Accountants Cranleigh: It will come as no surprise if you are self-employed or running your own business in Cranleigh, that having your own accountant can have big rewards. At the very minimum you can expect to have more time freed up for your core business operation, while the accountant takes care of the mundane paperwork. If you are only just getting started in business you will find the assistance of a qualified accountant indispensable. As you grow and move forward you'll find this help ever more necessary.

Different types of accountant will be marketing their services in and around Cranleigh. So, picking the right one for your company is important. Some Cranleigh accountants work within a larger business, whilst others work on their own. The benefit of accounting firms is that they've got many areas of expertise in one place. Accounting companies will normally offer the professional services of forensic accountants, management accountants, cost accountants, actuaries, tax preparation accountants, financial accountants, accounting technicians, investment accountants, auditors, chartered accountants and bookkeepers.

Finding a properly qualified Cranleigh accountant should be your priority. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. You can then have peace of mind knowing that your tax affairs are being handled professionally. Remember that a percentage of your accounting costs can be claimed back on the tax return.

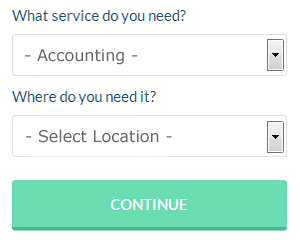

There is now a service available known as Bark, where you can look for local professionals including accountants. With Bark it is simply a process of ticking a few boxes and submitting a form. Just sit back and wait for the responses to roll in.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. Services like this are convenient and cost effective. Picking a reputable company is important if you choose to go with this option. Reading through reviews for any potential online services is a good way to get a feel for what is out there. We prefer not to recommend any particular online accounting company here.

At the top of the tree are chartered accountants, these professionals have all the qualifications and are experts in their field. However, as a sole trader or smaller business in Cranleigh using one of these specialists may be a bit of overkill. Some people might say, you should hire the best you can afford.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! There is also lots of software available to help you with your returns. These include Xero, Taxforward, ACCTAX, 123 e-Filing, Gbooks, Ablegatio, TaxCalc, Keytime, Forbes, GoSimple, Capium, Andica, CalCal, BTCSoftware, Nomisma, Ajaccts, Taxshield, Sage, Taxfiler, Basetax and Absolute Topup. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time. The standard fine for being up to three months late is £100.

Forensic Accountant Cranleigh

You could well come across the phrase "forensic accounting" when you are looking for an accountant in Cranleigh, and will undoubtedly be interested to learn about the difference between forensic accounting and normal accounting. With the actual word 'forensic' literally meaning "denoting or relating to the application of scientific techniques and methods to the investigation of criminal activity", you ought to get a hint as to what's involved. Also called 'financial forensics' or 'forensic accountancy', it uses accounting, investigative skills and auditing to discover irregularities in financial accounts which have contributed to fraud or theft. There are several bigger accountants firms in Surrey who have got specialist sections for forensic accounting, dealing with personal injury claims, professional negligence, bankruptcy, money laundering, tax fraud, insolvency and falsified insurance claims. (Tags: Forensic Accounting Cranleigh, Forensic Accountants Cranleigh, Forensic Accountant Cranleigh)

Small Business Accountants Cranleigh

Doing the yearly accounts can be a stressful experience for anybody running a small business in Cranleigh. A dedicated small business accountant in Cranleigh will offer you a hassle-free approach to keep your tax returns, annual accounts and VAT in the best possible order.

An experienced small business accountant in Cranleigh will regard it as their responsibility to help develop your business, and offer you sound financial guidance for peace of mind and security in your particular situation. The fluctuating and often complicated field of business taxation will be clearly explained to you in order to lower your business expenses, while at the same time improving tax efficiency.

A small business accountant, to do their job properly, will need to know complete details with regards to your current financial situation, business structure and any possible investments that you might be looking at, or already have set up. (Tags: Small Business Accountants Cranleigh, Small Business Accounting Cranleigh, Small Business Accountant Cranleigh).

Cranleigh accountants will help with HMRC submissions, workplace pensions, tax preparation in Cranleigh, partnership accounts Cranleigh, company secretarial services in Cranleigh, contractor accounts, accounting services for the construction industry, business acquisition and disposal, management accounts, sole traders, corporate finance, HMRC liaison, employment law in Cranleigh, double entry accounting Cranleigh, National Insurance numbers, tax returns, payslips, assurance services, bookkeeping, accounting and financial advice, personal tax, taxation accounting services, audit and compliance reports, self-employed registrations, year end accounts in Cranleigh, VAT returns, litigation support in Cranleigh, partnership registration, charities in Cranleigh, inheritance tax, small business accounting, VAT payer registration Cranleigh and other kinds of accounting in Cranleigh, Surrey. These are just a small portion of the tasks that are performed by nearby accountants. Cranleigh specialists will be delighted to keep you abreast of their whole range of accounting services.

Cranleigh Accounting Services

- Cranleigh Bookkeeping

- Cranleigh Payroll Management

- Cranleigh Self-Assessment

- Cranleigh Forensic Accounting

- Cranleigh Personal Taxation

- Cranleigh Tax Services

- Cranleigh Taxation Advice

- Cranleigh Account Management

- Cranleigh Debt Recovery

- Cranleigh Business Accounting

- Cranleigh Tax Planning

- Cranleigh Auditing Services

- Cranleigh Bookkeeping Healthchecks

- Cranleigh PAYE Healthchecks

Also find accountants in: Pitch Place, Buckland, Dormansland, Shottermill, Rushmoor, Burgh Heath, Hascombe, Hambledon, Cranleigh, Haslemere, Frimley, Thursley, Cobham, Oxshott, Ockley, Churt, Beare Green, Egham, Weybridge, Seale, New Haw, Ramsnest Common, Bagshot, Hurst Green, Thorpe, Chelsham, East Molesey, Chaldon, Guildford, Send Marsh, Salfords, Leatherhead, Littleton, Busbridge, Farley Green and more.

Accountant Cranleigh

Accountant Cranleigh Accountants Near Me

Accountants Near Me Accountants Cranleigh

Accountants CranleighMore Surrey Accountants: Guildford, Staines, Esher, Addlestone, Chertsey, Caterham, Woking, Molesey, Farnham, Epsom, Haslemere, Godalming, Horley, Walton-on-Thames, Hersham, Cranleigh, Dorking, Ewell, Ash, Redhill, Sunbury-on-Thames, Windlesham, Camberley, Banstead, Reigate, Weybridge and Leatherhead.

TOP - Accountants Cranleigh - Financial Advisers

Tax Return Preparation Cranleigh - Small Business Accountants Cranleigh - Bookkeeping Cranleigh - Affordable Accountant Cranleigh - Online Accounting Cranleigh - Investment Accountant Cranleigh - Chartered Accountants Cranleigh - Self-Assessments Cranleigh - Tax Advice Cranleigh