Accountants Guiseley: For those of you who are self-employed in Guiseley, a major nightmare each year is filling in your annual self-assessment form. This is a frequent problem for many others in Guiseley, West Yorkshire. But how can you find a local accountant in Guiseley to accomplish this task for you? Do you simply find self-assessment too challenging to do on your own? Regular accountants in Guiseley will generally charge about £200-£300 for this sort of service. You can definitely get it done cheaper by using online services.

There are plenty of accountants around, so you won't have that much trouble finding a good one. Finding a few local Guiseley accountants should be fairly simple with a short search on the net. But, are they all trustworthy? The sad truth is that anybody in Guiseley can advertise their services as an accountant. They don't need a degree or even appropriate qualifications like A Levels or BTEC's.

It is advisable for you to find an accountant in Guiseley who is properly qualified. Look for an AAT qualified accountant in the Guiseley area. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form.

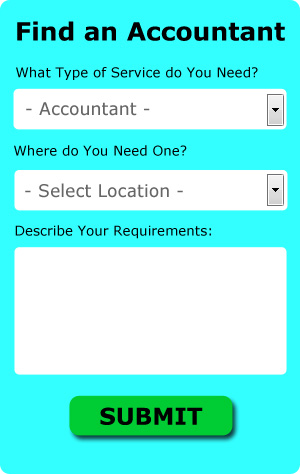

There is an online company called Bark who will do much of the work for you in finding an accountant in Guiseley. You only need to answer a few basic questions and complete a straightforward form. Just sit back and wait for the responses to roll in.

If you prefer the cheaper option of using an online tax returns service there are several available. This may save time and be more cost-effective for self-employed people in Guiseley. If you decide to go with this method, pick a company with a decent reputation. Check out some customer testimonials for companies you are considering. If you are looking for individual recommendations, this website is not the place to find them.

Although filling in your own tax return may seem too complicated, it is not actually that hard. To make life even easier there is some intuitive software that you can use. Including Taxforward, Capium, Taxfiler, Forbes, Basetax, Absolute Topup, Xero, Keytime, BTCSoftware, Nomisma, Andica, TaxCalc, Ablegatio, GoSimple, CalCal, Gbooks, Ajaccts, 123 e-Filing, Taxshield, ACCTAX and Sage. Whatever happens you need to get your self-assessment form in on time.

Auditors Guiseley

An auditor is a person or company appointed by an organisation or firm to undertake an audit, which is an official assessment of the financial accounts, typically by an impartial entity. They often also act as advisors to recommend potential risk prevention measures and the application of cost savings. For anyone to become an auditor they have to have certain specific qualifications and be approved by the regulating authority for accounting and auditing. (Tags: Auditing Guiseley, Auditors Guiseley, Auditor Guiseley)

Learning the Top Money Management Strategies for Business Success

The fact that you get to be completely in charge of your income is one of the good reasons to put up your own business. Then again, managing business finances isn't exactly a simple matter. In fact, even those who've successfully lived by sticking to a budget in their personal lives can have a tough time managing the finances of their business. Fortunately, you can do some things that will make it so much easier on you to manage your business finances. If you'd like to be able to manage your business funds, keep reading.

Hire an accountant. An accountant is well worth the business expense because she can manage your books for you full time. With an accountant on board, you can easily monitor your cash flow and more importantly pay the right amount of taxes you owe on time. You won't need to deal with the paperwork associated with these things; your accountant will deal with that for you. You, then, are free to concentrate on the other areas of building your business, like taking care of your clients, marketing, etc. The expense of having a business accountant is nothing compared to how much you'll save trying to figure out your finances and keeping everything in order.

You can help yourself by finding out how to keep your books. Make sure you've got a system set up for your money, whether it's business or personal. You can either use an Excel spreadsheet or invest in bookkeeping software such as QuickBooks and Quicken. In addition, you can make use of personal budgeting tools such as Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. Your books are the key to you knowing precisely how and where your money (personal and business) is being spent. And if you just can't afford to pay for a full-time bookkeeper for your small business, it'll serve you well to take a basic accounting and bookkeeping class at your community college.

Make sure you account for every penny your business brings in. Whenever a client or customer pays you, record that payment. This is important for two reasons: one, you need to know how much money you have coming in, and two, you need to be able to track who has paid you and who still needs to pay you. Tracking your income helps you figure out your taxes, how much to pay yourself, etc.

There are many things you can do to help you manage your money the right way. Proper management of business finances isn't merely a basic skill. It's actually a complex process that you need to keep developing as a small business owner. Hopefully, the tips we've shared in this article will help you get started in managing your finances better. If you want your business to be profitable, you need to stay on top of your finances.

Payroll Services Guiseley

For any business in Guiseley, from independent contractors to large scale organisations, dealing with staff payrolls can be tricky. The legislation regarding payroll for openness and accuracy mean that running a company's staff payroll can be an intimidating task for those not trained in this discipline.

A small business might not have the luxury of its own financial expert and the easiest way to deal with the issue of staff payrolls is to retain the services of an external payroll company in Guiseley. Working along with HMRC and pension scheme administrators, a payroll service accountant will also handle BACS payments to employees, making sure they are paid promptly each month, and that all required deductions are done accurately.

It will also be a requirement for a certified payroll accountant in Guiseley to provide a P60 declaration for all employees at the end of the financial year (by May 31st). At the end of a staff member's contract with your business, the payroll company must also provide a current P45 relating to the tax paid in the last financial period.

Guiseley accountants will help with accounting services for the construction industry, management accounts, charities, VAT returns, HMRC submissions, sole traders, consultancy and systems advice, HMRC submissions Guiseley, litigation support, tax preparation, business support and planning, contractor accounts, inheritance tax, self-employed registration, estate planning, investment reviews in Guiseley, bookkeeping, company secretarial services in Guiseley, corporate finance, financial planning, limited company accounting Guiseley, accounting services for start-ups, pension forecasts in Guiseley, assurance services in Guiseley, National Insurance numbers Guiseley, financial and accounting advice, tax investigations, self-assessment tax returns, accounting services for media companies, monthly payroll Guiseley, year end accounts Guiseley, corporate tax Guiseley and other professional accounting services in Guiseley, West Yorkshire. Listed are just some of the activities that are carried out by local accountants. Guiseley specialists will be happy to tell you about their entire range of services.

Guiseley Accounting Services

- Guiseley Tax Services

- Guiseley Forensic Accounting

- Guiseley Taxation Advice

- Guiseley Auditing Services

- Guiseley Tax Refunds

- Guiseley Business Accounting

- Guiseley Account Management

- Guiseley Tax Investigations

- Guiseley Tax Returns

- Guiseley PAYE Healthchecks

- Guiseley Payroll Management

- Guiseley Self-Assessment

- Guiseley Chartered Accountants

- Guiseley Specialist Tax

Also find accountants in: Linthwaite, Eldwick, Middleton, Aberford, Sandy Lane, Walsden, Denholme, Thorner, Kiddal Lane End, Holme, Thornton, Shelley, Austonley, Stainland, Woolley, Churwell, Highburton, Old Micklefield, Almondbury, Lane Head, Whitkirk, Alwoodley Park, Yeadon, Luddenden, Harden, Ravensthorpe, Rastrick, Shipley, Widdop, Lindley, Ackton, Boothtown, Garforth, Upton, Riddlesden and more.

Accountant Guiseley

Accountant Guiseley Accountants Near Me

Accountants Near Me Accountants Guiseley

Accountants GuiseleyMore West Yorkshire Accountants: Ilkley, Todmorden, Bradford, Garforth, Dewsbury, Horsforth, Holmfirth, Pudsey, Halifax, Yeadon, Liversedge, Normanton, Castleford, Huddersfield, Bingley, Rothwell, Otley, Morley, Mirfield, Brighouse, Wetherby, Leeds, Wakefield, Keighley, Pontefract, Batley, Knottingley, Cleckheaton, Baildon, Ossett, Heckmondwike, Guiseley, Elland, Shipley and Featherstone.

TOP - Accountants Guiseley - Financial Advisers

Chartered Accountant Guiseley - Bookkeeping Guiseley - Auditing Guiseley - Financial Accountants Guiseley - Small Business Accountant Guiseley - Cheap Accountant Guiseley - Self-Assessments Guiseley - Financial Advice Guiseley - Online Accounting Guiseley