Accountants Cowes: If you've got your own business or are a sole trader in Cowes, Isle of Wight, you'll soon realise that there are many benefits to be gained from using a competent accountant. One of the main advantages will be that with your accountant dealing with the routine paperwork and bookkeeping, you should have more free time to devote to what you do best, the actual running of your business. Businesses of all sizes and types can benefit from the expertise of an accountant but for newer businesses it could be even more vital. This type of expert help will enable your Cowes business to grow and prosper.

When hunting for an accountant in Cowes, you'll find that there are different kinds. Consequently, it is vital to identify an accountant who can fulfil your requirements. Whether you use an accountant working within a larger practice or one working on their own is up to you. An accounting company will offer a broader range of services, while a lone accountant may offer a more personal service. Among the primary accountancy positions are: investment accountants, financial accountants, management accountants, bookkeepers, accounting technicians, actuaries, chartered accountants, tax preparation accountants, auditors, forensic accountants and cost accountants.

It should be easy enough to track down an accountant who actually does have the relevant qualifications. For basic tax returns an AAT qualified accountant should be sufficient. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Your accountant will add his/her fees as tax deductable.

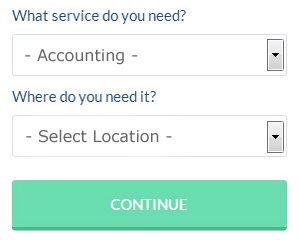

There is an online company called Bark who will do much of the work for you in finding an accountant in Cowes. You will quickly be able to complete the form and your search will begin. In the next day or so you should be contacted by potential accountants in your local area. Make the most of this service because it is free.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. This type of service is growing in popularity. Do some homework to single out a company with a good reputation. The easiest way to do this is by studying online reviews.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! It is also a good idea to make use of some self-assessment software such as TaxCalc, Capium, 123 e-Filing, Taxshield, Taxforward, Ajaccts, Taxfiler, Basetax, GoSimple, Ablegatio, Xero, Forbes, Gbooks, Sage, ACCTAX, BTCSoftware, Absolute Topup, CalCal, Andica, Keytime or Nomisma to simplify the process. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time. You can expect to pay a minimum penalty of £100 for being late.

Suggestions for Helping You Manage Your Finances Properly

One of the things that every small business owner struggles with is managing money properly, and this is especially true in the beginning, when you are just trying to find your feet as a business runner and proprietor. Poor money management can be a real drag on your confidence, and when you are having money problems, you are more willing to take on any old job. When this happens, it stops you from achieving the kind of success you want for yourself and your business. Keep reading to learn a few tips you can use to help you manage your finances better.

Avoid combining your business expenses and personal expenses in one account. It might seem simple at first but the truth is that in the long run it just makes everything more difficult. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. Streamline your process with two accounts.

Offer your clients payment plans. This isn't just a good idea for your business in terms of landing more clients, it's a good idea for your finances because it means that you will have money coming in regularly. Steady, regular payments, even if they're small, is a lot better than big payments that come in sporadically and you don't know when exactly they're going to come. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. If you're in control of your business finances, you'll feel more self-confident.

Be a responsible business owner by paying your taxes when they're due. Small business generally have to pay taxes every three months. Taxes are among the most confusing things, so it's best if you check with the IRS or the small business center in your area to get accurate information. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. Having the IRS at your doorstep isn't something you'd want, believe me!

There are so many little things that go into properly managing your money. It's a lot more than simply keeping a list of your expenditures. When it comes to your business finances, you have many things to keep track of. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. And as you continue to hone your skills in proper money management, you'll be able to find ways of streamlining your financial activities.

Small Business Accountants Cowes

Company accounting and bookkeeping can be a pretty stress-filled experience for anybody running a small business in Cowes. If your annual accounts are getting the better of you and tax returns and VAT issues are causing sleepless nights, it is a good idea to use a focused small business accountant in Cowes.

A professional small business accountant in Cowes will consider that it is their responsibility to help develop your business, and provide you with reliable financial advice for security and peace of mind in your specific situation. An accountancy firm in Cowes will provide you with a dedicated small business accountant and consultant who will remove the fog that veils the world of business taxation, in order to maximise your tax efficiency.

It is also crucial that you clarify your current financial situation, your business structure and your future plans truthfully to your small business accountant. (Tags: Small Business Accountant Cowes, Small Business Accounting Cowes, Small Business Accountants Cowes).

Auditors Cowes

An auditor is a person or a firm appointed by a company or organisation to conduct an audit, which is the official assessment of the financial accounts, generally by an impartial body. Auditors evaluate the fiscal activities of the firm that employs them and ensure the unwavering operation of the business. For anyone to start working as an auditor they should have certain specified qualifications and be approved by the regulatory body for auditing and accounting.

Payroll Services Cowes

Dealing with staff payrolls can be a stressful aspect of running a business in Cowes, regardless of its size. The legislation concerning payrolls and the legal requirements for transparency and accuracy means that handling a business's payroll can be an intimidating task.

Small businesses may not have the help that a dedicated financial expert can provide, and an easy way to handle employee payrolls is to retain the services of an external Cowes accountant. A payroll service accountant will work alongside HMRC, work with pensions providers and deal with BACS payments to ensure your employees are always paid promptly, and all required deductions are accurate.

It will also be necessary for a payroll management company in Cowes to prepare an accurate P60 tax form for each member of staff at the conclusion of the financial year (by May 31st). Upon the termination of an employee's contract, the payroll company will also provide an updated P45 form relating to the tax paid in the previous financial period.

Actuaries Cowes

An actuary offers advice on, evaluates and manages finance related risks. These risks can affect a company's balance sheet and require specialist liability management, valuation and asset management skills. Actuaries deliver assessments of fiscal security systems, with a focus on their complexity, their mechanisms and their mathematics.

Forensic Accountant Cowes

You might well notice the expression "forensic accounting" when you are looking for an accountant in Cowes, and will doubtless be wondering what is the distinction between forensic accounting and regular accounting. The actual word 'forensic' is the thing that gives a clue, meaning "relating to or denoting the application of scientific methods and techniques to the investigation of a crime." Also referred to as 'financial forensics' or 'forensic accountancy', it uses accounting, investigative skills and auditing to detect discrepancies in financial accounts that have resulted in fraud or theft. There are even some larger accountants firms throughout Isle of Wight who have dedicated departments for forensic accounting, addressing money laundering, personal injury claims, insolvency, bankruptcy, professional negligence, insurance claims and tax fraud.

Cowes accountants will help with bookkeeping Cowes, workplace pensions, business advisory services, payroll accounting Cowes, self-assessment tax returns in Cowes, limited company accounting in Cowes, cash flow, bureau payroll services in Cowes, contractor accounts Cowes, estate planning Cowes, VAT payer registration, HMRC submissions, capital gains tax, accounting services for the construction industry, business support and planning in Cowes, retirement planning, charities Cowes, partnership accounts Cowes, financial statements, debt recovery in Cowes, tax preparation, company secretarial services, litigation support, accounting and financial advice, business outsourcing, mergers and acquisitions Cowes, investment reviews, company formations, corporate finance, business acquisition and disposal, business start-ups, HMRC liaison and other types of accounting in Cowes, Isle of Wight. These are just an example of the tasks that are handled by local accountants. Cowes specialists will be delighted to keep you abreast of their full range of services.

Cowes Accounting Services

- Cowes Specialist Tax

- Cowes Personal Taxation

- Cowes Tax Services

- Cowes Tax Advice

- Cowes PAYE Healthchecks

- Cowes Tax Returns

- Cowes Business Accounting

- Cowes VAT Returns

- Cowes Financial Audits

- Cowes Tax Planning

- Cowes Bookkeepers

- Cowes Self-Assessment

- Cowes Account Management

- Cowes Chartered Accountants

Also find accountants in: Hillway, Blackgang, Pyle, Quarr Hill, Parkhurst, Carisbrooke, Sandown, Cowes, Yarmouth, Havenstreet, Wootton Bridge, Cranmore, Godshill, Chale Green, Staplers, Ryde, Porchfield, Merstone, Sandford, St Lawrence, East Cowes, Bowcombe, Rookley, Easton, Wellow, Alverstone, Gurnard, Brook, Kingston, Branstone, Bembridge, Downend, Niton, Northwood, Yaverland and more.

Accountant Cowes

Accountant Cowes Accountants Near Me

Accountants Near Me Accountants Cowes

Accountants CowesMore Isle of Wight Accountants: Sandown, Shanklin, Ryde and Cowes.

TOP - Accountants Cowes - Financial Advisers

Tax Advice Cowes - Auditing Cowes - Small Business Accountant Cowes - Investment Accounting Cowes - Online Accounting Cowes - Tax Preparation Cowes - Bookkeeping Cowes - Chartered Accountant Cowes - Financial Advice Cowes