Accountants Sandy: Completing your self-assessment form year after year can really give you a headache. Other small businesses and sole traders in the Sandy area are faced with the same challenge. Is it easy to find a local professional in Sandy to manage this for you? Perhaps it is simply the case that self-assessment is too complicated for you to do by yourself. £200-£300 is the average cost for such a service when using Sandy High St accountants. By utilizing an online service rather than a local Sandy accountant you can save quite a bit of cash.

Obtaining an accountant in Sandy isn't always that easy with various kinds of accountants out there. Picking out the best one for your company is essential. You might prefer to pick one who works alone or one within a practice or company. An accounting firm in Sandy will employ specialists in each of the primary sectors of accounting. It's likely that investment accountants, bookkeepers, tax accountants, cost accountants, actuaries, chartered accountants, accounting technicians, management accountants, auditors, financial accountants and forensic accountants will be available within an accounting company of any size.

To get the job done correctly you should search for a local accountant in Sandy who has the right qualifications. You don't need a chartered accountant but should get one who is at least AAT qualified. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. You will of course get a tax deduction on the costs involved in preparing your tax returns.

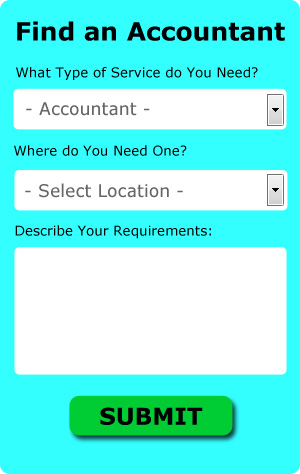

If you don't have the time to do a proper online search for local accountants, try using the Bark website. They provide an easy to fill in form that gives an overview of your requirements. Then you just have to wait for some prospective accountants to contact you.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. You might find that this is simpler and more convenient for you. Do some homework to single out a company with a good reputation. It should be a simple task to find some online reviews to help you make your choice. Apologies, but we do not endorse, recommend or advocate any specific company.

The real professionals in the field are chartered accountants. Accountants must be members of the ICAEW (or ICAS in Scotland) to work as a chartered accountant. You will certainly be hiring the best if you do choose one of these.

The cheapest option of all is to do your own self-assessment form. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of Keytime, Nomisma, Andica, 123 e-Filing, Ablegatio, TaxCalc, Absolute Topup, ACCTAX, Ajaccts, CalCal, Taxfiler, Basetax, GoSimple, Sage, Capium, Taxforward, Xero, BTCSoftware, Gbooks, Taxshield and Forbes. The most important thing is to make sure your self-assessment is sent in promptly.

Financial Actuaries Sandy

An actuary is a business professional who assesses the managing and measurement of uncertainty and risk. An actuary applies financial and statistical concepts to evaluate the odds of a specific event happening and its potential financial consequences. An actuary uses math and statistical concepts to appraise the financial impact of uncertainty and help their clientele limit risk. (Tags: Actuaries Sandy, Financial Actuaries Sandy, Actuary Sandy)

Payroll Services Sandy

An important aspect of any business enterprise in Sandy, large or small, is having a reliable payroll system for its employees. The legislation regarding payroll requirements for accuracy and transparency mean that running a company's payroll can be an intimidating task.

Using a professional accounting firm in Sandy, to take care of your payroll requirements is a simple way to reduce the workload of your own financial team. Working with HMRC and pension providers, a managed payroll service accountant will also take care of BACS payments to employees, ensuring that they're paid promptly each month, and that all mandatory deductions are done correctly.

It will also be a requirement for a qualified payroll accountant in Sandy to prepare an accurate P60 tax form for each staff member after the end of the financial year (by 31st May). Upon the termination of an employee's contract, the payroll company will also supply a current P45 form outlining what tax has been paid during the previous financial period. (Tags: Payroll Services Sandy, Payroll Administrator Sandy, Payroll Accountants Sandy).

Auditors Sandy

Auditors are experts who review the fiscal accounts of organisations and companies to ensure the validity and legality of their current financial reports. Auditors examine the fiscal procedures of the company which hires them and ensure the steady operation of the business. Auditors have to be authorised by the regulatory body for accounting and auditing and also have the required qualifications. (Tags: Auditing Sandy, Auditors Sandy, Auditor Sandy)

Sandy accountants will help with charities Sandy, personal tax, corporate finance, business outsourcing, estate planning Sandy, management accounts, double entry accounting Sandy, tax preparation, workplace pensions, accounting services for start-ups, inheritance tax, HMRC submissions, compliance and audit reports Sandy, corporation tax, accounting support services, taxation accounting services in Sandy, assurance services, company formations Sandy, partnership registrations, self-employed registrations, limited company accounting, payslips, contractor accounts Sandy, partnership accounts Sandy, debt recovery, VAT returns, pension advice, National Insurance numbers, business support and planning, financial statements, consultancy and systems advice in Sandy, company secretarial services in Sandy and other kinds of accounting in Sandy, Bedfordshire. Listed are just an example of the tasks that are conducted by nearby accountants. Sandy companies will be delighted to keep you abreast of their full range of services.

When you're searching for inspiration and ideas for accounting for small businesses, personal tax assistance, accounting & auditing and self-assessment help, you don't need to look much further than the internet to get pretty much everything that you need. With such a wide variety of carefully researched blog posts and webpages to select from, you will very shortly be brimming with creative ideas for your upcoming project. The other day we came across this enlightening article about how to track down an accountant to fill in your yearly tax return.

Sandy Accounting Services

- Sandy Tax Planning

- Sandy Account Management

- Sandy Personal Taxation

- Sandy Tax Investigations

- Sandy Financial Advice

- Sandy Taxation Advice

- Sandy Business Accounting

- Sandy Debt Recovery

- Sandy Self-Assessment

- Sandy Forensic Accounting

- Sandy Tax Refunds

- Sandy Chartered Accountants

- Sandy Bookkeeping

- Sandy VAT Returns

Also find accountants in: Heath And Reach, Shillington, Stanford, Bolnhurst, Church End, Pavenham, Renhold, Pulloxhill, Wilstead, Wrestlingworth, Stopsley, Staploe, Stanbridge, Tingrith, Aspley Guise, Swineshead, Girtford, Farndish, Odell, Slip End, Wilden, Eaton Bray, Wootton, Astwick, Sundon Park, Sharpenhoe, Wyboston, Cockayne Hatley, Silsoe, Podington, Willington, Harrowden, Keysoe, Higham Gobion, Ickwell Green and more.

Accountant Sandy

Accountant Sandy Accountants Near Me

Accountants Near Me Accountants Sandy

Accountants SandyMore Bedfordshire Accountants: Dunstable, Houghton Regis, Leighton Buzzard, Bedford, Flitwick, Biggleswade, Luton and Sandy.

TOP - Accountants Sandy - Financial Advisers

Bookkeeping Sandy - Online Accounting Sandy - Small Business Accountant Sandy - Investment Accountant Sandy - Self-Assessments Sandy - Tax Advice Sandy - Financial Accountants Sandy - Affordable Accountant Sandy - Tax Preparation Sandy