Accountants Ash: Anybody operating a small business in Ash, Surrey will pretty quickly realise that there are numerous advantages to having an accountant at hand. By handling key tasks like tax returns, payroll and bookkeeping your accountant can at the minimum free up a bit of time for you to focus on your core business. Being able to access professional financial advice is even more crucial for newer businesses.

When searching for a nearby Ash accountant, you'll notice that there are numerous different kinds on offer. A local accountant who perfectly meets your requirements is what you should be searching for. Yet another decision you'll need to make is whether to go for an accountancy firm or a lone wolf accountant. Each field of accounting will have their own specialists within an accounting practice. The key positions which will be covered by an accountancy firm include: bookkeepers, tax preparation accountants, auditors, financial accountants, accounting technicians, costing accountants, investment accountants, management accountants, actuaries, chartered accountants and forensic accountants.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. An AAT qualified accountant should be adequate for sole traders and small businesses. A certified Ash accountant might be more costly than an untrained one, but should be worth the extra expense. Your accountant will add his/her fees as tax deductable. Ash sole traders often opt to use bookkeeper rather than accountants for their tax returns.

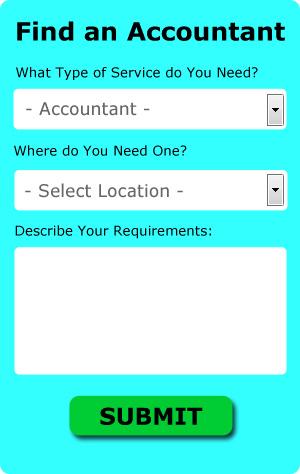

You could use an online service like Bark who will help you find an accountant. You'll be presented with a simple form which can be completed in a minute or two. You should start getting responses from local Ash accountants within the next 24 hours. You will not be charged for this service.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. Nowadays more and more people are using this kind of service. Even if you do decide to go down this route, take some time in singling out a trustworthy company. The better ones can soon be singled out by carefully studying reviews online. We prefer not to recommend any particular online accounting company here.

While you shouldn't totally discount the idea of using a chartered accountant, the high level of charges might put you off. Bigger limited companies are more likely to use these high achievers. Hiring the services of a chartered accountant means you will have the best that money can buy.

If you decide to bite the bullet and tackle the process by yourself there is lots of help on offer. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are TaxCalc, Taxfiler, Ajaccts, Absolute Topup, CalCal, 123 e-Filing, BTCSoftware, Capium, Basetax, Sage, Nomisma, ACCTAX, Keytime, Forbes, Andica, Taxshield, Taxforward, Ablegatio, GoSimple, Xero and Gbooks. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty. You�ll get a penalty of £100 if your tax return is up to 3 months late.

Financial Actuaries Ash

Analysts and actuaries are professionals in risk management. An actuary uses statistical and financial theories to assess the possibility of a certain event occurring and its possible monetary impact. Actuaries present judgements of fiscal security systems, with an emphasis on their mechanisms, their mathematics and their complexity. (Tags: Actuaries Ash, Financial Actuary Ash, Actuary Ash)

Tips to Help You Manage Your Money Better

One of the hardest aspects of starting a business is learning the proper use of money management strategies. Money management seems like one of those things that you should have the ability to do already. Personal money management, however, is completely different from business money management, although being experienced in the former can be handy when you go into business. Many business owners who have ruined their financial situation accidentally end up having no self-confidence at all. There are many things you can do to properly manage business finances and we'll share just a few of them in this article.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. You may not have problems in the beginning, but you can expect to have a hard time down the road. For one thing, proving your income is much more difficult when you run your business expenses through a personal account. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. You'll be able to manage your finances better if you separate the business expenses from the personal expenses.

You can help yourself by finding out how to keep your books. Don't neglect the importance of having a system set up for both your personal and business finances. You can either use an Excel spreadsheet or invest in bookkeeping software such as QuickBooks and Quicken. You could also try to use a personal budgeting tool like Mint.com. You'll find plenty of free resources on the internet that can help small business owners like you manage your books better. Keeping your books organized and up to date will help you understand your finances better. It won't hurt if you take a class or two on basic bookkeeping and accounting, as this could prove helpful to you especially if you don't think you can afford to hire a professional to manage your books.

If you deal with cash in any capacity, make sure that you deposit that cash every day, as keeping cash on hand is just too tempting. It could be that you need cash when you're out for lunch and you end up getting money from your register and telling yourself you'll return the money later. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. Put your cash in the bank at the end of every work day.

Proper money management is a skill that every adult needs to develop. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. So keep in mind the tips we've shared. If you want your business to be a success, it's important that you develop money management skills.

Forensic Accounting Ash

Whilst conducting your search for a reliable accountant in Ash there is a good chance that you will stumble on the phrase "forensic accounting" and be curious about what that is, and how it differs from regular accounting. With the actual word 'forensic' literally meaning "relating to or denoting the application of scientific methods and techniques for the investigation of crime", you will get a clue as to what's involved. Also known as 'financial forensics' or 'forensic accountancy', it uses auditing, investigative skills and accounting to detect inconsistencies in financial accounts that have resulted in fraud or theft. There are a few bigger accountants firms throughout Surrey who have got specialised departments for forensic accounting, addressing professional negligence, personal injury claims, bankruptcy, tax fraud, false insurance claims, insolvency and money laundering.

Auditors Ash

An auditor is an individual sanctioned to examine and verify the reliability of financial accounts and make sure that businesses conform to tax legislation. Auditors analyze the financial procedures of the firm that employs them to make certain of the consistent functioning of the business. To work as an auditor, a person should be certified by the regulating authority of accounting and auditing and have certain specified qualifications. (Tags: Auditing Ash, Auditor Ash, Auditors Ash)

Ash accountants will help with litigation support, taxation accounting services, self-employed registrations in Ash, accounting services for media companies, estate planning, tax investigations, HMRC submissions, accounting and auditing, investment reviews Ash, company formations Ash, limited company accounting, employment law, tax preparation, HMRC submissions, PAYE, audit and compliance issues in Ash, accounting and financial advice, business outsourcing in Ash, double entry accounting, management accounts Ash, workplace pensions Ash, contractor accounts, pension forecasts, accounting services for buy to let property rentals, general accounting services, partnership accounts, business disposal and acquisition, VAT payer registration, assurance services Ash, accounting support services, charities Ash, partnership registration and other forms of accounting in Ash, Surrey. These are just a small portion of the duties that are undertaken by nearby accountants. Ash specialists will be happy to tell you about their full range of accounting services.

With the world wide web as a resource it is of course possible to uncover a host of useful information and ideas regarding small business accounting, auditing & accounting, personal tax assistance and self-assessment help. For instance, with a quick search we found this illuminating article outlining how to locate an accountant to fill in your annual tax return.

Ash Accounting Services

- Ash PAYE Healthchecks

- Ash Payroll Services

- Ash VAT Returns

- Ash Bookkeeping Healthchecks

- Ash Tax Refunds

- Ash Account Management

- Ash Auditing

- Ash Bookkeepers

- Ash Specialist Tax

- Ash Financial Advice

- Ash Tax Planning

- Ash Business Accounting

- Ash Forensic Accounting

- Ash Chartered Accountants

Also find accountants in: Ottershaw, Buckland, Deepcut, Weybridge, Burstow, Camelsdale, Runfold, Whiteley Village, Sutton, Brookwood, Oakwoodhill, Tongham, Charleshill, Felbridge, Alfold, Guildford, Grafham, St Johns, Walton On Thames, Newlands Corner, Chertsey, Tatsfield, Grayswood, Hindhead, Godstone, Forest Green, Horsell, Walton On The Hill, Shottermill, Abinger Common, Wotton, Reigate, Ash, Shere, Normandy and more.

Accountant Ash

Accountant Ash Accountants Near Ash

Accountants Near Ash Accountants Ash

Accountants AshMore Surrey Accountants: Walton-on-Thames, Godalming, Guildford, Banstead, Hersham, Redhill, Dorking, Caterham, Weybridge, Reigate, Woking, Molesey, Staines, Windlesham, Farnham, Chertsey, Haslemere, Esher, Ash, Addlestone, Sunbury-on-Thames, Cranleigh, Horley, Ewell, Camberley, Leatherhead and Epsom.

TOP - Accountants Ash - Financial Advisers

Chartered Accountant Ash - Auditing Ash - Self-Assessments Ash - Financial Advice Ash - Tax Advice Ash - Small Business Accountant Ash - Financial Accountants Ash - Online Accounting Ash - Affordable Accountant Ash