Accountants Ashington: For Ashington individuals who are self-employed or running a business, there are several benefits to be had from retaining the expert services of an accountant. Time consuming accounts paperwork and bookkeeping can be handed to your accountant, while you're left to focus your attention on your main business. Being able to access expert financial advice is even more important for newer businesses.

So, how should you set about obtaining an accountant in Ashington? Using your favourite internet search engine should quickly supply you with a list of possibles. However, it isn't always that easy to spot the good guys from the bad. You should never forget that anyone in Ashington can call themselves an accountant. They don't need a degree or even appropriate qualifications such as A Levels or BTEC's.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. The AAT qualification is the minimum you should look for. It is worth paying a little more for that extra peace of mind. You will be able to claim the cost of your accountant as a tax deduction.

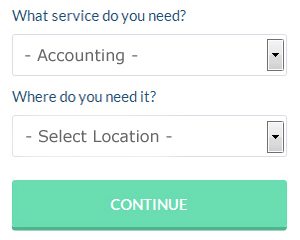

Though you may not have heard of them before there is an online service called Bark who can help you in your search. You only need to answer a few basic questions and complete a straightforward form. Then you just have to wait for some prospective accountants to contact you.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. You might find that this is simpler and more convenient for you. Even if you do decide to go down this route, take some time in singling out a trustworthy company. It is a good idea to check out customer reviews and testimonials, and those on an independent should be more reliable. Sorry but we cannot recommend any individual service on this website.

At the top of the tree are chartered accountants, these professionals have all the qualifications and are experts in their field. However, as a sole trader or smaller business in Ashington using one of these specialists may be a bit of overkill. So, these are your possible options.

At the end of the day you could always do it yourself and it will cost you nothing but time. Software programs like CalCal, Basetax, Nomisma, Absolute Topup, Forbes, Xero, Gbooks, TaxCalc, Andica, Taxshield, Sage, BTCSoftware, Ablegatio, Ajaccts, Capium, Keytime, Taxforward, GoSimple, Taxfiler, 123 e-Filing and ACCTAX have been developed to help the self-employed do their own tax returns. Make sure your tax returns are sent off promptly to avoid getting a penalty fine. Penalties are £100 for being 3 months late and an extra £10 per day after that, so don't be late.

Payroll Services Ashington

For any business in Ashington, from independent contractors to large scale organisations, payrolls for staff can be tricky. The legislation relating to payroll requirements for openness and accuracy mean that processing a company's payroll can be an intimidating task.

A small business might not have the advantage of a dedicated financial expert and the simplest way to deal with the issue of employee payrolls is to use an outside payroll company in Ashington. Working with HMRC and pension scheme administrators, a payroll accountant will also deal with BACS payments to personnel, ensuring they are paid promptly every month, and that all mandatory deductions are done accurately.

A dedicated payroll accountant in Ashington will also, in keeping with the current legislation, organise P60's at the end of the financial year for every staff member. They'll also provide P45 tax forms at the end of an employee's contract.

Auditors Ashington

Auditors are professionals who examine the accounts of businesses and organisations to check the validity and legality of their current financial reports. They also sometimes act as advisors to recommend possible the prevention of risk and the application of financial savings. To become an auditor, a person must be certified by the regulatory body of auditing and accounting or have earned certain specific qualifications.

Small Business Accountants Ashington

Operating a small business in Ashington is stressful enough, without having to fret about doing your accounts and similar bookkeeping duties. A decent small business accountant in Ashington will provide you with a hassle-free solution to keep your annual accounts, tax returns and VAT in perfect order.

Helping you to grow your business, and giving financial advice relating to your particular situation, are just two of the means by which a small business accountant in Ashington can benefit you. A quality accounting firm in Ashington should be able to offer proactive small business advice to maximise your tax efficiency while lowering costs; crucial in the sometimes shady world of business taxation.

It is essential that you explain your plans for the future, your company's financial circumstances and your business structure truthfully to your small business accountant.

Ashington accountants will help with National Insurance numbers, VAT payer registration, estate planning, year end accounts, employment law, PAYE Ashington, accounting support services, investment reviews, bookkeeping, limited company accounting, tax preparation, accounting services for property rentals, financial planning Ashington, bureau payroll services, consultancy and systems advice, consulting services, mergers and acquisitions Ashington, business planning and support Ashington, sole traders, double entry accounting Ashington, management accounts Ashington, accounting and financial advice, company formations, small business accounting, compliance and audit issues, business acquisition and disposal, self-employed registration Ashington, pension forecasts Ashington, financial statements in Ashington, accounting and auditing Ashington, general accounting services, business outsourcing and other accounting related services in Ashington, Northumberland. These are just a small portion of the activities that are performed by nearby accountants. Ashington specialists will tell you about their entire range of services.

Ashington Accounting Services

- Ashington Financial Advice

- Ashington Payroll Services

- Ashington Chartered Accountants

- Ashington Bookkeepers

- Ashington Auditing

- Ashington Bookkeeping Healthchecks

- Ashington Forensic Accounting

- Ashington VAT Returns

- Ashington Business Accounting

- Ashington Debt Recovery

- Ashington Specialist Tax

- Ashington Tax Returns

- Ashington Tax Refunds

- Ashington PAYE Healthchecks

Also find accountants in: Park End, Stamfordham, Shilbottle, Harlow Hill, West Chevington, Tranwell, Longwitton, Wingates, Wylam, Berrington, Cornhill On Tweed, Felkington, Lesbury, Highgreen Manor, Thropton, Branton, Goswick, Hedley On The Hill, Castle Heaton, Roddam, Ridsdale, Budle, Newton On The Moor, Longframlington, Newbiggin, Whitton, Shoresdean, Warton, Kirkheaton, Knowesgate, Ovingham, South Charlton, Hebron, Hartburn, Amble and more.

Accountant Ashington

Accountant Ashington Accountants Near Me

Accountants Near Me Accountants Ashington

Accountants AshingtonMore Northumberland Accountants: Bedlington, Cramlington, Ashington, Morpeth and Blyth.

TOP - Accountants Ashington - Financial Advisers

Financial Advice Ashington - Bookkeeping Ashington - Cheap Accountant Ashington - Tax Preparation Ashington - Auditors Ashington - Tax Advice Ashington - Small Business Accountants Ashington - Online Accounting Ashington - Self-Assessments Ashington