer bookkeeping and accountancy services in Ealing whether they have got qualifications or not. This can result in inexperienced individuals entering this profession.

Finding a properly qualified Ealing accountant should be your priority. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. It is worth paying a little more for that extra peace of mind. Make sure that you include the accountants fees in your expenses, because these are tax deductable.

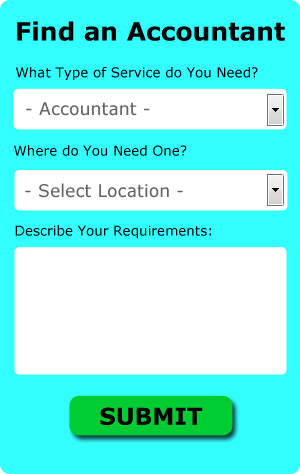

You could use an online service like Bark who will help you find an accountant. Little is required other than ticking a few boxes on the search form. Then you just have to wait for some prospective accountants to contact you. Make the most of this service because it is free.

Utilizing an online tax returns service will be your other option. For many self-employed people this is a convenient and time-effective solution. Picking a reputable company is important if you choose to go with this option. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable.

Going from the cheapest service to the most expensive, you could always use a chartered accountant if you are prepared to pay the price. Smaller businesses and sole traders will probably not need to aim quite this high. If you can afford one why not hire the best?

At the end of the day you could always do it yourself and it will cost you nothing but time. There is also lots of software available to help you with your returns. These include CalCal, Nomisma, Capium, GoSimple, Taxshield, Taxfiler, ACCTAX, Ablegatio, Gbooks, Forbes, TaxCalc, Ajaccts, Basetax, Andica, Sage, Xero, Absolute Topup, 123 e-Filing, Keytime, BTCSoftware and Taxforward. In any event the most important thing is to get your self-assessment set in before the deadline. You can expect to pay a minimum penalty of £100 for being late.

Payroll Services Ealing

Staff payrolls can be a challenging area of running a business in Ealing, no matter its size. Handling payrolls demands that all legal requirements regarding their accuracy, transparency and timings are observed to the finest detail.

All small businesses don't have their own in-house financial specialists, and the best way to handle employee pay is to hire an independent Ealing accounting company. The accountant dealing with payrolls will work along with HMRC and pension schemes, and set up BACS transfers to ensure accurate and timely payment to all staff.

It will also be a requirement for a decent payroll accountant in Ealing to provide a P60 tax form for all personnel at the conclusion of the financial year (by May 31st). Upon the termination of an employee's contract with your business, the payroll company will supply an updated P45 outlining what tax has been paid during the last financial period.

Forensic Accountant Ealing

While engaged on your search for a professional accountant in Ealing there is a fair chance that you'll stumble on the term "forensic accounting" and be wondering what it is, and how it differs from regular accounting. The hint for this is the actual word 'forensic', which essentially means "appropriate for use in a law court." Sometimes also known as 'forensic accountancy' or 'financial forensics', it uses auditing, accounting and investigative skills to search through financial accounts so as to detect criminal activity and fraud. Some of the larger accountancy companies in and around Ealing have even got specialist departments investigating insolvency, bankruptcy, insurance claims, professional negligence, tax fraud, money laundering and personal injury claims.

Ealing accountants will help with audit and auditing, inheritance tax in Ealing, accounting services for the construction sector Ealing, pension advice, business planning and support, accounting and financial advice, management accounts, small business accounting in Ealing, litigation support, assurance services Ealing, general accounting services, year end accounts, National Insurance numbers, double entry accounting in Ealing, charities in Ealing, accounting services for media companies, capital gains tax Ealing, cashflow projections, business advisory services in Ealing, accounting services for landlords Ealing, limited company accounting, mergers and acquisitions, tax returns, accounting services for start-ups Ealing, self-employed registrations in Ealing, consulting services, business outsourcing, tax investigations, corporate finance, HMRC liaison in Ealing, company formations Ealing, partnership registration and other kinds of accounting in Ealing, Greater London. Listed are just a small portion of the activities that are performed by nearby accountants. Ealing providers will tell you about their entire range of services.

Using the internet as a useful resource it is quite easy to uncover a host of invaluable inspiration and ideas relating to accounting for small businesses, self-assessment help, accounting & auditing and personal tax assistance. For example, with a brief search we discovered this super article outlining how to find an accountant to fill in your income tax return.

Ealing Accounting Services

- Ealing VAT Returns

- Ealing Business Planning

- Ealing Business Accounting

- Ealing Bookkeepers

- Ealing Specialist Tax

- Ealing Bookkeeping Healthchecks

- Ealing Tax Services

- Ealing Financial Advice

- Ealing Tax Planning

- Ealing Chartered Accountants

- Ealing Account Management

- Ealing PAYE Healthchecks

- Ealing Auditing

- Ealing Taxation Advice

Also find accountants in: White City, Orpington, West Ham, Colliers Wood, Haringey, Hampton, Commercial Road, Keston, Monument, Upminster, Sloane Square, Eastcote, Downe, St Johns Wood, Romford, Lower Sydenham, Warren Street, Burnt Oak, Upton Park, Hayes, Park Royal, Finchley Central, Bloomsbury, Forest Gate, Borough, Beckenham, Malden, Latimer Road, Fenchurch Street, Plashet, Westbourne Park, Shaftesbury Avenue, New Cross Gate, Grange Park, Kensington And Chelsea and more.

Accountant Ealing

Accountant Ealing Accountants Near Me

Accountants Near Me Accountants Ealing

Accountants EalingMore Greater London Accountants: Harrow, Hounslow, Richmond upon Thames, Barnet, Bexley, Ealing, Kingston upon Thames, Enfield, Greenwich, Croydon, London and Bromley.

TOP - Accountants Ealing - Financial Advisers

Investment Accountant Ealing - Auditors Ealing - Self-Assessments Ealing - Financial Advice Ealing - Chartered Accountant Ealing - Tax Accountants Ealing - Affordable Accountant Ealing - Online Accounting Ealing - Tax Return Preparation Ealing