Accountants Wythall: Do you seem to get nothing but a headache when you fill out your yearly self-assessment form? You, along with lots of others who are self-employed in Wythall, face this annual trauma. But how can you track down a local accountant in Wythall to do it for you? Perhaps it is simply the case that self-assessment is too complicated for you to do on your own. You should expect to pay out about £200-£300 when retaining the services of a regular Wythall accountant or bookkeeper. Those who consider this too expensive have the added option of using an online tax return service.

So, what should you be looking for in an accountant and how much should you expect to pay for this kind of service? A shortlist of potential Wythall accountants may be identified with just a few minutes searching on the internet. However, which of these prospects can you put your trust in? You must never forget that anybody in Wythall can call themselves an accountant. They don't need to have any particular qualifications.

You should take care to find a properly qualified accountant in Wythall to complete your self-assessment forms correctly and professionally. Look for an AAT qualified accountant in the Wythall area. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. It should go without saying that accountants fees are tax deductable. Only larger Limited Companies are actually required by law to use a trained accountant.

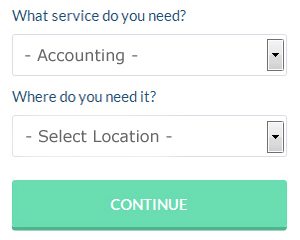

There is a unique online website called Bark which will actually find you a choice of accountants in the Wythall area. They provide an easy to fill in form that gives an overview of your requirements. Just sit back and wait for the responses to roll in. There are absolutely no charges for using this service.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. This type of service is growing in popularity. You still need to do your homework to pick out a company you can trust. The better ones can soon be singled out by carefully studying reviews online.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example Xero, Keytime, Taxforward, BTCSoftware, Absolute Topup, Forbes, 123 e-Filing, Andica, Nomisma, Basetax, Taxfiler, ACCTAX, Sage, Capium, Ajaccts, Ablegatio, Taxshield, Gbooks, TaxCalc, GoSimple and CalCal. You'll receive a fine if your self-assessment is late.

Payroll Services Wythall

For any company in Wythall, from large scale organisations down to independent contractors, dealing with staff payrolls can be tricky. The laws regarding payrolls and the legal obligations for transparency and accuracy means that handling a business's payroll can be an intimidating task.

A small business may well not have the luxury of its own financial specialist and the best way to deal with the issue of staff payrolls is to hire an external accounting company in Wythall. Working along with HMRC and pension schemes, a payroll accountant will also manage BACS payments to personnel, making certain that they're paid on time every month, and that all deductions are done accurately.

Adhering to current regulations, a professional payroll management accountant in Wythall will also provide each of your employees with a P60 at the conclusion of each fiscal year. They will also provide P45 tax forms at the end of an employee's working contract.

Forensic Accountant Wythall

When you're searching for an accountant in Wythall you'll probably encounter the expression "forensic accounting" and wonder what the differences are between a normal accountant and a forensic accountant. With the word 'forensic' meaning literally "suitable for use in a court of law", you ought to get a hint as to what is involved. Sometimes also called 'forensic accountancy' or 'financial forensics', it uses investigative skills, accounting and auditing to search through financial accounts in order to detect criminal activity and fraud. Some of the larger accountancy companies in and near to Wythall have even got specialist divisions dealing with tax fraud, insolvency, false insurance claims, personal injury claims, money laundering, professional negligence and bankruptcy. (Tags: Forensic Accountant Wythall, Forensic Accountants Wythall, Forensic Accounting Wythall)

Wythall accountants will help with estate planning, partnership accounts Wythall, business outsourcing, small business accounting, bureau payroll services Wythall, company formations in Wythall, double entry accounting, taxation accounting services, charities, contractor accounts in Wythall, year end accounts, accounting and auditing, assurance services, limited company accounting, financial statements, debt recovery, VAT payer registration in Wythall, corporate tax in Wythall, accounting services for start-ups in Wythall, workplace pensions, accounting services for media companies, tax preparation in Wythall, audit and compliance reports Wythall, business support and planning, HMRC submissions in Wythall, management accounts, monthly payroll in Wythall, payslips, tax returns, HMRC submissions, company secretarial services in Wythall, financial planning and other professional accounting services in Wythall, Worcestershire. These are just a few of the tasks that are carried out by nearby accountants. Wythall companies will keep you informed about their entire range of services.

Using the web as an unlimited resource it is quite simple to uncover a whole host of valuable information and ideas regarding self-assessment help, personal tax assistance, small business accounting and auditing & accounting. For instance, with a brief search we came across this illuminating article describing 5 tips for selecting a top-notch accountant.

Wythall Accounting Services

- Wythall Self-Assessment

- Wythall Chartered Accountants

- Wythall Business Accounting

- Wythall Tax Refunds

- Wythall Account Management

- Wythall Bookkeepers

- Wythall Debt Recovery

- Wythall Tax Returns

- Wythall VAT Returns

- Wythall Financial Advice

- Wythall Tax Services

- Wythall Taxation Advice

- Wythall Business Planning

- Wythall Bookkeeping Healthchecks

Also find accountants in: Grimley, Abberton, Wythall, Elmley Lovett, Bredon, Charlton, South Littleton, Upper Bentley, Malvern, Dormston, Eastham, Catshill, Besford, Wadborough, Dunstall Common, Frog Pool, Knightwick, Hunt End, Baughton, Horsham, Croome Dabitot, Hampton Lovett, Astley Cross, Madresfield, Abbots Morton, Bliss Gate, Cropthorne, Elcocks Brook, Tenbury Wells, Drakes Broughton, Birts Street, Ham Green, Ripple, Bordesley, Overbury and more.

Accountant Wythall

Accountant Wythall Accountants Near Wythall

Accountants Near Wythall Accountants Wythall

Accountants WythallMore Worcestershire Accountants: Wythall, Bewdley, Kidderminster, Worcester, Droitwich, Redditch, Malvern, Evesham, Stourport-on-Severn and Bromsgrove.

TOP - Accountants Wythall - Financial Advisers

Financial Advice Wythall - Tax Preparation Wythall - Small Business Accountant Wythall - Self-Assessments Wythall - Bookkeeping Wythall - Financial Accountants Wythall - Tax Accountants Wythall - Investment Accounting Wythall - Online Accounting Wythall