Accountants Clevedon: Does filling in your yearly self-assessment form give you a headache? You and countless other self-employed Clevedon people will have to deal with this every twelve months. You might prefer to obtain a local Clevedon accountant to accomplish this task for you. Is self-assessment a bit too complicated for you to do on your own? Regular small business accountants in Clevedon will probably charge approximately two to three hundred pounds for such a service. You will be able to get this done significantly cheaper by making use of one of the various online services.

You may be surprised to find that accountants don't just handle taxes, they have many duties. A local accountant who perfectly matches your requirements is the one you should be looking for. Accountants sometimes work on their own and sometimes as part of a much bigger company. Accountancy practices usually have specialists in each principal field of accounting. With an accountancy company you'll have a pick of: bookkeepers, auditors, management accountants, costing accountants, tax preparation accountants, financial accountants, forensic accountants, investment accountants, actuaries, accounting technicians and chartered accountants.

Therefore you should check that your chosen Clevedon accountant has the appropriate qualifications to do the job competently. Your minimum requirement should be an AAT qualified accountant. You can then have peace of mind knowing that your tax affairs are being handled professionally. You will of course get a tax deduction on the costs involved in preparing your tax returns.

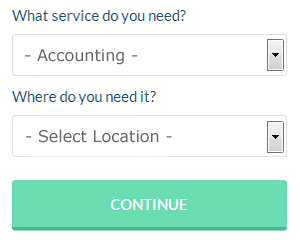

If you want to save time in your search for an accountant you could use a service like Bark which you can find online. Little is required other than ticking a few boxes on the search form. Just sit back and wait for the responses to roll in. Bark do not charge people looking for services.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. More accountants are offering this modern alternative. It would be advisable to investigate that any online company you use is reputable. Study reviews and customer feedback.

At the top of the tree are chartered accountants, these professionals have all the qualifications and are experts in their field. Bigger limited companies are more likely to use these high achievers. We have now outlined all of your available choices.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. The process can be simplified even further by the use of software such as GoSimple, Ajaccts, 123 e-Filing, ACCTAX, TaxCalc, CalCal, Sage, Xero, Nomisma, Taxfiler, Ablegatio, Andica, Basetax, Absolute Topup, Gbooks, Taxshield, Forbes, BTCSoftware, Capium, Keytime or Taxforward. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Forensic Accountant Clevedon

When you are on the lookout for an accountant in Clevedon you'll perhaps run into the term "forensic accounting" and wonder what the differences are between a regular accountant and a forensic accountant. The actual word 'forensic' is the thing that gives a clue, meaning basically "denoting or relating to the application of scientific methods and techniques to the investigation of a crime." Using investigative skills, accounting and auditing to discover inaccuracies in financial accounts that have contributed to fraud or theft, it is also occasionally called 'financial forensics' or 'forensic accountancy'. Some of the larger accountancy firms in and near to Clevedon even have specialised departments addressing falsified insurance claims, bankruptcy, money laundering, insolvency, professional negligence, personal injury claims and tax fraud. (Tags: Forensic Accounting Clevedon, Forensic Accountant Clevedon, Forensic Accountants Clevedon)

Payroll Services Clevedon

A vital aspect of any business enterprise in Clevedon, small or large, is having an efficient payroll system for its employees. The legislation regarding payrolls and the legal requirements for transparency and accuracy means that dealing with a company's payroll can be a daunting task.

Using a reliable accounting company in Clevedon, to deal with your payroll is a simple way to lessen the workload of your own financial team. A payroll accountant will work alongside HMRC, work with pensions providers and take care of BACS payments to make sure that your personnel are paid punctually, and that all required deductions are correct.

It will also be a requirement for a qualified payroll accountant in Clevedon to provide a P60 tax form for all personnel at the end of the financial year (by May 31st). They will also provide P45 tax forms at the end of a staff member's contract with your company.

How Money Management Helps with Self Improvement and Business

For many people, starting their own business has many advantages. One of the advantages is that they get to be in charge of their income. They're able to control just how much money they make and how much money they spend. Nonetheless, this aspect of business is something that people find overwhelming despite the fact that many of them have successfully used a budget in managing their personal finances. Don't worry, though, because there are a few things you can do to make sure you properly manage the financial side of your business. Today, we'll discuss a few tips on how you can be better at managing the money for your business.

Do you have many expenditures (e.g., membership dues, hosting, subscriptions)? If you do, you may be putting them all on your credit card. This can certainly help your memory because you only have one payment to make each month instead of several. However, it can be tricky to use credit cards for your business expenses because interest charges can accrue and you may end up paying more if you carry a balance each month. So if you want to keep it all on your bank account, you need to make sure that you pay off your credit card in full each month. With this money management strategy, you only have to keep track of one consolidated payment, not pay any interest, and build your credit rating.

Give your clients the choice to pay in installments. In addition to attracting more clients, it will guarantee you'll get a steady stream of income for your business. This is a lot better than having payments come in sporadically. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. You'll be a lot more confident about yourself if the financial side of your business is running smoothly.

Make sure you're prompt in paying your taxes. Typically, small businesses must pay taxes every quarter. When it comes to taxes, you want to make sure you have accurate information, so it's a good idea to consult with someone at the small business center in your town, city, or county or even with someone from the IRS. You can also seek the help of an accountant who specializes in small business accounting. He or she can ensure that you're following all the taxation laws as they relate to small businesses and that you're paying the right amount of taxes on time. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

Even if you don't have your own business, you'll still benefit from learning how to manage your money properly. As a business owner, you're a lot more likely to succeed if you know how much money your business is generating, how much money you're spending, and basically what's happening with your money. Try implementing the above tips in your business. In truth, if you want to improve yourself as you relate to your business, learning proper money management is crucial.

Clevedon accountants will help with estate planning Clevedon, accounting services for media companies, contractor accounts, payslips in Clevedon, VAT returns, company formations in Clevedon, payroll accounting in Clevedon, cashflow projections, litigation support, compliance and audit issues Clevedon, National Insurance numbers, corporate finance, bureau payroll services, financial statements, business outsourcing, debt recovery in Clevedon, partnership accounts, capital gains tax, accounting services for buy to let property rentals Clevedon, employment law, workplace pensions, HMRC submissions, small business accounting, accounting support services, corporation tax, HMRC submissions Clevedon, general accounting services, accounting services for the construction industry Clevedon, self-assessment tax returns Clevedon, accounting and auditing, financial planning, business advisory services and other professional accounting services in Clevedon, Somerset. Listed are just an example of the tasks that are carried out by local accountants. Clevedon providers will be happy to inform you of their full range of services.

You actually have the perfect resource right at your fingertips in the shape of the net. There's such a lot of inspiration and information readily available online for stuff like auditing & accounting, small business accounting, self-assessment help and personal tax assistance, that you will pretty quickly be knee-deep in ideas for your accounting needs. One example might be this fascinating article outlining how to find a top-notch accountant.

Clevedon Accounting Services

- Clevedon Bookkeeping

- Clevedon Tax Advice

- Clevedon VAT Returns

- Clevedon Business Accounting

- Clevedon PAYE Healthchecks

- Clevedon Tax Refunds

- Clevedon Self-Assessment

- Clevedon Tax Services

- Clevedon Debt Recovery

- Clevedon Specialist Tax

- Clevedon Personal Taxation

- Clevedon Tax Planning

- Clevedon Business Planning

- Clevedon Bookkeeping Healthchecks

Also find accountants in: Emborough, Norton St Philip, Saltford, Bathpool, Lansdown, Norton Malreward, Charlton Musgrove, Panborough, Dowlish Wake, Bramwell, Tatworth, Ubley, Hewish, Pill, Kingsdon, Monksilver, Thorne St Margaret, Keynsham, Blue Anchor, West Horrington, Rodney Stoke, Portishead, East Lydford, Stawell, Isle Abbotts, Wrantage, Carhampton, Claverham, Spaxton, Dunster, Coleford, Stoke Sub Hambon, Lattiford, Bridgetown, Stanton Prior and more.

Accountant Clevedon

Accountant Clevedon Accountants Near Me

Accountants Near Me Accountants Clevedon

Accountants ClevedonMore Somerset Accountants: Bristol, Portishead, Bath, Clevedon, Bridgwater, Nailsea, Keynsham, Frome, Weston-super-Mare, Yeovil, Burnham-on-Sea and Taunton.

TOP - Accountants Clevedon - Financial Advisers

Tax Accountants Clevedon - Tax Return Preparation Clevedon - Auditing Clevedon - Cheap Accountant Clevedon - Chartered Accountants Clevedon - Online Accounting Clevedon - Financial Accountants Clevedon - Small Business Accountants Clevedon - Financial Advice Clevedon