Accountants Kenilworth: Any individual operating a small business in Kenilworth, Warwickshire will pretty quickly realise that there are lots of advantages to having an accountant at the end of the phone. By handling your bookkeeping and self-assessment tax returns your accountant can free up a bit of time so that you can focus on the things you do best. This sort of financial help is crucial for any business, but is especially beneficial for start-up businesses.

So, what sort of accounting service should you look for and how much should you pay? A substantial list of possible Kenilworth accountants can be compiled with one quick search on the web. But, how do you tell which accountant you can trust? Don't forget that anybody who's so inclined can go into business as an accountant in Kenilworth. They are able to offer accounting services in Kenilworth whether they've got qualifications or not. Strange as that sounds.

Finding an accountant in Kenilworth who is qualified is generally advisable. Ask if they at least have an AAT qualification or higher. A certified Kenilworth accountant might be more costly than an untrained one, but should be worth the extra expense. Make sure that you include the accountants fees in your expenses, because these are tax deductable. It is perfectly acceptable to use a qualified bookkeeper in Kenilworth if you are a sole trader or a smaller business.

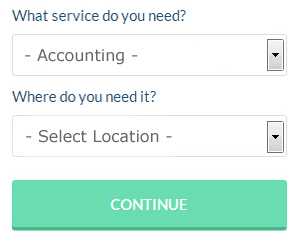

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. A couple of minutes is all that is needed to complete their simple and straighforward search form. Within a few hours you should hear from some local accountants who are willing to help you. This service is free of charge.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. For many self-employed people this is a convenient and time-effective solution. Don't simply go with the first company you find on Google, take time to do some research. A quick browse through some reviews online should give you an idea of the best and worse services. This is something you need to do yourself as we do not wish to favour any particular service here.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? The process can be simplified even further by the use of software such as Xero, ACCTAX, TaxCalc, Taxfiler, Basetax, 123 e-Filing, Keytime, Taxforward, Taxshield, GoSimple, Sage, Ablegatio, Nomisma, Capium, Ajaccts, CalCal, Gbooks, BTCSoftware, Andica, Absolute Topup or Forbes. You will get a penalty if your tax return isn't in on time. You can expect to pay a minimum penalty of £100 for being late.

Auditors Kenilworth

An auditor is a person or company selected by an organisation or firm to execute an audit, which is the official assessment of the financial accounts, normally by an independent entity. They can also act as consultants to suggest possible the prevention of risk and the introduction of cost efficiency. To work as an auditor, an individual should be authorised by the regulating authority for auditing and accounting and have certain specified qualifications.

Learning the Top Money Management Strategies for Business Success

It can be a very exciting thing to start your own business -- whether your business is online of offline. You're your own boss and you're in control of how much you make. Well, you're basically in charge of everything! How scary is that? Truly, while exhilarating, starting your own business is also quite intimidating because it can be quite difficult to find your feet. It then pays to be aware of a few self-improvement strategies like knowing how to manage finances the proper way. In this article, we'll share a few tips proper money management.

In case you're paying many business expenses on a regular basis, you may find it easier to charge them on your credit card. With this method, you don't need to make multiple payment and risk forgetting to pay any one of them on time. But then again, there's a risk to using credit cards because you'll end up paying interest if you don't pay the balance off in full every month. This isn't to say you shouldn't use your credit card, but if you do, it's best if you pay it all off every month. In addition to making it simpler for you to pay your expenses and avoid paying interest, you're building your credit rating.

Be aware of where every last cent of your money is being spent, both in your business and personal life. There are many benefits to doing this even though it is a pain to track each and every thing you spend money on, no matter how small it is. When you meticulously record every expenditure you make, whether personal or business related, you can keep an eye on your spending habits. No one likes to have that feeling of "I'm making decent money, but where is it?" This can come in handy, especially when you're trying to budget your money because you can see where you can potentially save money. And when you're filling out tax forms, it's less harder to identify your business expenses from your personal expenses and you know exactly how much you spent on business related stuff.

Fight the urge to spend unnecessarily. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. Put your money in your business savings account so that if unexpected business expenses come up, you'll have the means to deal with it in a prompt manner. Buy your office supplies in bulk. Invest in reliable computing equipment so you won't have to replace it all the time. Be smart about entertainment expenses, etc.

You can improve yourself in many ways when you're managing your own business. Having a business can help you hone your money management skills. Everybody wishes that they could be better with money. Learning how to manage, plan a budget your money can do quite a lot for your confidence. Most importantly, your business and personal life will become a lot easier to organize. There are many other money management tips out there that you can apply to your small business. Give the ones we provided here a try and you'll see yourself improving in your money management skills soon.

Payroll Services Kenilworth

Dealing with staff payrolls can be a complicated aspect of running a company in Kenilworth, irrespective of its size. Managing staff payrolls demands that all legal requirements in relation to their exactness, timing and transparency are observed to the finest detail.

Using a reliable company in Kenilworth, to take care of your payroll is a easiest way to reduce the workload of your financial department. Working along with HMRC and pension schemes, a payroll service accountant will also take care of BACS payments to employees, ensuring that they're paid on time each month, and that all mandatory deductions are done accurately.

Adhering to current regulations, a decent payroll accountant in Kenilworth will also present every one of your staff members with a P60 tax form at the conclusion of each fiscal year. They will also provide P45 tax forms at the end of an employee's contract. (Tags: Payroll Services Kenilworth, Payroll Administrator Kenilworth, Payroll Accountants Kenilworth).

Kenilworth accountants will help with self-assessment tax returns in Kenilworth, business advisory services, accounting services for the construction sector, double entry accounting, accounting support services, business start-ups, general accounting services, PAYE, accounting and auditing Kenilworth, retirement advice, workplace pensions, contractor accounts, estate planning, HMRC submissions Kenilworth, business outsourcing in Kenilworth, cashflow projections, VAT returns in Kenilworth, year end accounts Kenilworth, consulting services, mergers and acquisitions Kenilworth, bookkeeping in Kenilworth, compliance and audit reporting Kenilworth, tax investigations, investment reviews, business support and planning, National Insurance numbers, inheritance tax, business disposal and acquisition Kenilworth, small business accounting, corporate tax Kenilworth, limited company accounting, debt recovery in Kenilworth and other accounting services in Kenilworth, Warwickshire. Listed are just a few of the activities that are performed by nearby accountants. Kenilworth specialists will inform you of their full range of services.

You do, of course have the best possible resource right at your fingertips in the form of the internet. There's such a lot of inspiration and information available online for things like personal tax assistance, auditing & accounting, self-assessment help and accounting for small businesses, that you will soon be overwhelmed with suggestions for your accounting needs. An illustration might be this fascinating article on the subject of choosing an accountant for your business.

Kenilworth Accounting Services

- Kenilworth Tax Returns

- Kenilworth Tax Advice

- Kenilworth Self-Assessment

- Kenilworth Specialist Tax

- Kenilworth Tax Planning

- Kenilworth Forensic Accounting

- Kenilworth Tax Refunds

- Kenilworth VAT Returns

- Kenilworth Auditing Services

- Kenilworth Debt Recovery

- Kenilworth Chartered Accountants

- Kenilworth Bookkeepers

- Kenilworth Business Accounting

- Kenilworth Account Management

Also find accountants in: Corley Moor, Withybrook, Chapel End, Burton Hastings, Preston On Stour, Newton, Nuthurst, Church End, Tanworth In Arden, Bishops Tachbrook, Wolfhampcote, Collycroft, Westwood Heath, Oxhill, Kenilworth, Whichford, Churchover, Abbots Salford, Willoughby, Corley Ash, Cherington, Hillmorton, Combrook, Grandborough, Walton, Ufton, Shottery, Budbrooke, Shrewley, Bourton On Dunsmore, Haselor, Over Whitacre, Preston Bagot, Whatcote, Wood End and more.

Accountant Kenilworth

Accountant Kenilworth Accountants Near Me

Accountants Near Me Accountants Kenilworth

Accountants KenilworthMore Warwickshire Accountants: Atherstone, Rugby, Warwick, Nuneaton, Polesworth, Stratford-upon-Avon, Bedworth, Kenilworth and Leamington Spa.

TOP - Accountants Kenilworth - Financial Advisers

Tax Accountants Kenilworth - Auditors Kenilworth - Bookkeeping Kenilworth - Small Business Accountants Kenilworth - Chartered Accountant Kenilworth - Self-Assessments Kenilworth - Online Accounting Kenilworth - Financial Accountants Kenilworth - Tax Preparation Kenilworth