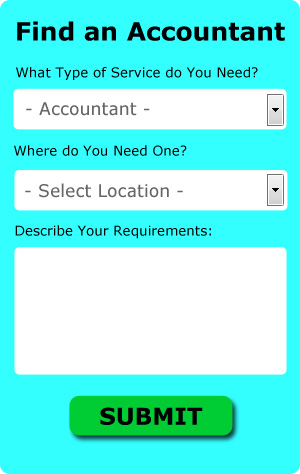

Accountants Droitwich: Does filling in your yearly self-assessment form give you nightmares? Many self-employed people in Droitwich feel the same way that you do. Maybe calling on the assistance of a local Droitwich professional is the answer? This could be a better idea for you if you find self-assessment too taxing. This kind of service will usually cost about £200-£300 if you use a High Street accountant in Droitwich. If you are looking for a cheap alternative you might find the answer online.

But exactly what do you get for your money, how much will you need to pay and where can you obtain the best Droitwich accountant for your requirements? An internet search engine will pretty quickly provide a substantial list of potential candidates in Droitwich. However, it is hard to spot the gems from the scoundrels. It is always worth considering that it is possible for practically any Droitwich individual to advertise themselves as a bookkeeper or accountant. No certifications or qualifications are required by law in the UK.

You would be best advised to find a fully qualified Droitwich accountant to do your tax returns. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. Qualified Droitwich accountants might charge a bit more but they may also get you the maximum tax savings. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat. Local Droitwich bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

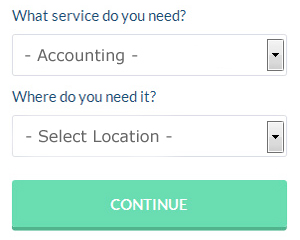

If you want to reach out to a number of local Droitwich accountants, you could always use a service called Bark. All that is required is the ticking of a few boxes so that they can understand your exact needs. Just sit back and wait for the responses to roll in.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. A number of self-employed people in Droitwich prefer to use this simple and convenient alternative. There is no reason why this type of service will not prove to be as good as your average High Street accountant. A quick browse through some reviews online should give you an idea of the best and worse services. Recommending any specific services is beyond the scope of this short article.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. Their expertise is better suited to high finance and bigger businesses. If you can afford one why not hire the best?

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! It is also a good idea to make use of some self-assessment software such as Taxshield, Andica, Ajaccts, 123 e-Filing, Capium, ACCTAX, Xero, BTCSoftware, Sage, Keytime, TaxCalc, Taxforward, Taxfiler, GoSimple, Forbes, Nomisma, CalCal, Gbooks, Ablegatio, Absolute Topup or Basetax to simplify the process. Whichever service you use your tax returns will need to be in on time to avoid penalties. You can expect a fine of £100 if your assessment is in even 1 day late.

Payroll Services Droitwich

An important part of any business in Droitwich, small or large, is having a reliable payroll system for its workforce. Handling company payrolls demands that all legal requirements regarding their exactness, transparency and timing are observed in all cases.

Using a professional accountant in Droitwich, to deal with your payroll requirements is a simple way to lessen the workload of your financial team. Working along with HMRC and pension scheme administrators, a payroll service accountant will also manage BACS payments to staff, making certain that they are paid promptly each month, and that all required deductions are done accurately.

A genuine payroll accountant in Droitwich will also, in keeping with current legislations, provide P60's after the end of the financial year for every employee. A P45 form must also be provided for any staff member who finishes working for your business, as outlined by current legislations.

Tips for Better Money Management

Want to put up your own business? Making the decision is quite easy. However, knowing exactly how to start it is a different matter altogether, and actually getting the business up and running can be a huge challenge. It is most difficult to make your business profitable because there are so many things that can take place along the way that will not just negatively affect your business but your confidence level as well. For instance, if you don't manage your finances properly, this can hurt you and your business. Many business owners disregard the important of money management because it's an easy and simple task during the beginning stages of a business. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

Don't mix your business and personal expenses by having just one account. If you do, you run the risk of confusion. It might seem simple at first but the truth is that in the long run it just makes everything more difficult. For one thing, proving your income is much more difficult when you run your business expenses through a personal account. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. Having separate accounts for your personal and business finances will save you a lot of headaches in the long run.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. This way, you won't have a hard time keeping track of your business and personal finances. Send all of the payments you receive for your goods and services into your business account then every week or every two weeks or even every month, pay yourself out of that account. How much should you pay yourself? It's up to you. You can pay yourself by billable hours or a portion of your business income for that month.

Do you receive cash payments regularly in your business? It may be a good idea to deposit money at the end of the day or as soon as possible. This will minimize the temptation of having money available that you can easily spend. It's so easy to take a couple of dollars here and there when you're short on cash and just say you'll put back in however much you took. When you do this, however, it's very possible that you'll forget all about the money you took out and then when you're doing your books, you're going to wonder why you're short. You can avoid this problem by putting your cash in your bank account at the end of the day.

Proper money management is a skill that every adult needs to develop. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. So keep in mind the tips we've shared. Truly, when it comes to self improvement in business, properly managing your money is incredibly important.

Actuaries Droitwich

Actuaries work within businesses and government departments, to help them in anticipating long-term investment risks and fiscal expenditure. An actuary employs statistical and financial theories to analyse the chances of a certain event taking place and the possible financial ramifications. To work as an actuary it's essential to have an economic, statistical and mathematical consciousness of real-life scenarios in the world of business finance. (Tags: Actuaries Droitwich, Actuary Droitwich, Financial Actuary Droitwich)

Droitwich accountants will help with auditing and accounting Droitwich, accounting services for media companies in Droitwich, accounting services for buy to let property rentals in Droitwich, accounting and financial advice, HMRC submissions, year end accounts, debt recovery, audit and compliance reports, bureau payroll services, cash flow, assurance services, HMRC liaison Droitwich, accounting support services, accounting services for start-ups, litigation support in Droitwich, taxation accounting services, consultancy and systems advice Droitwich, business advisory services, consulting services, capital gains tax, corporation tax Droitwich, self-employed registrations, VAT returns in Droitwich, investment reviews, business outsourcing in Droitwich, inheritance tax, employment law, self-assessment tax returns in Droitwich, accounting services for the construction industry, VAT registrations, personal tax, National Insurance numbers and other professional accounting services in Droitwich, Worcestershire. Listed are just a selection of the duties that are carried out by nearby accountants. Droitwich specialists will let you know their full range of accounting services.

Droitwich Accounting Services

- Droitwich Financial Advice

- Droitwich Debt Recovery

- Droitwich Tax Refunds

- Droitwich Specialist Tax

- Droitwich Tax Planning

- Droitwich Business Planning

- Droitwich Tax Services

- Droitwich Bookkeeping Healthchecks

- Droitwich Self-Assessment

- Droitwich Bookkeeping

- Droitwich Tax Advice

- Droitwich Payroll Management

- Droitwich Account Management

- Droitwich Tax Returns

Also find accountants in: Fernhill Heath, Holt Fleet, Clent, Pound Green, Ryall, Sedgeberrow, Shrawley, Bournheath, Shenstone, Besford, Kerswell Green, Hanley Castle, Bell End, Burcot, Hanley William, St Johns, Fairfield, Worcester, Webheath, Birlingham, White Ladies Aston, Brockleton, Hillhampton, Barnards Green, Redditch, Hadzor, Stoke Heath, Belbroughton, Elmley Castle, Pershore, Great Comberton, Kersoe, Hampton, Kington, Lower Sapey and more.

Accountant Droitwich

Accountant Droitwich Accountants Near Me

Accountants Near Me Accountants Droitwich

Accountants DroitwichMore Worcestershire Accountants: Bewdley, Malvern, Worcester, Wythall, Redditch, Stourport-on-Severn, Kidderminster, Droitwich, Bromsgrove and Evesham.

TOP - Accountants Droitwich - Financial Advisers

Self-Assessments Droitwich - Online Accounting Droitwich - Chartered Accountants Droitwich - Tax Advice Droitwich - Small Business Accountant Droitwich - Financial Advice Droitwich - Financial Accountants Droitwich - Auditors Droitwich - Investment Accounting Droitwich