Accountants Guisborough: There are many advantages to be had from retaining the services of a professional accountant if you operate a business or are self-employed in Guisborough, North Yorkshire. By handling some mundane financial jobs like bookkeeping and tax returns you accountant will be able to free up extra time for you to focus your attention on your main business operations. The value of having a qualified accountant by your side cannot be overstated.

With different kinds of accountants working in Guisborough it can be a bit confusing. Therefore, be certain to pick one that matches your requirements perfectly. Certain accountants work as part of an accountancy practice, while some work as sole traders. An accounting practice will offer a wider range of services, while an independent accountant will provide a more personal service. With an accounting company you will have the choice of: cost accountants, tax accountants, forensic accountants, accounting technicians, investment accountants, chartered accountants, management accountants, financial accountants, auditors, actuaries and bookkeepers.

To get the job done correctly you should search for a local accountant in Guisborough who has the right qualifications. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. You will be able to claim the cost of your accountant as a tax deduction.

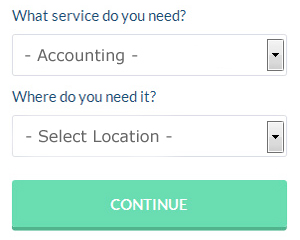

If you don't have the time to do a proper online search for local accountants, try using the Bark website. Little is required other than ticking a few boxes on the search form. Your details will be sent out to potential accountants and they will contact you directly with details and prices.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. Nowadays more and more people are using this kind of service. Some of these companies are more reputable than others. It should be a simple task to find some online reviews to help you make your choice.

Maybe when you have looked all the options you will still decide to do your own tax returns. There is also lots of software available to help you with your returns. These include GoSimple, BTCSoftware, Basetax, Gbooks, Taxforward, CalCal, Ablegatio, Sage, Taxfiler, Nomisma, ACCTAX, Capium, Ajaccts, Absolute Topup, Andica, TaxCalc, Xero, 123 e-Filing, Taxshield, Keytime and Forbes. In any event the most important thing is to get your self-assessment set in before the deadline. Penalties start at £100 and rise considerably if you are more that 3 months late.

Learn How to Manage Your Business Budget Properly

There are many things you can do in life that are exciting, and one of them is starting up your own online or offline business. You are finally in charge of yourself, you are finally in charge of your income -- you are in charge of everything! Now that can be a little scary! However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. Thus, it can be very helpful if you know a few self-improvement strategies like managing your finances properly. If you'd like to keep your finances in order, continue reading this article.

Get yourself an accountant. This is a business expense that's really worth it because an accountant can help keep your books straight on a full time basis. An accountant can easily monitor your business cash flow, help you pay yourself, and even determine the right amount of taxes you should be paying and when. The good news is that you don't have to tackle with the paperwork that goes with these things yourself. You can leave all that to your accountant. As a result, you can put your energy towards making your business more profitable, such as creating new products, marketing, and increasing your customer base. With an accountant, you'll save many hours (or even days) figuring out your books.

It's a good idea to do a weekly balancing of your books. If you run a traditional store with registers or that brings in multiple payments a day, it is better to balance your books at the end of every day, and this is particularly true if you handle cash. It's important that you keep track of the money coming in and the money you're spending. At the end of each business day or business week, tally it all up and the amount you come up with should match the amount you should have in the bank or on hand. If there are any discrepancies in your records, there won't be a lot of them or they won't be too difficult to track when you do your end-of-month or quarterly balancing. If you regularly balance your books, you won't need to spend too long a time doing it. If you do it every once in a while, though, it can take hours.

Save every receipt. These receipts are going to be heaven-sent if the IRS ever come knocking at your door demanding to see proof of what you've been spending and where you've been spending your money on. These receipts are also a record of your business expenditures. Be organized with your receipts and have them together in just one place. When you've got your receipts organized and kept in one central location, you can easily find specific transactions for certain amounts you may not recognize in your bank account because you forgot to write them in. Get yourself a small accordion file and keep your receipt there. Have this file easily accessible too.

You may not have thought about it, but having your own business offers you lots of self-improvement opportunities. Managing your money is one of those things. Everyone can use help in learning how to manage money better. Your self-confidence can be given a huge boost when you learn how to manage your money properly. Moreover, your business and personal lives will be more organized. Implement the tips we shared in this article and you're sure to see good results in the long run.

Auditors Guisborough

An auditor is an individual or company appointed by a firm to perform an audit, which is the official assessment of the financial accounts, usually by an independent body. They offer companies from fraud, illustrate inaccuracies in accounting strategies and, from time to time, work on a consultancy basis, helping firms to spot ways to improve efficiency. Auditors should be certified by the regulating body for auditing and accounting and also have the required accounting qualifications. (Tags: Auditing Guisborough, Auditor Guisborough, Auditors Guisborough)

Guisborough accountants will help with litigation support, VAT returns Guisborough, bookkeeping in Guisborough, small business accounting, estate planning, PAYE, HMRC liaison Guisborough, cash flow, year end accounts Guisborough, investment reviews, workplace pensions, inheritance tax, taxation accounting services, tax preparation, compliance and audit reporting Guisborough, corporate finance, VAT registrations in Guisborough, contractor accounts in Guisborough, partnership accounts in Guisborough, sole traders, business advisory, company secretarial services, business outsourcing, financial planning, consulting services, payslips, accounting services for the construction sector in Guisborough, HMRC submissions, capital gains tax, management accounts Guisborough, company formations, self-employed registrations and other professional accounting services in Guisborough, North Yorkshire. Listed are just a few of the activities that are accomplished by local accountants. Guisborough companies will keep you informed about their entire range of accountancy services.

Guisborough Accounting Services

- Guisborough Auditing

- Guisborough Bookkeeping Healthchecks

- Guisborough Specialist Tax

- Guisborough Taxation Advice

- Guisborough Forensic Accounting

- Guisborough Debt Recovery

- Guisborough Bookkeeping

- Guisborough Tax Planning

- Guisborough Self-Assessment

- Guisborough Tax Refunds

- Guisborough Financial Advice

- Guisborough Personal Taxation

- Guisborough Account Management

- Guisborough Tax Services

Also find accountants in: Bainbridge, Manfield, Marsett, Airton, Ampleforth College, Crackpot, Appleton Le Moors, Knapton, Appletreewick, Threapland, Hebden, Thornton, Stape, Kennythorpe, Settle, East Hauxwell, Embsay, Malton, Stutton, Burton Leonard, Swinithwaite, Stean, Low Hawkser, New Earswick, Raskelf, Foston, New Houses, Arkendale, Lawkland, Shipton, Sutton Howgrave, Deepdale, Murton, Skipwith, Hardraw and more.

Accountant Guisborough

Accountant Guisborough Accountants Near Me

Accountants Near Me Accountants Guisborough

Accountants GuisboroughMore North Yorkshire Accountants: Harrogate, Knaresborough, Yarm, York, Ripon, Guisborough, Middlesbrough, Skipton, Northallerton, Whitby, Thornaby, Scarborough, Selby and Redcar.

TOP - Accountants Guisborough - Financial Advisers

Financial Advice Guisborough - Tax Accountants Guisborough - Financial Accountants Guisborough - Small Business Accountants Guisborough - Chartered Accountants Guisborough - Investment Accountant Guisborough - Affordable Accountant Guisborough - Tax Return Preparation Guisborough - Self-Assessments Guisborough