Accountants Seaford: Having a qualified accountant to keep an eye on your finances brings numerous benefits to anybody operating a small business in Seaford or for that matter anyplace else in the British Isles. The very least you can expect is to gain a bit more time to devote to your core business, while financial matters are processed by your accountant. Businesses of all types and sizes can benefit from the expertise of an accountant but for newer businesses it can be even more important. A lot of Seaford businesses have been able to flourish due to having this type of professional help.

You'll find many different types of accountants in the Seaford area. Picking one that matches your needs precisely should be your goal. It isn't unusual for Seaford accountants to operate independently, others prefer being part of an accounting firm. An accountancy firm will include accountants with varying fields of expertise. With an accounting practice you'll have a pick of: accounting technicians, financial accountants, bookkeepers, cost accountants, auditors, chartered accountants, forensic accountants, actuaries, investment accountants, management accountants and tax accountants.

If you want your tax returns to be correct and error free it might be better to opt for a professional Seaford accountant who is appropriately qualified. For basic tax returns an AAT qualified accountant should be sufficient. Qualified Seaford accountants might charge a bit more but they may also get you the maximum tax savings. It should go without saying that accountants fees are tax deductable.

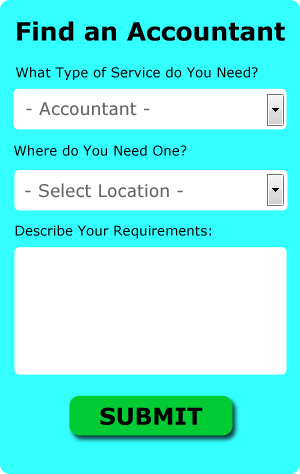

Though you may not have heard of them before there is an online service called Bark who can help you in your search. It is just a case of ticking some boxes on a form. Then you just have to wait for some prospective accountants to contact you. Try this free service because you've got nothing to lose.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. This may save time and be more cost-effective for self-employed people in Seaford. Don't simply go with the first company you find on Google, take time to do some research. A good method for doing this is to check out any available customer reviews and testimonials. It is beyond the scope of this article to recommend any specific service.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! There is also lots of software available to help you with your returns. These include Ajaccts, Capium, Taxshield, Keytime, BTCSoftware, Basetax, Xero, Taxfiler, Nomisma, ACCTAX, Forbes, Gbooks, Sage, Absolute Topup, Taxforward, GoSimple, CalCal, 123 e-Filing, Andica, TaxCalc and Ablegatio. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns.

How Managing Your Money Better Makes You a Better Business Owner

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. Personal money management, however, is completely different from business money management, although being experienced in the former can be handy when you go into business. Many business owners who have ruined their financial situation accidentally end up having no self-confidence at all. In this article, we'll share a few tips you can apply to help you be a better money manager for your business.

Start numbering your invoice. This is something that a lot of business owners don't really think about but it can save you a lot of hassle down the road. When you've got your invoices numbered, you can easily track your transactions. You'll be able to easily track who has paid you and who still owes you. There will be times when a client will tell you that his invoice is all paid up and this can be easily resolved if you have a numbered invoice. In business, errors will happen and numbered invoices is one simple strategy to identify those problems when they take place.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. Paying yourself like you would a regular employee would make your business accounting so much easier. So how do you do this exactly? First, any payments you get from the sale of your products or services should go to your business account. Next, decide how often you want to receive a salary. Let's say you want to pay yourself once every month, such as on the 15th. When the 15th comes around, write yourself a check. How much should you pay yourself? It's up to you. It can be a percentage of your business income or it can be an hourly rate.

Keep all of your receipts. For one, you'll need to have receipts because they're proof should the IRS want to know exactly what and where you have been spending your money on. These receipts serve as a record of expenses related to your business. Keep them all in one central location. Tracking your expenses becomes easy if you have all your receipts in one place. The best way to store your receipts is in an accordion file and then have this file in a drawer in your desk so you can easily go through your receipts if you need to.

There are many things involved in the proper management of your money. It's a lot more than simply keeping a list of your expenditures. You have other things to track and many ways to do so. We've shared some things in this article that should make tracking your money easier for you to do. As you become more skilled in managing your business finances, you'll be able to implement other things that will help make the process easier for you.

Small Business Accountants Seaford

Managing a small business in Seaford is pretty stressful, without having to fret about doing your accounts and similar bookkeeping duties. If your annual accounts are getting the better of you and VAT and tax return issues are causing sleepless nights, it is wise to hire a small business accountant in Seaford.

Giving guidance, ensuring that your business follows optimum financial practices and providing strategies to help your business reach its full potential, are just some of the responsibilities of a reputable small business accountant in Seaford. An effective accounting firm in Seaford should be able to offer practical small business guidance to optimise your tax efficiency while at the same time minimising business costs; essential in the sometimes murky world of business taxation.

You also ought to be supplied with an assigned accountancy manager who understands the structure of your business, your plans for the future and your company's circumstances.

Seaford accountants will help with capital gains tax Seaford, financial planning, National Insurance numbers in Seaford, consultancy and systems advice in Seaford, tax investigations, accounting support services, accounting services for media companies Seaford, PAYE, business planning and support in Seaford, double entry accounting, contractor accounts, company secretarial services, litigation support, payslips in Seaford, year end accounts, corporation tax Seaford, accounting services for the construction sector Seaford, partnership accounts, accounting and auditing, self-employed registration, corporate finance, debt recovery, compliance and audit issues, business start-ups, partnership registration, HMRC submissions, payroll accounting, financial statements, inheritance tax, accounting and financial advice Seaford, employment law, business acquisition and disposal and other accounting related services in Seaford, East Sussex. These are just a few of the duties that are handled by nearby accountants. Seaford specialists will let you know their entire range of accounting services.

By using the internet as an unlimited resource it is very easy to uncover plenty of useful inspiration and ideas relating to personal tax assistance, accounting & auditing, small business accounting and self-assessment help. To illustrate, with a brief search we found this illuminating article about choosing an accountant.

Seaford Accounting Services

- Seaford Self-Assessment

- Seaford Business Planning

- Seaford Account Management

- Seaford Business Accounting

- Seaford Bookkeeping Healthchecks

- Seaford Specialist Tax

- Seaford Personal Taxation

- Seaford Debt Recovery

- Seaford Tax Services

- Seaford Financial Advice

- Seaford Tax Planning

- Seaford Tax Returns

- Seaford Payroll Management

- Seaford Bookkeepers

Also find accountants in: Telscombe Cliffs, Telscombe, Selmeston, Fairlight Cove, Dallington, Upper Horsebridge, Westfield Moor, Falmer, East Guldeford, Steel Cross, Jevington, Pevensey, Ripe, Lower Dicker, Four Oaks, Chelwood Gate, East Chiltington, Westham, Millcorner, Mark Cross, Brede, Alfriston, Southease, Sharpthorne, Robertsbridge, Foxhunt Green, Hankham, Hooe, Westmeston, Foul Mile, Penhurst, Portslade By Sea, Broadoak, St Leonards, Playden and more.

Accountant Seaford

Accountant Seaford Accountants Near Seaford

Accountants Near Seaford Accountants Seaford

Accountants SeafordMore East Sussex Accountants: Hastings, Uckfield, Peacehaven, Telscombe, Crowborough, Ringmer, Eastbourne, Wadhurst, Lewes, Newhaven, Westham, Hailsham, Ore, Polegate, Portslade, Battle, Bexhill-on-Sea, Hove, Heathfield, Seaford, Forest Row, Brighton, Rye and Willingdon.

TOP - Accountants Seaford - Financial Advisers

Self-Assessments Seaford - Tax Accountants Seaford - Tax Preparation Seaford - Small Business Accountants Seaford - Investment Accounting Seaford - Financial Advice Seaford - Financial Accountants Seaford - Online Accounting Seaford - Cheap Accountant Seaford