Accountants Banbury: Do you get little else but a spinning head when completing your annual tax self-assessment form? This can be challenging for you and many other Banbury folks in self-employment. You may prefer to find a local Banbury accountant to get this done for you. Perhaps it is simply the case that self-assessment is too complex for you to do on your own. Regular small business accountants in Banbury will most likely charge you approximately two to three hundred pounds for such a service. If you are looking for a cheap option you might find the answer online.

So, precisely what should you expect to pay for this service and what do you get for your money? Any good quality internet search engine will swiftly supply you with an extensive shortlist of local Banbury accountants, who'll be delighted to help. However, which of these prospects can you put your trust in? The truth of the matter is that in the UK anyone can start up in business as an accountant or bookkeeper. Qualifications and certificates are not actually required by law.

Find yourself a properly qualified one and don't take any chances. Your minimum requirement should be an AAT qualified accountant. The extra peace of mind should compensate for any higher costs. Make sure that you include the accountants fees in your expenses, because these are tax deductable.

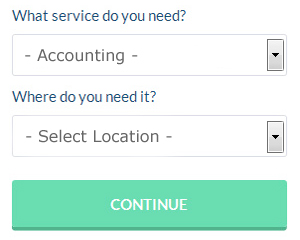

If you want to reach out to a number of local Banbury accountants, you could always use a service called Bark. You will quickly be able to complete the form and your search will begin. Sometimes in as little as a couple of hours you will hear from prospective Banbury accountants who are keen to get to work for you.

Utilizing an online tax returns service will be your other option. This kind of service may not suit everyone but could be the answer for your needs. Do a bit of research to find a reputable company. Check out some customer testimonials for companies you are considering.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. You could even use a software program like Taxfiler, Ablegatio, Nomisma, CalCal, ACCTAX, Gbooks, Capium, TaxCalc, Taxshield, BTCSoftware, GoSimple, Ajaccts, Xero, Keytime, Andica, Taxforward, Sage, Forbes, 123 e-Filing, Basetax or Absolute Topup to make life even easier. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty. Penalties start at £100 and rise considerably if you are more that 3 months late.

Small Business Accountants Banbury

Managing a small business in Banbury is stressful enough, without having to fret about doing your accounts and other similar bookkeeping tasks. A focused small business accountant in Banbury will provide you with a hassle-free method to keep your VAT, annual accounts and tax returns in the best possible order.

Giving advice, making sure that your business follows the optimum financial practices and suggesting methods to help your business to achieve its full potential, are just some of the responsibilities of a reputable small business accountant in Banbury. An accountancy firm in Banbury will provide you with an allocated small business accountant and adviser who will clear the fog that shrouds the world of business taxation, in order to enhance your tax efficiences.

A small business accountant, to do their job properly, will need to know exact details with regards to your current financial standing, business structure and any potential investment that you may be looking at, or have put in place.

Auditors Banbury

An auditor is a person or company hired by an organisation or firm to perform an audit, which is an official inspection of an organisation's financial accounts, typically by an impartial entity. They can also act as consultants to suggest potential the prevention of risk and the introduction of financial savings. For anybody to start working as an auditor they should have certain specified qualifications and be approved by the regulating body for accounting and auditing.

Forensic Accounting Banbury

When you happen to be trying to find an accountant in Banbury you will possibly run across the term "forensic accounting" and wonder what the differences are between a forensic accountant and a normal accountant. The word 'forensic' is the thing that gives it away, meaning literally "suitable for use in a court of law." Also often known as 'forensic accountancy' or 'financial forensics', it uses accounting, investigative skills and auditing to detect discrepancies in financial accounts that have resulted in fraud or theft. Some of the bigger accounting companies in the Banbury area may even have independent forensic accounting divisions with forensic accountants concentrating on certain kinds of fraud, and may be addressing personal injury claims, money laundering, professional negligence, tax fraud, insolvency, bankruptcy and false insurance claims.

Banbury accountants will help with accounting services for start-ups in Banbury, VAT returns Banbury, workplace pensions, year end accounts, inheritance tax Banbury, capital gains tax in Banbury, HMRC submissions, pension advice, partnership registrations in Banbury, limited company accounting, compliance and audit reports in Banbury, personal tax, VAT registrations Banbury, National Insurance numbers, consulting services, financial planning, company formations Banbury, mergers and acquisitions, corporate tax, accounting services for buy to let property rentals, accounting services for the construction sector, litigation support in Banbury, cashflow projections in Banbury, business advisory, sole traders, business disposal and acquisition, accounting services for media companies, debt recovery, annual tax returns, tax preparation Banbury, accounting support services in Banbury, payslips and other types of accounting in Banbury, Oxfordshire. Listed are just an example of the activities that are carried out by local accountants. Banbury specialists will tell you about their full range of services.

Banbury Accounting Services

- Banbury Specialist Tax

- Banbury Tax Services

- Banbury Bookkeeping Healthchecks

- Banbury Self-Assessment

- Banbury Financial Advice

- Banbury Personal Taxation

- Banbury Debt Recovery

- Banbury Account Management

- Banbury Business Accounting

- Banbury Chartered Accountants

- Banbury Business Planning

- Banbury Forensic Accounting

- Banbury Tax Refunds

- Banbury Auditing

Also find accountants in: Chipping Norton, Cote, Stratton Audley, Aston Upthorpe, Eynsham, Emmington, Marston, Lewknor, Chinnor, Stonesfield, Binfield Heath, Exlade Street, Kiddington, Begbroke, Murcott, Carterton, Steeple Aston, South Moreton, Wheatley, Little Tew, Letcombe Regis, Netherton, Little Haseley, Hardwick, Baulking, Salford, South Leigh, Chimney, Caulcott, Balscote, Christmas Common, Whitchurch Hill, Uffington, Twyford, Tadmarton and more.

Accountant Banbury

Accountant Banbury Accountants Near Banbury

Accountants Near Banbury Accountants Banbury

Accountants BanburyMore Oxfordshire Accountants: Witney, Abingdon, Didcot, Banbury, Carterton, Kidlington, Oxford and Bicester.

TOP - Accountants Banbury - Financial Advisers

Financial Advice Banbury - Bookkeeping Banbury - Self-Assessments Banbury - Tax Accountants Banbury - Online Accounting Banbury - Auditing Banbury - Small Business Accountants Banbury - Affordable Accountant Banbury - Financial Accountants Banbury