Accountants Rochdale: Do you get little else but a headache when completing your annual tax self-assessment form? Many others in Rochdale have to deal with this very same problem. Of course, you could always get yourself a local Rochdale accountant to do this task instead. Do you find self-assessment just too taxing to tackle on your own? You can typically get this done by Rochdale High Street accountants for something like £200-£300. Instead of using a local Rochdale accountant you could try one of the currently available online self-assessment services which may offer a saving on cost.

You'll find various types of accountants in the Rochdale area. So, be certain to pick one that matches your requirements perfectly. You'll need to choose between an accountant working solo or one that is associated with an established accountancy firm. Accounting firms will have experts in each specific accounting department. Some of the major accounting positions include the likes of: tax accountants, investment accountants, financial accountants, actuaries, forensic accountants, management accountants, chartered accountants, cost accountants, accounting technicians, auditors and bookkeepers.

Finding an accountant in Rochdale who is qualified is generally advisable. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. You will of course get a tax deduction on the costs involved in preparing your tax returns.

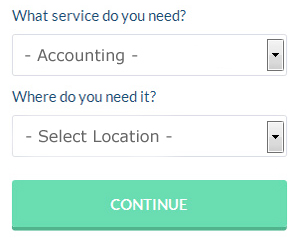

Though you may not have heard of them before there is an online service called Bark who can help you in your search. Filling in a clear and simple form is all that you need to do to set the process in motion. In the next day or so you should be contacted by potential accountants in your local area. You will not be charged for this service.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. This kind of service may not suit everyone but could be the answer for your needs. Do some homework to single out a company with a good reputation. The better ones can soon be singled out by carefully studying reviews online. It is beyond the scope of this article to recommend any specific service.

While you shouldn't totally discount the idea of using a chartered accountant, the high level of charges might put you off. The services these specialists provide are perhaps beyond the needs of the smaller business in Rochdale. You will certainly be hiring the best if you do choose one of these.

The cheapest option of all is to do your own self-assessment form. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are Taxshield, TaxCalc, 123 e-Filing, Capium, Andica, Taxfiler, Taxforward, Forbes, Ajaccts, Xero, Ablegatio, Basetax, BTCSoftware, CalCal, Sage, Gbooks, Absolute Topup, GoSimple, ACCTAX, Nomisma and Keytime. Whatever happens you need to get your self-assessment form in on time.

Payroll Services Rochdale

For any business in Rochdale, from independent contractors to large scale organisations, dealing with staff payrolls can be complicated. The laws regarding payroll requirements for openness and accuracy mean that running a company's payroll can be an intimidating task.

Using a reliable company in Rochdale, to handle your payroll is a easiest way to reduce the workload of your own financial department. Working with HMRC and pension scheme administrators, a managed payroll service accountant will also take care of BACS payments to employees, ensuring that they're paid on time each month, and that all required deductions are done correctly.

A genuine payroll management accountant in Rochdale will also, in line with current legislations, provide P60 tax forms after the end of the financial year for every one of your workers. A P45 form will also be presented to any employee who stops working for your business, according to the current legislation.

Auditors Rochdale

An auditor is an individual or company hired by a firm to carry out an audit, which is the official inspection of an organisation's accounts, typically by an independent body. They offer companies from fraud, find discrepancies in accounting methods and, from time to time, operate on a consultancy basis, helping firms to determine ways to boost efficiency. Auditors should be licensed by the regulatory body for auditing and accounting and also have the required accounting qualifications.

Actuary Rochdale

Actuaries work with government departments and companies, to help them in predicting long-term investment risks and financial costs. Such risks can impact both sides of the balance sheet and call for liability management, asset management and valuation skills. An actuary uses statistics and math concepts to determine the fiscal impact of uncertainty and help clients cut down on potential risks. (Tags: Actuaries Rochdale, Actuary Rochdale, Financial Actuaries Rochdale)

Rochdale accountants will help with employment law, cash flow Rochdale, capital gains tax in Rochdale, management accounts, business advisory in Rochdale, HMRC submissions in Rochdale, double entry accounting, taxation accounting services, year end accounts, limited company accounting, self-employed registration, business start-ups, contractor accounts, tax investigations Rochdale, partnership registrations, VAT returns, self-assessment tax returns, bookkeeping in Rochdale, business outsourcing Rochdale, accounting and auditing, accounting services for the construction sector in Rochdale, consulting services, company formations Rochdale, inheritance tax Rochdale, company secretarial services in Rochdale, bureau payroll services, sole traders Rochdale, tax preparation, payroll accounting, mergers and acquisitions, workplace pensions, HMRC submissions Rochdale and other forms of accounting in Rochdale, Greater Manchester. These are just some of the tasks that are performed by nearby accountants. Rochdale specialists will be delighted to keep you abreast of their full range of accounting services.

Rochdale Accounting Services

- Rochdale Tax Returns

- Rochdale Tax Investigations

- Rochdale Auditing Services

- Rochdale Self-Assessment

- Rochdale Forensic Accounting

- Rochdale PAYE Healthchecks

- Rochdale Tax Refunds

- Rochdale Chartered Accountants

- Rochdale Payroll Services

- Rochdale Business Accounting

- Rochdale Personal Taxation

- Rochdale Debt Recovery

- Rochdale Tax Services

- Rochdale Tax Advice

Also find accountants in: Cheetham Hill, Gorton, Dukinfield, Atherton, Westhoughton, Littleborough, Middleton, Newhey, Stockport, Lately Common, Abram, Smallbridge, Kearsley, Summerseat, Broughton, Moorside, Compstall, Higher Blackley, Lane Head, Bolton, Fishpool, Cheadle, Hyde, Whitefield, Delph, Astley Green, Denshaw, Diggle, Oldham, Heaton Moor, Denton, Lostock Junction, Romiley, Cheesden, Kenyon and more.

Accountant Rochdale

Accountant Rochdale Accountants Near Rochdale

Accountants Near Rochdale Accountants Rochdale

Accountants RochdaleMore Greater Manchester Accountants: Leigh, Oldham, Sale, Manchester, Whitefield, Bolton, Horwich, Rochdale, Hyde, Westhoughton, Dukinfield, Golborne, Heywood, Eccles, Gatley, Middleton, Stockport, Denton, Altrincham, Wigan, Cheadle Hulme, Droylsden, Irlam, Chadderton, Bury, Atherton, Hindley, Farnworth, Walkden, Swinton, Ashton-in-Makerfield, Stalybridge, Urmston, Stretford, Royton, Radcliffe, Romiley, Ashton-under-Lyne and Salford.

TOP - Accountants Rochdale - Financial Advisers

Tax Advice Rochdale - Online Accounting Rochdale - Self-Assessments Rochdale - Investment Accountant Rochdale - Financial Accountants Rochdale - Chartered Accountant Rochdale - Auditors Rochdale - Tax Return Preparation Rochdale - Small Business Accountants Rochdale