Accountants Runcorn: Have you found that filling in your self-assessment form each year is a bit of a headache? Don't fret, you are not the only one, many others in Runcorn face the same issues. Finding a local Runcorn professional to do it for you might be the answer. If you find self-assessment too taxing, this could be better for you. High Street accountants in Runcorn will normally charge about £200-£300 for this sort of service. You can definitely get it done cheaper by using online services.

But which accounting service is best for your requirements and how should you go about locating it? Several possible candidates can soon be located by performing a swift search on the internet. But, how do you know who to trust? The sad fact is that anyone in Runcorn can promote their services as an accountant. No formal qualifications are required in order to do this.

You would be best advised to find a fully qualified Runcorn accountant to do your tax returns. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. A qualified accountant may cost a little more but in return give you peace of mind. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

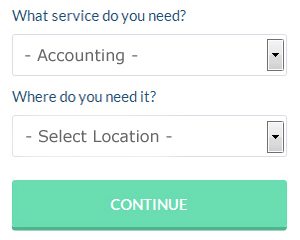

There is an online company called Bark who will do much of the work for you in finding an accountant in Runcorn. They provide an easy to fill in form that gives an overview of your requirements. Within a few hours you should hear from some local accountants who are willing to help you.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. An increasing number of self-employed people are plumping for this option. If you decide to go with this method, pick a company with a decent reputation. It should be a simple task to find some online reviews to help you make your choice.

Although filling in your own tax return may seem too complicated, it is not actually that hard. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of TaxCalc, Basetax, Ajaccts, Ablegatio, Andica, Taxfiler, Keytime, Forbes, GoSimple, Absolute Topup, 123 e-Filing, Xero, ACCTAX, Nomisma, CalCal, Gbooks, Taxforward, Taxshield, Sage, Capium and BTCSoftware. You will get a penalty if your tax return isn't in on time. The standard fine for being up to three months late is £100.

Forensic Accountant Runcorn

You could well notice the expression "forensic accounting" when you are trying to find an accountant in Runcorn, and will perhaps be interested to learn about the distinction between forensic accounting and regular accounting. The hint for this is the word 'forensic', which basically means "appropriate for use in a law court." Occasionally also known as 'forensic accountancy' or 'financial forensics', it uses investigative skills, auditing and accounting to dig through financial accounts in order to discover criminal activity and fraud. Some of the larger accountancy firms in and near Runcorn have even got specialised divisions addressing bankruptcy, personal injury claims, tax fraud, professional negligence, money laundering, insurance claims and insolvency. (Tags: Forensic Accounting Runcorn, Forensic Accountant Runcorn, Forensic Accountants Runcorn)

Learning the Top Money Management Strategies for Business Success

Many business owners have discovered early on that it can be difficult to learn how to properly use money management techniques. You may be thinking that money management is something that you should already be able to do. However, there is a huge difference between managing your personal finances and managing your business finances, although it can help if you've got some experience in the former. Very few things in life can kill your confidence quite like how unintentionally ruining your financial situation does. Continue reading if you want to know how you can better manage your business finances.

Keep separate accounts for your business and personal expenses, as trying to run everything through one account just makes everything confusing. It may be simple to keep track of everything in the beginning, but over time, you'll find it's so much easier to track your expenses if you have separate accounts. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. You'll be able to manage your finances better if you separate the business expenses from the personal expenses.

Give your clients the choice to pay in installments. In addition to attracting more clients, it will guarantee you'll get a steady stream of income for your business. This is easier to count on than money that comes in in giant bursts with long dry spells between them. Reliable income makes it a lot easier for you to budget, makes it easier to keep your bills paid, and makes it much simpler to properly manage your money. This is a great boost to your confidence.

f your business deals with cash all the time, you're better off depositing money to your bank account at the end of each business day. Doing so will help you avoid being tempted to use any cash you have on hand for unnecessary expenses. For example, if you're out for lunch and you're short on cash, you might be tempted to dip in to the cash in your register and tell yourself you'll return the money the next day or two. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

There are many things you can do to help you manage your money the right way. Proper money management isn't really a simple or basic skill you can master over the weekend. It's something you have to constantly learn over time, particularly if you have a small business. Make sure that you use the suggestions we've provided to help you track and manage your finances better. If you want your business to be profitable, you need to stay on top of your finances.

Payroll Services Runcorn

For any company in Runcorn, from large scale organisations down to independent contractors, dealing with staff payrolls can be complicated. The legislation regarding payrolls and the legal requirements for accuracy and openness means that handling a company's payroll can be an intimidating task.

All small businesses don't have their own in-house financial specialists, and an easy way to take care of employee payrolls is to employ an external Runcorn accounting firm. Working along with HMRC and pension schemes, a managed payroll service accountant will also manage BACS payments to personnel, making sure they are paid promptly every month, and that all deductions are done correctly.

Abiding by the current regulations, a professional payroll accountant in Runcorn will also present every one of your staff members with a P60 tax form at the end of each financial year. A P45 will also be provided for any staff member who finishes working for your business, in keeping with current legislations. (Tags: Payroll Services Runcorn, Payroll Accountants Runcorn, Payroll Companies Runcorn).

Runcorn accountants will help with taxation accounting services Runcorn, payslips Runcorn, audit and auditing, business advisory services Runcorn, small business accounting Runcorn, company formations Runcorn, tax investigations Runcorn, consulting services, cash flow, tax returns, general accounting services Runcorn, inheritance tax, accounting services for buy to let landlords Runcorn, personal tax Runcorn, mergers and acquisitions, financial planning, sole traders, litigation support, accounting support services, business planning and support, self-employed registrations in Runcorn, contractor accounts, accounting and financial advice, estate planning, National Insurance numbers in Runcorn, management accounts, employment law, year end accounts Runcorn, payroll accounting, business start-ups, partnership accounts, accounting services for the construction industry and other forms of accounting in Runcorn, Cheshire. These are just a handful of the duties that are conducted by nearby accountants. Runcorn professionals will keep you informed about their full range of services.

When hunting for inspiration and ideas for personal tax assistance, auditing & accounting, self-assessment help and accounting for small businesses, you don't really need to look much further than the internet to get all the information that you need. With such a multitude of well researched webpages and blog posts to pick from, you will soon be bursting with great ideas for your upcoming project. Just recently we came across this informative article covering how to track down an excellent accountant.

Runcorn Accounting Services

- Runcorn Chartered Accountants

- Runcorn Bookkeeping

- Runcorn PAYE Healthchecks

- Runcorn Payroll Services

- Runcorn Self-Assessment

- Runcorn Financial Advice

- Runcorn Tax Returns

- Runcorn VAT Returns

- Runcorn Business Accounting

- Runcorn Audits

- Runcorn Specialist Tax

- Runcorn Personal Taxation

- Runcorn Tax Planning

- Runcorn Tax Refunds

Also find accountants in: Antrobus, Bruera, Backford, Picton, Tytherington, Mount Manisty, Whitby, Church Minshull, Spen Green, Middlewich, Woolston, Kettleshulme, Sutton Lane Ends, Monks Heath, Brookhouse Green, Great Sutton, Mottram St Andrew, Haslington, Holmes Chapel, Marbury, Weaverham, Culcheth, Salterswall, Arclid, Blakenhall, High Legh, Lower Whitley, Dodleston, Risley, Blacon, Jodrell Bank, Tattenhall, Handbridge, Spurstow, Warmingham and more.

Accountant Runcorn

Accountant Runcorn Accountants Near Runcorn

Accountants Near Runcorn Accountants Runcorn

Accountants RuncornMore Cheshire Accountants: Middlewich, Alsager, Knutsford, Nantwich, Wilmslow, Warrington, Winsford, Poynton, Sandbach, Northwich, Chester, Frodsham, Crewe, Ellesmere Port, Congleton, Runcorn, Lymm, Macclesfield, Neston and Widnes.

TOP - Accountants Runcorn - Financial Advisers

Small Business Accountant Runcorn - Bookkeeping Runcorn - Investment Accounting Runcorn - Financial Advice Runcorn - Financial Accountants Runcorn - Chartered Accountant Runcorn - Affordable Accountant Runcorn - Self-Assessments Runcorn - Auditing Runcorn