Accountants Holmfirth: Do you get little else but a spinning head when filling out your yearly tax self-assessment form? A lot of people in Holmfirth have the same problem as you. Of course, you could always get yourself a local Holmfirth accountant to do this task instead. If you find self-assessment too taxing, this could be far better for you. You should expect to pay approximately two to three hundred pounds for a regular small business accountant. By making use of one of the many online services you should be able to get a cheaper deal.

There are a number of different disciplines of accounting. Choosing one who dovetails perfectly with your business is crucial. Many accountants work independently, whilst others are part of a larger business. An accounting firm will include accountants with varying fields of expertise. You should be able to locate an accounting practice offering accounting technicians, costing accountants, tax accountants, investment accountants, management accountants, chartered accountants, actuaries, financial accountants, auditors, forensic accountants and bookkeepers.

It is advisable for you to find an accountant in Holmfirth who is properly qualified. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. You can then have peace of mind knowing that your tax affairs are being handled professionally. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. Sole traders and smaller businesses might get away with using a bookkeeper.

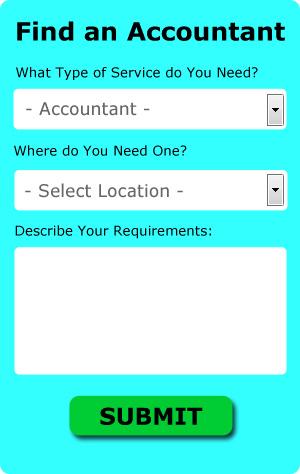

One online service which helps people like you find an accountant is Bark. You just have to fill in a simple form and answer some basic questions. Your details will be sent out to potential accountants and they will contact you directly with details and prices. Bark offer this service free of charge.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. More accountants are offering this modern alternative. Should you decide to go down this route, take care in choosing a legitimate company. Be sure to study customer reviews and testimonials.

If you decide to bite the bullet and tackle the process by yourself there is lots of help on offer. To make life even easier there is some intuitive software that you can use. Including TaxCalc, Ablegatio, CalCal, Gbooks, Keytime, Taxforward, Nomisma, Andica, Sage, Taxshield, Xero, Capium, GoSimple, 123 e-Filing, Ajaccts, BTCSoftware, Absolute Topup, Forbes, ACCTAX, Basetax and Taxfiler. You will get a penalty if your tax return isn't in on time.

Small Business Accountants Holmfirth

Doing the yearly accounts can be a stress-filled experience for any owner of a small business in Holmfirth. A dedicated small business accountant in Holmfirth will offer you a stress free means to keep your tax returns, annual accounts and VAT in the best possible order.

Offering guidance, ensuring your business follows the optimum financial practices and suggesting techniques to help your business to reach its full potential, are just some of the duties of a decent small business accountant in Holmfirth. An effective accounting firm in Holmfirth will offer practical small business guidance to optimise your tax efficiency while at the same time minimising expense; crucial in the sometimes shady field of business taxation.

You should also be offered a dedicated accountancy manager who understands your plans for the future, your company's situation and your business structure.

Improving Yourself and Your Business with the Help of the Top Money Management Techniques

In the last several years, thousands of people have discovered one great thing about starting their own business: they completely control their income potential. They are in control of the amount of money they spend and if they're wise, the only limit to their earning potential is their willingness to put in the work. Then again, managing business finances isn't exactly a simple matter. In fact, even those who've successfully lived by sticking to a budget in their personal lives can have a tough time managing the finances of their business. Luckily there are plenty of things that you can do to make it easier on yourself. If you'd like to be able to manage your business funds, keep reading.

Your invoices must be numbered. This is one of those things that you probably think isn't that big of a deal but it really is. It makes it easy to track invoices if you have them numbered. It doesn't just help you track who owes you what, it helps you track who has paid you what as well. There will be times when a client will tell you that his invoice is all paid up and this can be easily resolved if you have a numbered invoice. Keep in mind that mistakes are bound to happen in business, but if you've got an invoicing system, no matter how simple it is, you'll be able to quickly find those mistakes and correct them should they happen.

Track both your personal and business expenses down to the last penny. It's actually helpful when you know where each penny is being spent. When you meticulously record every expenditure you make, whether personal or business related, you can keep an eye on your spending habits. Have you ever wondered where all your money is going? If you keep a record of all your expenditures, you know exactly where you're spending your money. If your budget is a little too tight, you'll be able to identify expenditures that you can cut back on to save money. It will also help you streamline things when you need to fill out your tax forms.

Don't be late in paying your taxes. Typically, small businesses must pay taxes every quarter. It's crucial that you have the most current and accurate information when it comes to small business taxes. For this, it's best that you get your information from the IRS or from the local small business center. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. The only way you won't get that dreaded visit from the IRS is if you're paying your taxes.

Even if you don't have your own business, you'll still benefit from learning how to manage your money properly. As a business owner, you're a lot more likely to succeed if you know how much money your business is generating, how much money you're spending, and basically what's happening with your money. So keep in mind the tips we've shared. When you take the time to learn how to properly manage money, you'll get the benefit of having a successful business and a higher confidence level.

Actuaries Holmfirth

Analysts and actuaries are professionals in risk management. Such risks can impact both sides of the balance sheet and require professional asset management, valuation and liability management skills. Actuaries provide assessments of fiscal security systems, with a focus on their mechanisms, complexity and mathematics. (Tags: Actuary Holmfirth, Actuaries Holmfirth, Financial Actuary Holmfirth)

Auditors Holmfirth

An auditor is a person or company sanctioned to examine and validate the correctness of financial accounts and ensure that organisations conform to tax legislation. They protect businesses from fraud, find irregularities in accounting techniques and, every so often, work as consultants, helping organisations to identify ways to maximize efficiency. Auditors must be licensed by the regulatory body for accounting and auditing and have the required accounting qualifications.

Holmfirth accountants will help with company secretarial services, VAT payer registration Holmfirth, business advisory services, taxation accounting services, retirement advice Holmfirth, self-employed registrations, PAYE, accounting services for start-ups in Holmfirth, limited company accounting, year end accounts in Holmfirth, partnership accounts, small business accounting Holmfirth, cashflow projections, partnership registration, payslips in Holmfirth, accounting support services, accounting services for buy to let rentals, HMRC submissions, employment law, financial planning, tax investigations in Holmfirth, management accounts, VAT returns in Holmfirth, consultancy and systems advice Holmfirth, accounting services for the construction industry in Holmfirth, company formations in Holmfirth, tax returns, litigation support Holmfirth, estate planning in Holmfirth, debt recovery Holmfirth, payroll accounting in Holmfirth, capital gains tax in Holmfirth and other forms of accounting in Holmfirth, West Yorkshire. Listed are just some of the tasks that are conducted by nearby accountants. Holmfirth professionals will let you know their whole range of services.

Holmfirth Accounting Services

- Holmfirth Debt Recovery

- Holmfirth Financial Advice

- Holmfirth Forensic Accounting

- Holmfirth VAT Returns

- Holmfirth Payroll Management

- Holmfirth Personal Taxation

- Holmfirth PAYE Healthchecks

- Holmfirth Tax Advice

- Holmfirth Specialist Tax

- Holmfirth Bookkeeping Healthchecks

- Holmfirth Auditing

- Holmfirth Self-Assessment

- Holmfirth Tax Services

- Holmfirth Tax Investigations

Also find accountants in: Riddlesden, Holme, Moselden Height, Roundhay, Wilsden, Ossett, Chapel Allerton, Kiddal Lane End, Farnley Tyas, Lofthouse, East Hardwick, Lepton, Kirkhamgate, Quarmby, Yeadon, Whitkirk, Drighlington, Hipperholme, Lane Head, Stainland, Tinshill, High Ackworth, Shepley, Denby Dale, Meltham, Warley Town, Buttershaw, Denholme, Baildon, Cross Gates, Ryhill, Bardsey, Thorp Arch, Kinsley, Booth Wood and more.

Accountant Holmfirth

Accountant Holmfirth Accountants Near Me

Accountants Near Me Accountants Holmfirth

Accountants HolmfirthMore West Yorkshire Accountants: Elland, Baildon, Holmfirth, Wetherby, Castleford, Featherstone, Knottingley, Bradford, Todmorden, Cleckheaton, Ilkley, Leeds, Huddersfield, Shipley, Liversedge, Halifax, Otley, Normanton, Brighouse, Keighley, Yeadon, Horsforth, Ossett, Pontefract, Batley, Bingley, Mirfield, Morley, Rothwell, Garforth, Dewsbury, Pudsey, Wakefield, Heckmondwike and Guiseley.

TOP - Accountants Holmfirth - Financial Advisers

Financial Accountants Holmfirth - Investment Accounting Holmfirth - Bookkeeping Holmfirth - Self-Assessments Holmfirth - Affordable Accountant Holmfirth - Financial Advice Holmfirth - Chartered Accountants Holmfirth - Small Business Accountant Holmfirth - Auditors Holmfirth