Accountants Falkirk: Do you get little else but a headache when completing your annual tax self-assessment form? You are not alone in Falkirk if this problem affects you every year. You may prefer to obtain a local Falkirk accountant to accomplish this task for you. If you find that doing your self-assessment tax return is too stressful, this could be the best alternative. You can usually get this done by regular Falkirk accountants for something like £200-£300. You can definitely get it done cheaper by using online services.

You'll find many different types of accountants in the Falkirk area. Therefore, be certain to pick one that suits your requirements perfectly. You will come to realise that there are accountants who work alone and accountants who work for accounting firms. An accountancy company may offer a broader range of services, while an independent accountant will provide a more personal service. You should be able to locate an accountancy company offering investment accountants, financial accountants, costing accountants, forensic accountants, management accountants, actuaries, accounting technicians, chartered accountants, auditors, bookkeepers and tax preparation accountants.

It should be easy enough to track down an accountant who actually does have the relevant qualifications. The recommended minimum qualification you should look for is an AAT. Qualified accountants may come with higher costs but may also save you more tax. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction.

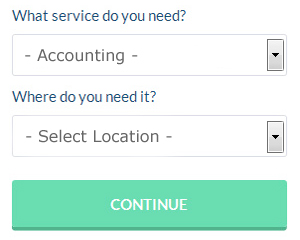

By using an online service such as Bark.com you could be put in touch with a number of local accountants. You simply answer a few relevant questions so that they can find the most suitable person for your needs. In no time at all you will get messages from accountants in the Falkirk area.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. More accountants are offering this modern alternative. You still need to pick out a company offering a reliable and professional service. There are resources online that will help you choose, such as review websites.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! You can take much of the hard graft out of this procedure by using a software program such as Andica, 123 e-Filing, Capium, GoSimple, Xero, Taxshield, Taxforward, Taxfiler, Ablegatio, ACCTAX, Basetax, Nomisma, BTCSoftware, Absolute Topup, Ajaccts, Forbes, Gbooks, CalCal, Sage, Keytime or TaxCalc. Make sure your tax returns are sent off promptly to avoid getting a penalty fine.

Actuaries Falkirk

An actuary is a professional person who studies the measurement and managing of uncertainty and risk. Such risks can affect both sides of the balance sheet and call for expert liability management, valuation and asset management skills. Actuaries present judgements of financial security systems, with a focus on their mechanisms, their complexity and their mathematics. (Tags: Financial Actuary Falkirk, Actuaries Falkirk, Actuary Falkirk)

Improve Your Business and Yourself By Learning Better Money Management

There are many things you can do in life that are exciting, and one of them is starting up your own online or offline business. You are finally in charge of yourself, you are finally in charge of your income -- you are in charge of everything! It can be kind of scary, can't it? However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. This is where knowing some simple self improvement techniques, like learning how to properly manage your money, can be quite helpful. Today, we've got a few suggestions on how you can keep your finances in order.

Start numbering your invoice. This may not be that big of a deal to you right now, but you'll thank yourself later on if you implement this tip early on in your business. It makes it easy to track invoices if you have them numbered. Not only will it help you find out quickly enough who has already paid their invoices, it will help you find out who still owes you and how much. There will be times when a client will tell you that his invoice is all paid up and this can be easily resolved if you have a numbered invoice. It's so much easier to find errors in your invoicing too if you have an invoicing system in place.

You may want to offer payment plans to clients. Besides making it more appealing for potential clients to do business with you, this strategy will have money coming in on a regular basis. This is easier to count on than money that comes in in giant bursts with long dry spells between them. If you have steady income coming in, you're in a better position to plan your budget, get your bills paid on time, and properly manage your money in general. This is a great boost to your confidence.

Keep a complete accounting of how much business you generate down to the last penny. Every single time you receive a payment, write down that you have been paid and how much. With this money management strategy, you can easily keep track of how much money you've got on hand, as well as who has already paid their dues and who hasn't. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

Proper money management is one of the best things you can learn both for your own self improvement and for self improvement in your business. The ones we've mentioned in this article are only a few of many other proper money management tips out there that will help you in keeping track of your finances better. When you've got your finances under control, you can expect your business and personal life to be a success.

Auditors Falkirk

An auditor is a company or person appointed to evaluate and authenticate the reliability of financial records and make certain that businesses or organisations abide by tax legislation. They often also adopt an advisory role to recommend potential risk prevention measures and the implementation of cost efficiency. To work as an auditor, a person should be certified by the regulatory authority for accounting and auditing and have achieved certain specified qualifications.

Falkirk accountants will help with accounting support services, business outsourcing, year end accounts, National Insurance numbers Falkirk, financial and accounting advice in Falkirk, accounting services for the construction sector in Falkirk, consultancy and systems advice, pension forecasts in Falkirk, monthly payroll, litigation support, small business accounting, capital gains tax in Falkirk, cash flow in Falkirk, business start-ups in Falkirk, mergers and acquisitions, self-employed registrations, double entry accounting in Falkirk, HMRC liaison, VAT registrations Falkirk, financial planning Falkirk, annual tax returns in Falkirk, estate planning, financial statements, audit and auditing, accounting services for media companies in Falkirk, corporate tax Falkirk, limited company accounting Falkirk, PAYE, partnership accounts, corporate finance, bookkeeping, contractor accounts in Falkirk and other forms of accounting in Falkirk, Scotland. These are just a selection of the activities that are undertaken by nearby accountants. Falkirk companies will tell you about their entire range of accounting services.

When you're hunting for inspiration and advice for personal tax assistance, self-assessment help, auditing & accounting and small business accounting, you will not really need to look any further than the world wide web to get all the information that you need. With such a diversity of meticulously written blog posts and webpages to choose from, you will quickly be deluged with ideas for your forthcoming project. Just recently we stumbled across this enlightening article outlining 5 tips for locating a top-notch accountant.

Falkirk Accounting Services

- Falkirk Chartered Accountants

- Falkirk Tax Returns

- Falkirk Personal Taxation

- Falkirk Specialist Tax

- Falkirk Tax Services

- Falkirk Self-Assessment

- Falkirk Bookkeeping Healthchecks

- Falkirk Business Planning

- Falkirk Taxation Advice

- Falkirk Tax Planning

- Falkirk Business Accounting

- Falkirk Payroll Services

- Falkirk VAT Returns

- Falkirk Bookkeepers

Also find accountants in: Viewpark, Kirkcaldy, Dumbarton, Stirling, Westhill, Paisley, Peebles, Banchory, Musselburgh, Selkirk, Renfrew, Airdrie, Turriff, Bathgate, Larbert, Falkirk, Port Glasgow, Dundee, Peterhead, Blantyre, Rutherglen, Barrhead, Ayr, Edinburgh, Cambuslang, Glasgow, Newton Mearns, Greenock, Coatbridge, Perth, Denny, Bonnyrigg, Bearsden, Hamilton, Kilmarnock and more.

Accountant Falkirk

Accountant Falkirk Accountants Near Falkirk

Accountants Near Falkirk Accountants Falkirk

Accountants FalkirkMore Scotland Accountants: Kilmarnock, Greenock, Dumfries, Glenrothes, Glasgow, Dunfermline, Livingston, Kirkcaldy, Stirling, Aberdeen, Hamilton, Edinburgh, Inverness, Falkirk, Ayr, Dundee, Coatbridge, East Kilbride, Irvine, Motherwell, Airdrie, Perth, Paisley and Cumbernauld.

TOP - Accountants Falkirk - Financial Advisers

Auditors Falkirk - Affordable Accountant Falkirk - Tax Advice Falkirk - Online Accounting Falkirk - Investment Accountant Falkirk - Tax Preparation Falkirk - Financial Advice Falkirk - Chartered Accountant Falkirk - Financial Accountants Falkirk