Accountants Castleford: Filling in your self-assessment form each year can really give you nightmares. Many people in Castleford have the same problem as you. You could always get yourself a local Castleford accountant to do this job instead. If you find that doing your self-assessment tax return is too stressful, this could be the best option. You can typically get this done by regular Castleford accountants for something in the region of £200-£300. If you're looking for a cheap option you might find the solution online.

But which accounting service is best for your requirements and how should you go about locating it? A few potential candidates can soon be located by conducting a swift search on the internet. Yet, which accountants can you trust to do a decent job for you? The fact that somebody in Castleford advertises themselves as an accountant is no real guarantee of quality. While, of course qualifications are an advantage, they aren't required by law. This can result in untrained individuals entering this profession.

It is advisable for you to find an accountant in Castleford who is properly qualified. Your minimum requirement should be an AAT qualified accountant. Qualified accountants may come with higher costs but may also save you more tax. It should go without saying that accountants fees are tax deductable.

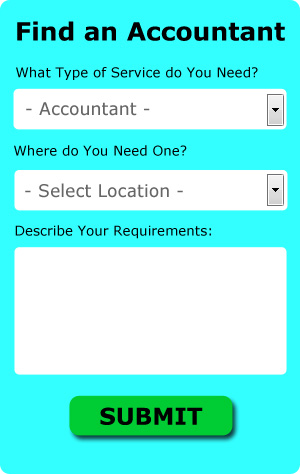

There is now a service available known as Bark, where you can look for local professionals including accountants. A couple of minutes is all that is needed to complete their simple and straighforward search form. In the next day or so you should be contacted by potential accountants in your local area. There is no fee for this service.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. This may save time and be more cost-effective for self-employed people in Castleford. If you decide to go with this method, pick a company with a decent reputation. Study reviews and customer feedback.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. You can take much of the hard graft out of this procedure by using a software program such as Sage, Gbooks, Taxforward, Keytime, GoSimple, Basetax, 123 e-Filing, Xero, Andica, Forbes, Ajaccts, Capium, ACCTAX, Ablegatio, Taxshield, Nomisma, BTCSoftware, CalCal, TaxCalc, Taxfiler or Absolute Topup. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Tips for Better Money Management

Many people find that putting up a business is very exciting. You get to be in charge of practically everything when you've got your own business -- your time, the work you do, and even your income! Now that can be a little scary! However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. In this case, you'll benefit a great deal from knowing a few simple techniques like managing your business finances properly. If you'd like to keep your finances in order, continue reading this article.

Hire a good accountant. This is a business expense that's really worth it because an accountant can help keep your books straight on a full time basis. She will help you keep track of the money you have coming in and the money you are sending out, help you pay yourself, and help you meet your tax obligations. What's more, she'll deal with all of the paperwork that is associated with those things. You, then, are free to concentrate on the other areas of building your business, like taking care of your clients, marketing, etc. When you've got an accountant working for you, you won't end up wasting hours or even days working your finances every week or every month.

Try to learn bookkeeping. You need to have a system set up for your money -- both personally and professionally. You can set up your system using a basic spreadsheet or get yourself a bookkeeping software like QuickBooks or Quicken. In addition, you can make use of personal budgeting tools such as Mint.com. You'll find plenty of free resources on the internet that can help small business owners like you manage your books better. You'll know exactly what's happening to your business and personal finances when you've got your books in order. It won't hurt if you take a class or two on basic bookkeeping and accounting, as this could prove helpful to you especially if you don't think you can afford to hire a professional to manage your books.

Be a prompt tax payer. Generally, taxes must be paid quarterly by small business owners. Taxes are among the most confusing things, so it's best if you check with the IRS or the small business center in your area to get accurate information. Additionally, you can have a professional set up a payment plan for you to ensure that you're paying your taxes promptly and that you're meeting all your business obligation as required by the law. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

There are many things you can do to help you manage your money the right way. Proper money management isn't really a simple or basic skill you can master over the weekend. It's something you have to constantly learn over time, particularly if you have a small business. Use the tips in this article to help you keep track of everything. One of the secrets to having a successful business is learning proper money management.

Auditors Castleford

An auditor is an individual or company appointed by a firm or organisation to perform an audit, which is the official inspection of an organisation's financial accounts, generally by an unbiased body. They also sometimes act in a consultative role to encourage possible the prevention of risk and the implementation of cost savings. For anyone to become an auditor they have to have certain specific qualifications and be accredited by the regulatory body for accounting and auditing.

Forensic Accountant Castleford

Whilst conducting your search for a professional accountant in Castleford there's a good likelihood that you'll stumble upon the phrase "forensic accounting" and be wondering what it is, and how it is different from regular accounting. The hint for this is the word 'forensic', which essentially means "relating to or denoting the application of scientific techniques and methods to the investigation of crime." Occasionally also called 'forensic accountancy' or 'financial forensics', it uses investigative skills, accounting and auditing to search through financial accounts so as to discover criminal activity and fraud. Some of the bigger accountancy companies in and near Castleford even have specialist departments dealing with bankruptcy, tax fraud, falsified insurance claims, insolvency, professional negligence, money laundering and personal injury claims. (Tags: Forensic Accountant Castleford, Forensic Accountants Castleford, Forensic Accounting Castleford)

Payroll Services Castleford

Payrolls for staff can be a stressful aspect of running a company in Castleford, no matter its size. The legislation relating to payroll requirements for openness and accuracy mean that running a business's staff payroll can be an intimidating task.

A small business might not have the luxury of a dedicated financial expert and the simplest way to cope with employee payrolls is to use an external payroll company in Castleford. Working with HMRC and pension schemes, a managed payroll service accountant will also take care of BACS payments to personnel, making sure they're paid promptly each month, and that all required deductions are done correctly.

It will also be a requirement for a payroll management company in Castleford to provide a P60 declaration for each employee at the end of the financial year (by 31st May). At the end of a staff member's contract with your company, the payroll service should also supply an updated P45 outlining what tax has been paid in the previous financial period. (Tags: Payroll Accountant Castleford, Payroll Administrator Castleford, Payroll Services Castleford).

Castleford accountants will help with accounting services for media companies, mergers and acquisitions, cashflow projections in Castleford, capital gains tax Castleford, corporate tax, employment law Castleford, accounting support services, retirement planning, debt recovery, accounting services for the construction sector, management accounts, assurance services, investment reviews in Castleford, small business accounting, partnership accounts Castleford, charities Castleford, year end accounts, HMRC liaison in Castleford, business planning and support in Castleford, HMRC submissions, VAT returns, National Insurance numbers, consultancy and systems advice, contractor accounts, taxation accounting services, corporate finance, business outsourcing, sole traders Castleford, double entry accounting, VAT registrations Castleford, company secretarial services in Castleford, audit and compliance reporting and other types of accounting in Castleford, West Yorkshire. These are just a small portion of the tasks that are handled by nearby accountants. Castleford professionals will inform you of their whole range of services.

Castleford Accounting Services

- Castleford Chartered Accountants

- Castleford Self-Assessment

- Castleford Bookkeeping Healthchecks

- Castleford Financial Advice

- Castleford PAYE Healthchecks

- Castleford Tax Planning

- Castleford Financial Audits

- Castleford Payroll Management

- Castleford Forensic Accounting

- Castleford Specialist Tax

- Castleford Personal Taxation

- Castleford Bookkeepers

- Castleford VAT Returns

- Castleford Debt Recovery

Also find accountants in: Lindley, Carleton, Outwood, Heckmondwike, Almondbury, Allerton, Ackworth Moor Top, Oldfield, Greetland, Ossett, Woodlesford, Guiseley, Cornholme, Wentbridge, Mount Tabor, Barwick In Elmet, High Gate, Slaithwaite, Mytholmroyd, Gledhow, Westgate Hill, Castleford, Addingham, Clayton, High Ackworth, Oakenshaw, Ripponden, Darrington, Honley, Cleckheaton, Lumb, Birstall Smithies, Rawdon, Knottingley, Flockton Green and more.

Accountant Castleford

Accountant Castleford Accountants Near Me

Accountants Near Me Accountants Castleford

Accountants CastlefordMore West Yorkshire Accountants: Horsforth, Shipley, Knottingley, Wetherby, Brighouse, Bingley, Ilkley, Heckmondwike, Morley, Huddersfield, Baildon, Pudsey, Keighley, Bradford, Wakefield, Liversedge, Garforth, Halifax, Leeds, Otley, Rothwell, Elland, Castleford, Batley, Ossett, Todmorden, Yeadon, Holmfirth, Pontefract, Mirfield, Dewsbury, Normanton, Guiseley, Cleckheaton and Featherstone.

TOP - Accountants Castleford - Financial Advisers

Affordable Accountant Castleford - Bookkeeping Castleford - Tax Preparation Castleford - Investment Accounting Castleford - Chartered Accountants Castleford - Self-Assessments Castleford - Small Business Accountants Castleford - Auditing Castleford - Financial Accountants Castleford