Accountants Seaham: For those of you who are self-employed in Seaham, a major headache every year is filling out your annual self-assessment form. Don't worry, you're not the only one, plenty of others in Seaham are faced with the same issues. The obvious solution would be to pay a reliable Seaham accountant to tackle this job instead. Perhaps it is simply the case that self-assessment is too complex for you to do on your own. This should cost you approximately £200-£300 if you retain the services of an average Seaham accountant. You will be able to get this done significantly cheaper by using one of the available online services.

So, what do you get for your hard earned money and what's the best way to locate an accountant in Seaham, County Durham? In this modern technological world the first port of call is the internet when hunting for any local services, including bookkeepers and accountants. But, exactly who can you trust? You need to appreciate that there are no regulations regarding who in Seaham can advertise accounting services. Qualifications and accreditations aren't actually required by law. Crazy as that sounds.

To get the job done correctly you should search for a local accountant in Seaham who has the right qualifications. You don't need a chartered accountant but should get one who is at least AAT qualified. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent.

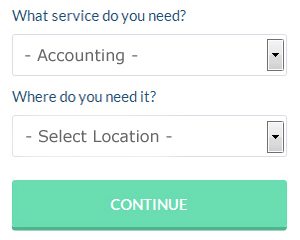

There is an online company called Bark who will do much of the work for you in finding an accountant in Seaham. Little is required other than ticking a few boxes on the search form. It is then simply a case of waiting for some suitable responses.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. A number of self-employed people in Seaham prefer to use this simple and convenient alternative. There is no reason why this type of service will not prove to be as good as your average High Street accountant. It should be a simple task to find some online reviews to help you make your choice. Apologies, but we do not endorse, recommend or advocate any specific company.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. Their services are normally required by larger limited companies and big business. Some people might say, you should hire the best you can afford.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of GoSimple, Andica, Forbes, BTCSoftware, Capium, Xero, Ablegatio, Taxfiler, Keytime, TaxCalc, Sage, ACCTAX, CalCal, 123 e-Filing, Nomisma, Taxforward, Gbooks, Taxshield, Basetax, Ajaccts and Absolute Topup. You will get a penalty if your tax return isn't in on time.

Small Business Accountants Seaham

Making sure your accounts are accurate can be a challenging job for anyone running a small business in Seaham. Hiring a small business accountant in Seaham will enable you to operate your business knowing that your tax returns, annual accounts and VAT, and various other business tax requirements, are being met.

A quality small business accountant will consider it their responsibility to help your business to improve, encouraging you with sound guidance, and providing you with security and peace of mind about your financial situation. The vagaries and often complicated field of business taxation will be clearly laid out for you in order to lower your business costs, while at the same time improving tax efficiency.

It is essential that you explain your future plans, the structure of your business and your company's financial situation accurately to your small business accountant.

Payroll Services Seaham

For any business in Seaham, from independent contractors to large scale organisations, staff payrolls can be stressful. The laws relating to payroll for accuracy and transparency mean that processing a company's payroll can be a daunting task for those not trained in this discipline.

A small business may well not have the luxury of its own financial specialist and the easiest way to work with employee payrolls is to hire an external payroll company in Seaham. Your payroll accounting company will manage accurate BACS payments to your employees, as well as working along with any pension schemes that your company might have, and use current HMRC regulations for tax deductions and NI contributions.

It will also be a requirement for a payroll management service in Seaham to provide a P60 tax form for all employees after the end of the financial year (by May 31st). They will also be responsible for providing P45 tax forms at the termination of a staff member's contract.

Auditors Seaham

Auditors are experts who examine the fiscal accounts of organisations and companies to ascertain the validity and legality of their financial records. Auditors assess the fiscal activities of the company which employs them to ensure the unwavering running of the business. To work as an auditor, an individual must be approved by the regulating body of auditing and accounting or possess certain specific qualifications. (Tags: Auditors Seaham, Auditor Seaham, Auditing Seaham)

Tips for Better Money Management

Many people find that putting up a business is very exciting. You're your own boss and you're in control of how much you make. Well, you're basically in charge of everything! That sounds a little scary, doesn't it? However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. Thus, it can be very helpful if you know a few self-improvement strategies like managing your finances properly. So if you wish to know how you can manage your money correctly, keep reading.

Have an account that's just for your business expenses and another for your personal expenses. It might seem simple at first but the truth is that in the long run it just makes everything more difficult. And here's the thing -- if you run your business expenses through your personal account, it'll be a lot harder to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. Streamline your process with two accounts.

Learn bookkeeping. You need to have a system set up for your money -- both personally and professionally. You can do this simply by setting up a basic Excel spreadsheet or you could use bookkeeping software like Quicken or QuickBooks. There are also other online tools you can use, like Mint.com. There are a lot of free resources online to help small business owners better manage their bookkeeping. Your books are the key to you knowing precisely how and where your money (personal and business) is being spent. It might even be in your best interest, particularly if you don't have the money to hire a professional to help you, to take a class is basic bookkeeping and accounting.

Just as you should track every penny you spend, you should track every penny that goes in as well. Keep a record of every payment you get from customers or clients. With this money management strategy, you can easily keep track of how much money you've got on hand, as well as who has already paid their dues and who hasn't. Tracking your income helps you figure out your taxes, how much to pay yourself, etc.

Whether you're a business owner or not, it's important that you learn proper money management. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. You can get started with the money management tips we've shared. When you take the time to learn how to properly manage money, you'll get the benefit of having a successful business and a higher confidence level.

Forensic Accountant Seaham

While engaged on your search for an experienced accountant in Seaham there's a fair chance that you'll stumble on the phrase "forensic accounting" and be curious about what that is, and how it differs from regular accounting. With the word 'forensic' literally meaning "appropriate for use in a law court", you should get a hint as to what is involved. Sometimes also referred to as 'forensic accountancy' or 'financial forensics', it uses accounting, investigative skills and auditing to examine financial accounts in order to identify criminal activity and fraud. Some larger accounting companies in the Seaham area may even have specialist forensic accounting divisions with forensic accountants focusing on certain types of fraud, and could be dealing with personal injury claims, professional negligence, bankruptcy, money laundering, tax fraud, insolvency and insurance claims.

Seaham accountants will help with monthly payroll Seaham, cashflow projections Seaham, contractor accounts, bureau payroll services, accounting and financial advice Seaham, corporate finance, auditing and accounting, PAYE, partnership accounts, accounting services for the construction sector, self-employed registration, management accounts, general accounting services, financial statements Seaham, year end accounts, company secretarial services, business outsourcing, corporation tax, estate planning, taxation accounting services, consultancy and systems advice Seaham, financial planning, limited company accounting Seaham, sole traders Seaham, employment law, bookkeeping in Seaham, pension forecasts, company formations Seaham, capital gains tax, National Insurance numbers, accounting services for landlords, tax returns Seaham and other forms of accounting in Seaham, County Durham. Listed are just a handful of the tasks that are carried out by nearby accountants. Seaham companies will be delighted to keep you abreast of their full range of accounting services.

Seaham Accounting Services

- Seaham Account Management

- Seaham Forensic Accounting

- Seaham Auditing Services

- Seaham Tax Planning

- Seaham Personal Taxation

- Seaham VAT Returns

- Seaham Debt Recovery

- Seaham Payroll Management

- Seaham Self-Assessment

- Seaham Taxation Advice

- Seaham Business Planning

- Seaham Tax Refunds

- Seaham Business Accounting

- Seaham Tax Returns

Also find accountants in: Bowburn, Carlton, Toft Hill, Cockfield, Burnopfield, Summer House, Leadgate, Low Etherley, Little Thorpe, Thornley, Langley Moor, Seaham, Westwick, Greta Bridge, Shadforth, Mickleton, Ludworth, Wearhead, Trimdon, Lartington, Sadberge, Evenwood, Cornsay, Langley Park, Barnard Castle, Aycliffe, West Auckland, Elwick, Thornaby On Tees, Wolsingham, Willington, Murton, Crook, St Johns, Houghton Bank and more.

Accountant Seaham

Accountant Seaham Accountants Near Me

Accountants Near Me Accountants Seaham

Accountants SeahamMore County Durham Accountants: Stockton-on-Tees, Darlington, Billingham, Hartlepool, Stanley, Chester-le-Street, Peterlee, Consett, Newton Aycliffe, Durham, Bishop Auckland and Seaham.

TOP - Accountants Seaham - Financial Advisers

Chartered Accountants Seaham - Financial Advice Seaham - Tax Return Preparation Seaham - Bookkeeping Seaham - Online Accounting Seaham - Financial Accountants Seaham - Tax Accountants Seaham - Cheap Accountant Seaham - Self-Assessments Seaham