Accountants March: Completing your yearly self-assessment form can be something of a headache. Many other folks in March have to deal with this very problem. Is it a much better idea to get someone else to accomplish this task for you? If you find that doing your self-assessment tax return is too stressful, this could be the best option. Regular small business accountants in March will probably charge you approximately two to three hundred pounds for this service. By utilizing an online service instead of a local March accountant you can save quite a bit of cash.

You will find many different kinds of accountants in the March area. So, its crucial to identify an accountant who can fulfil your requirements exactly. A lot of accountants work independently, while others are part of a larger accounting business. An accounting business in March will employ specialists in each of the main sectors of accounting. Accounting companies will usually offer the services of bookkeepers, auditors, actuaries, accounting technicians, forensic accountants, chartered accountants, tax preparation accountants, management accountants, costing accountants, financial accountants and investment accountants.

If you want your tax returns to be correct and error free it might be better to opt for a professional March accountant who is appropriately qualified. You don't need a chartered accountant but should get one who is at least AAT qualified. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction.

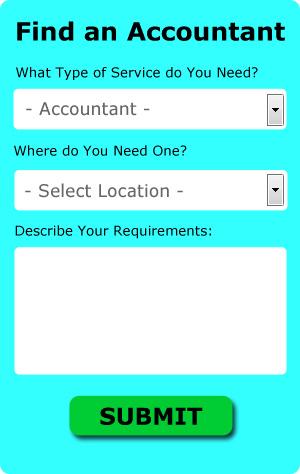

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. You'll be presented with a simple form which can be completed in a minute or two. Your details will be sent out to potential accountants and they will contact you directly with details and prices. You can use Bark to find accountants and other similar services.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. An increasing number of self-employed people are plumping for this option. Should you decide to go down this route, take care in choosing a legitimate company. A quick browse through some reviews online should give you an idea of the best and worse services.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. Larger limited companies must use a chartered accountant, smaller businesses do not need to. This widens your choice of accountants.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. You can take much of the hard graft out of this procedure by using a software program such as Taxfiler, CalCal, BTCSoftware, Ablegatio, Keytime, Andica, Absolute Topup, Basetax, Sage, ACCTAX, Forbes, TaxCalc, Capium, Xero, Nomisma, 123 e-Filing, Ajaccts, GoSimple, Taxshield, Taxforward or Gbooks. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Financial Actuaries March

An actuary is a professional who deals with the measurement and management of risk and uncertainty. Such risks can have an impact on both sides of the balance sheet and call for liability management, asset management and valuation skills. An actuary uses statistics and math to determine the financial effect of uncertainties and help their clients cut down on risks.

March accountants will help with accounting services for buy to let rentals in March, VAT registrations, partnership registration, consulting services, accounting services for start-ups, audit and auditing March, corporate tax, tax investigations in March, capital gains tax March, debt recovery, assurance services March, payroll accounting March, tax returns March, partnership accounts, double entry accounting March, self-employed registrations in March, VAT returns, PAYE in March, employment law, tax preparation, business outsourcing March, financial planning, financial statements, mergers and acquisitions, company secretarial services, workplace pensions, litigation support, small business accounting, management accounts, accounting services for media companies, accounting services for the construction industry, business acquisition and disposal in March and other kinds of accounting in March, Cambridgeshire. Listed are just a small portion of the tasks that are conducted by local accountants. March companies will tell you about their full range of services.

March Accounting Services

- March Specialist Tax

- March Business Accounting

- March Tax Refunds

- March Forensic Accounting

- March Debt Recovery

- March Self-Assessment

- March Tax Advice

- March Chartered Accountants

- March Tax Services

- March Bookkeepers

- March Bookkeeping Healthchecks

- March PAYE Healthchecks

- March VAT Returns

- March Auditing

Also find accountants in: Eynesbury, Trumpington, Kennett, Barway, Thorney, Newton, Caldecote, Haslingfield, Buckworth, Kneesworth, Ely, Eaton Ford, Camps End, Woodwalton, Little Paxton, Great Abington, Landbeach, Grafham, Linton, Coppingford, Harlton, Helpston, Horseway, Comberton, Upwood, St Ives, Westley Waterless, Graveley, Spaldwick, Chittering, Fitton End, Meldreth, Down Field, Peterborough, Carlton and more.

Accountant March

Accountant March Accountants Near March

Accountants Near March Accountants March

Accountants MarchMore Cambridgeshire Accountants: Chatteris, St Ives, Peterborough, Huntingdon, Ely, Wisbech, Whittlesey, Cambridge, St Neots and March.

TOP - Accountants March - Financial Advisers

Financial Accountants March - Small Business Accountants March - Bookkeeping March - Investment Accountant March - Affordable Accountant March - Chartered Accountants March - Self-Assessments March - Online Accounting March - Tax Accountants March