Accountants Great Baddow: Do you find that filling in your self-assessment form each year is a bit of a headache? This can be challenging for you and a multitude of other Great Baddow people in self-employment. But is there an easy way to find a local Great Baddow accountant to accomplish this task for you? Perhaps it is simply the case that self-assessment is too complicated for you to do on your own. You should expect to fork out about £200-£300 when using the services of a run-of-the-mill Great Baddow accountant or bookkeeper. If this sounds like a lot to you, then think about using an online service.

Now you will want to work out where to locate an accountant, what to expect, and how much will you have to pay? A long list of possible Great Baddow accountants can be found with one short search on the web. Though, making certain that you single out an accountant that you can trust might not be quite as straightforward. The fact that almost anybody in Great Baddow can set themselves up as an accountant is a thing that you need to bear in mind. They can work as accountants even if they don't have any qualifications. Which to most people would seem a little peculiar.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. Qualified accountants in Great Baddow might cost more but they will do a proper job. Your accountant will add his/her fees as tax deductable. Sole traders in Great Baddow may find that qualified bookkeepers are just as able to do their tax returns.

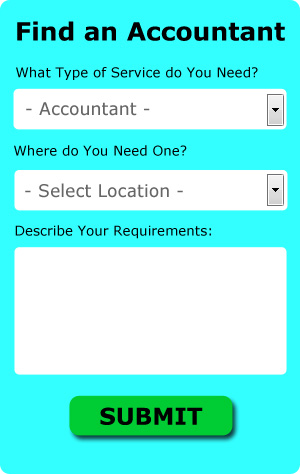

One online service which helps people like you find an accountant is Bark. Little is required other than ticking a few boxes on the search form. Your requirements will be distributed to accountants in the Great Baddow area and they will be in touch with you directly.

If you prefer the cheaper option of using an online tax returns service there are several available. Services like this are convenient and cost effective. Make a short list of such companies and do your homework to find the most reputable. A quick browse through some reviews online should give you an idea of the best and worse services.

At the other extreme of the accounting spectrum are chartered accountants, these highly trained professional are at the top of their game. While such specialists can deal with all aspects of finance, they may be over qualified for your modest needs. We have now outlined all of your available choices.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? Available software that will also help includes Basetax, Andica, Gbooks, Nomisma, Sage, Ablegatio, Absolute Topup, Taxforward, BTCSoftware, Capium, Keytime, TaxCalc, Forbes, ACCTAX, Xero, Taxfiler, CalCal, 123 e-Filing, Taxshield, Ajaccts and GoSimple. In any event the most important thing is to get your self-assessment set in before the deadline.

Self Improvement for Business Through Better Money Management

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. It is most difficult to make your business profitable because there are so many things that can take place along the way that will not just negatively affect your business but your confidence level as well. For example, failure on your part to properly manage your finances will contribute to this. Money management may not be something you've really given much thought too because figuring out your finances is pretty simple -- in the beginning stages of your business. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

Make sure you are numbering your invoices. This is something that a lot of business owners don't really think about but it can save you a lot of hassle down the road. Numbering your invoices helps you keep track of them. You're able to track people who still owe you and for how much and even quickly find out who have already paid. There are going to come times when a client will insist that he has paid you and having a numbered invoice to look up can be very helpful in that situation. Keep in mind that mistakes are bound to happen in business, but if you've got an invoicing system, no matter how simple it is, you'll be able to quickly find those mistakes and correct them should they happen.

Learn bookkeeping. Make sure you've got a system set up for your money, whether it's business or personal. You can do this simply by setting up a basic Excel spreadsheet or you could use bookkeeping software like Quicken or QuickBooks. In addition, you can make use of personal budgeting tools such as Mint.com. You'll find plenty of free resources on the internet that can help small business owners like you manage your books better. Keeping your books organized and up to date will help you understand your finances better. It's also a good idea to take a couple of classes on basic accounting and bookkeeping, particularly if you're not in a position yet to hire a bookkeeper full-time.

f your business deals with cash all the time, you're better off depositing money to your bank account at the end of each business day. Doing so will help you avoid being tempted to use any cash you have on hand for unnecessary expenses. You might need a few extra bucks to pay for lunch and you might think, "oh I'll put this back in a couple of days." But it's not hard at all to forget that you "owe" money to your business and if you do this often enough, your books are going to get all screwed up and you'll be wondering why the numbers don't add up. So when you close up shop at the end of each day, it's best if you deposit your cash to the bank each time.

There are many things you can do to help you manage your money the right way. Managing your money is not a basic skill or easy thing to learn. It's really a complicated process that requires constant learning and practicing, especially by small business owners. Keep in mind the tips we've mentioned in this article so you can properly keep track of your finances. One of the secrets to having a successful business is learning proper money management.

Great Baddow accountants will help with financial statements, corporation tax, inheritance tax, tax preparation, business acquisition and disposal, National Insurance numbers Great Baddow, assurance services, payroll accounting, bookkeeping, business advisory, general accounting services, accounting support services, year end accounts in Great Baddow, accounting services for landlords, mergers and acquisitions Great Baddow, payslips in Great Baddow, HMRC submissions in Great Baddow, PAYE Great Baddow, corporate finance in Great Baddow, VAT payer registration, capital gains tax in Great Baddow, personal tax in Great Baddow, partnership accounts, business support and planning, self-employed registration, business start-ups, tax investigations Great Baddow, bureau payroll services Great Baddow, employment law, litigation support, cashflow projections in Great Baddow, company formations Great Baddow and other forms of accounting in Great Baddow, Essex. These are just a selection of the tasks that are carried out by local accountants. Great Baddow specialists will be delighted to keep you abreast of their whole range of accounting services.

Great Baddow Accounting Services

- Great Baddow Tax Services

- Great Baddow Tax Refunds

- Great Baddow Financial Advice

- Great Baddow Tax Investigations

- Great Baddow Taxation Advice

- Great Baddow Account Management

- Great Baddow Audits

- Great Baddow Personal Taxation

- Great Baddow Self-Assessment

- Great Baddow VAT Returns

- Great Baddow Bookkeeping Healthchecks

- Great Baddow Debt Recovery

- Great Baddow Forensic Accounting

- Great Baddow PAYE Healthchecks

Also find accountants in: Theydon Bois, Bulmer Tye, Upper Green, Birdbrook, Gosfield, South Green, Dovercourt, Cornish Hall End, Barnston, West Tilbury, Church Langley, Lambourne End, Gambles Green, Walton On Naze, Little Easton, Norton Mandeville, Burnham On Crouch, Thorpe Bay, Mucking, East Horndon, Bournebridge, Middleton, Wimbish, Chrishall, Great Braxted, Baythorn End, White Colne, Dengie, Langdon Hills, Smiths Green, Loves Green, Hockley, Epping, Chipping Hill, Orsett and more.

Accountant Great Baddow

Accountant Great Baddow Accountants Near Me

Accountants Near Me Accountants Great Baddow

Accountants Great BaddowMore Essex Accountants: Rainham, Canvey Island, Corringham, Heybridge, Dagenham, Frinton-on-Sea, Hawkwell, Harwich, Parkeston, Walton-on-the-Naze, Chingford, Rochford, Hornchurch, Chafford Hundred, South Woodham Ferrers, Hadleigh, Brentwood, West Mersea, Tilbury, Maldon, Halstead, Stanford-le-Hope, Southminster, Saffron Walden, Witham, Burnham-on-Crouch, Holland-on-Sea, Hockley, Great Dunmow, Chipping Ongar, Manningtree, Coggeshall, Rayleigh, Laindon, West Thurrock, Stanway, Billericay, Wivenhoe, Waltham Abbey, Hullbridge, Purfleet, Langdon Hills, Westcliff-on-Sea, Upminster, Southend-on-Sea, Ingatestone, South Ockendon, South Benfleet, Wickford, Brightlingsea, Clacton-on-Sea, Stansted Mountfitchet, Chigwell, Harlow, Chelmsford, Shoeburyness, Barking, Leigh-on-Sea, Pitsea, Great Baddow, Epping, Galleywood, Great Wakering, Basildon, Braintree, Tiptree, Danbury, Buckhurst Hill, Writtle, Ilford, Colchester, Grays, Romford, Southchurch, North Weald Bassett and Loughton.

TOP - Accountants Great Baddow - Financial Advisers

Online Accounting Great Baddow - Self-Assessments Great Baddow - Financial Advice Great Baddow - Investment Accountant Great Baddow - Tax Advice Great Baddow - Bookkeeping Great Baddow - Chartered Accountants Great Baddow - Auditing Great Baddow - Financial Accountants Great Baddow