Accountants Crewe: If you run a small business or are a sole trader in Crewe, you will find there are numerous benefits to be gained from having an accountant at hand. Your accountant should at the minimum be able to free up a bit of time for you by handling areas like payroll, self-assessment tax returns and bookkeeping. Getting this type of advice and help can be critical for smaller businesses and even more so for start-ups.

Your next task will be to look for a nearby Crewe accountant who you can trust to do a good job on your books. Tracking down a shortlist of local Crewe accountants should be quite simple with a swift search on the internet. But, how do you know which ones can be trusted with your paperwork? It is always worthwhile considering that it is possible for practically any Crewe individual to advertise themselves as a bookkeeper or accountant. They don't need to have any particular qualifications. Which, like me, you might find incredible.

It should be easy enough to track down an accountant who actually does have the relevant qualifications. For simple self-assessment work an AAT qualification is what you need to look for. A certified Crewe accountant might be more costly than an untrained one, but should be worth the extra expense. Accounting fees are of course a business expense and can be included as such on your tax return. It is perfectly acceptable to use a qualified bookkeeper in Crewe if you are a sole trader or a smaller business.

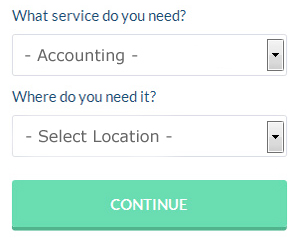

There is a unique online website called Bark which will actually find you a choice of accountants in the Crewe area. You simply answer a few relevant questions so that they can find the most suitable person for your needs. Then you just have to wait for some prospective accountants to contact you.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. Nowadays more and more people are using this kind of service. Make a short list of such companies and do your homework to find the most reputable. The better ones can soon be singled out by carefully studying reviews online.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. It is also a good idea to make use of some self-assessment software such as ACCTAX, Taxforward, Gbooks, Andica, Sage, Keytime, Taxfiler, Ablegatio, 123 e-Filing, Taxshield, Nomisma, Basetax, Capium, TaxCalc, Absolute Topup, Ajaccts, CalCal, GoSimple, BTCSoftware, Forbes or Xero to simplify the process. Getting your self-assessment form submitted on time is the most important thing.

Auditors Crewe

An auditor is an individual or a firm appointed by an organisation or company to undertake an audit, which is the official examination of the accounts, usually by an independent entity. Auditors assess the financial behaviour of the company that hires them and make certain of the steady functioning of the organisation. Auditors need to be approved by the regulating body for accounting and auditing and have the required accounting qualifications. (Tags: Auditor Crewe, Auditing Crewe, Auditors Crewe)

Small Business Accountants Crewe

Making sure your accounts are accurate can be a stressful job for anyone running a small business in Crewe. Appointing a small business accountant in Crewe will permit you to operate your business knowing your annual accounts, VAT and tax returns, amongst many other business tax requirements, are being fully met.

Helping you expand your business, and providing financial advice for your particular circumstances, are just two of the means by which a small business accountant in Crewe can benefit you. An effective accounting firm in Crewe should be able to give proactive small business advice to optimise your tax efficiency while reducing expense; vital in the sometimes shadowy world of business taxation.

You also ought to be provided with a dedicated accountancy manager who understands your company's situation, your business structure and your plans for the future. (Tags: Small Business Accountants Crewe, Small Business Accountant Crewe, Small Business Accounting Crewe).

Staying on Top of Your Finances When You're a Business Owner

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. Very few things in life can kill your confidence quite like how unintentionally ruining your financial situation does. Continue reading if you want to know how you can better manage your business finances.

You may think it's a good idea to wait to pay the taxes you owe until they're due. However, if you have poor money management skills, you may not have the money you need to pay your estimated tax and other related fees. To prevent yourself from coming up short, set money aside with every payment your receive. Do this and you'll never have to worry where to get the money to pay your taxes every quarter because you've already got it saved. You want to be able to pay taxes promptly and in full and being able to do so every quarter is a great feeling.

Learn bookkeeping. It's important that you have a system in place for your money -- both for your personal and business finances. You can either use basic spreadsheet or software such as QuickBooks. In addition, you can make use of personal budgeting tools such as Mint.com. There are a lot of free resources online to help small business owners better manage their bookkeeping. Your books are your key to truly understanding your money because they help you see what is happening with your business (and personal) finances. It might even be in your best interest, particularly if you don't have the money to hire a professional to help you, to take a class is basic bookkeeping and accounting.

Do not forget to pay your taxes on time. Generally, taxes must be paid quarterly by small business owners. Taxes can be quite confusing so you might want to make an appointment with your local small business center or even at the IRS so you can get accurate information. You can also seek the help of an accountant who specializes in small business accounting. He or she can ensure that you're following all the taxation laws as they relate to small businesses and that you're paying the right amount of taxes on time. Having the IRS at your doorstep isn't something you'd want, believe me!

Proper money management is one of the best things you can learn both for your own self improvement and for self improvement in your business. You'll benefit a great deal if you remember and put these tips we've shared to use. Keep your finances under control and you can look forward to a better, more successful personal life and business life.

Actuaries Crewe

An actuary is a business professional who studies the managing and measurement of uncertainty and risk. Actuaries use their mathematical skills to assess the probability and risk of future events and to estimate their effect on a business. Actuaries deliver reviews of fiscal security systems, with an emphasis on their complexity, their mechanisms and their mathematics.

Crewe accountants will help with PAYE Crewe, VAT payer registration Crewe, annual tax returns Crewe, double entry accounting, partnership registration in Crewe, business start-ups, partnership accounts in Crewe, general accounting services in Crewe, debt recovery, charities, accounting support services, contractor accounts, tax preparation Crewe, employment law Crewe, VAT returns, management accounts, estate planning, accounting services for landlords Crewe, mergers and acquisitions, National Insurance numbers, workplace pensions Crewe, personal tax, pension planning in Crewe, financial and accounting advice, HMRC submissions, investment reviews, company secretarial services, business outsourcing, HMRC submissions, year end accounts, consulting services, auditing and accounting and other accounting services in Crewe, Cheshire. Listed are just an example of the duties that are undertaken by local accountants. Crewe specialists will inform you of their entire range of services.

Crewe Accounting Services

- Crewe Financial Advice

- Crewe Personal Taxation

- Crewe Account Management

- Crewe Tax Refunds

- Crewe Debt Recovery

- Crewe Bookkeeping Healthchecks

- Crewe Tax Planning

- Crewe Tax Services

- Crewe Forensic Accounting

- Crewe Taxation Advice

- Crewe Financial Audits

- Crewe PAYE Healthchecks

- Crewe Auditing

- Crewe Self-Assessment

Also find accountants in: Burton, Walgherton, Stockton Heath, Buerton, Bruera, Oakgrove, North Rode, Clutton, Keckwick, Tilston, Winterley, Parkgate, Peover Heath, Weston Point, Willington Corner, Rostherne, Warren, Ness, Antrobus, Holmes Chapel, Heatley, Marbury, Stoak, High Legh, Rodeheath, Littleton, Kerridge, Widnes, Wettenhall Green, Over, Burland, Jodrell Bank, Hapsford, Anderton, Penketh and more.

Accountant Crewe

Accountant Crewe Accountants Near Me

Accountants Near Me Accountants Crewe

Accountants CreweMore Cheshire Accountants: Nantwich, Macclesfield, Ellesmere Port, Warrington, Wilmslow, Congleton, Knutsford, Northwich, Neston, Frodsham, Runcorn, Poynton, Crewe, Alsager, Lymm, Widnes, Winsford, Middlewich, Sandbach and Chester.

TOP - Accountants Crewe - Financial Advisers

Financial Accountants Crewe - Bookkeeping Crewe - Small Business Accountant Crewe - Tax Accountants Crewe - Financial Advice Crewe - Online Accounting Crewe - Tax Return Preparation Crewe - Investment Accountant Crewe - Cheap Accountant Crewe