Accountants Sedgley: Does it seem to you that the only "reward" for completing your annual self-assessment form a massive headache? Lots of self-employed people in Sedgley feel much the same as you. But how can you find a local accountant in Sedgley to do it for you? If self-assessment is too complex for you, this could be the way forward. A regular accountant in Sedgley is likely to charge you around £200-£300 for the privilege. If you don't mind using an online service rather than someone local to Sedgley, you might be able to get this done for less.

Accountants don't solely handle tax returns, there are different sorts of accountant. Your aim is to choose one that meets your exact requirements. You'll find that there are accountants who work solo and accountants who work for large accountancy companies. An accountancy firm in Sedgley will employ specialists in each of the major accounting fields. You will possibly find the likes of chartered accountants, auditors, tax accountants, cost accountants, accounting technicians, management accountants, investment accountants, actuaries, bookkeepers, forensic accountants and financial accountants in a sizable accountancy company.

To get the job done correctly you should search for a local accountant in Sedgley who has the right qualifications. The recommended minimum qualification you should look for is an AAT. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form.

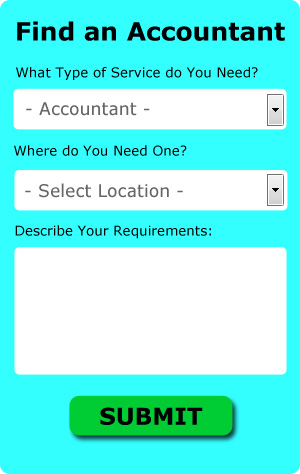

If you don't have the time to do a proper online search for local accountants, try using the Bark website. In no time at all you can fill out the job form and submit it with a single click. Then you just have to wait for some prospective accountants to contact you. At the time of writing this service was totally free.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. For many self-employed people this is a convenient and time-effective solution. Some of these companies are more reputable than others. Carefully read reviews online in order to find the best available. Sorry, but we cannot give any recommendations in this respect.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. Software is also available to make doing your self-assessment even easier. Some of the best ones include Ajaccts, GoSimple, Taxshield, Nomisma, Andica, Keytime, CalCal, Absolute Topup, 123 e-Filing, TaxCalc, Forbes, Ablegatio, Capium, BTCSoftware, Taxfiler, Sage, Gbooks, Basetax, ACCTAX, Taxforward and Xero. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns. You will receive a fine of £100 if you are up to three months late with your tax return.

Small Business Accountants Sedgley

Running a small business in Sedgley is pretty stress-filled, without needing to fret about your accounts and other bookkeeping duties. If your annual accounts are getting on top of you and VAT and tax return issues are causing you sleepless nights, it is wise to employ a dedicated small business accountant in Sedgley.

Helping you to grow your business, and offering financial advice for your specific circumstances, are just a couple of the ways that a small business accountant in Sedgley can benefit you. An accountancy firm in Sedgley will provide a dedicated small business accountant and adviser who will clear the fog that shrouds the world of business taxation, so as to enhance your tax efficiency.

It is crucial that you explain the structure of your business, your plans for the future and your company's circumstances truthfully to your small business accountant.

Payroll Services Sedgley

A crucial component of any business enterprise in Sedgley, large or small, is having an effective payroll system for its personnel. The legislation relating to payroll for accuracy and openness mean that running a company's payroll can be an intimidating task for the uninitiated.

Using an experienced accounting firm in Sedgley, to take care of your payroll is the simple way to lessen the workload of your own financial team. A payroll accountant will work along with HMRC, work with pensions scheme administrators and deal with BACS payments to ensure that your personnel are always paid punctually, and all required deductions are accurate.

It will also be a requirement for a qualified payroll accountant in Sedgley to prepare a P60 tax form for all workers after the end of the financial year (by 31st May). They will also provide P45 tax forms at the end of an employee's working contract.

Financial Actuaries Sedgley

An actuary is a professional who evaluates the managing and measurement of risk and uncertainty. An actuary applies statistical and financial hypotheses to measure the chance of a particular event taking place and its potential monetary implications. To be an actuary it's essential to have a statistical, mathematical and economic awareness of day to day situations in the financial world. (Tags: Actuary Sedgley, Actuaries Sedgley, Financial Actuary Sedgley)

Sedgley accountants will help with capital gains tax, small business accounting Sedgley, financial planning, accounting services for media companies in Sedgley, assurance services, VAT registrations, National Insurance numbers in Sedgley, consultancy and systems advice in Sedgley, business advisory services, accounting and auditing Sedgley, year end accounts, business acquisition and disposal, bureau payroll services, inheritance tax Sedgley, VAT returns, payslips, consulting services, HMRC submissions, litigation support, financial statements, workplace pensions, partnership accounts, company formations, debt recovery, business start-ups in Sedgley, double entry accounting, tax preparation Sedgley, personal tax, audit and compliance issues, partnership registrations in Sedgley, taxation accounting services, estate planning and other types of accounting in Sedgley, West Midlands. Listed are just an example of the activities that are carried out by local accountants. Sedgley companies will tell you about their full range of services.

By using the world wide web as a powerful resource it is quite simple to find lots of valuable ideas and information concerning self-assessment help, accounting & auditing, personal tax assistance and accounting for small businesses. For instance, with a very quick search we discovered this interesting article describing 5 tips for choosing a first-rate accountant.

Sedgley Accounting Services

- Sedgley Forensic Accounting

- Sedgley Audits

- Sedgley Bookkeeping Healthchecks

- Sedgley PAYE Healthchecks

- Sedgley Financial Advice

- Sedgley Specialist Tax

- Sedgley Tax Advice

- Sedgley Personal Taxation

- Sedgley Tax Planning

- Sedgley Business Accounting

- Sedgley Tax Services

- Sedgley Self-Assessment

- Sedgley VAT Returns

- Sedgley Account Management

Also find accountants in: Amblecote, Dudley, Hawkes End, Whitlocks End, Allesley, Woodside, Tettenhall, Monmore Green, Sutton Coldfield, Oxley, Walsall Wood, Shire Oak, Princes End, Solihull Lodge, Mere Green, Edgbaston, Harborne, Tettenhall Wood, Wall Heath, Wylde Green, Olton, Erdington, Vigo, Northfield, Hall Green, Castle Bromwich, Elmdon, Chapel Fields, Bloxwich, Wergs, Halesowen, Perry Barr, Coventry, Bilston, Foleshill and more.

Accountant Sedgley

Accountant Sedgley Accountants Near Sedgley

Accountants Near Sedgley Accountants Sedgley

Accountants SedgleyMore West Midlands Accountants: Darlaston, Smethwick, Rowley Regis, Birmingham, Solihull, Sedgley, Tipton, Blackheath, Wednesfield, Brierley Hill, Halesowen, Coseley, Bilston, Coventry, Sutton Coldfield, Brownhills, Wolverhampton, Stourbridge, Aldridge, Dudley, Wednesbury, Kingswinford, West Bromwich, Bloxwich, Oldbury, Willenhall and Walsall.

TOP - Accountants Sedgley - Financial Advisers

Self-Assessments Sedgley - Cheap Accountant Sedgley - Financial Accountants Sedgley - Tax Return Preparation Sedgley - Bookkeeping Sedgley - Tax Accountants Sedgley - Chartered Accountant Sedgley - Financial Advice Sedgley - Small Business Accountants Sedgley