Accountants Bingley: Have you found that filling in your self-assessment form every year gives you a headache? Other small businesses and sole traders in the Bingley area face the same predicament. Is it a much better idea to get someone else to do this task for you? This could be a better alternative for you if you find self-assessment a bit too taxing. This ought to cost you around £200-£300 if you use the services of an average Bingley accountant. Online accounting services are available more cheaply than this.

When looking for an accountant in Bingley, you'll find there are different kinds. Choosing one that dovetails neatly with your business is crucial. Whether you use an accountant working within a larger accounting practice or one who's working on their own is your choice to make. The good thing about accountancy practices is that they have many fields of expertise in one place. It is likely that financial accountants, accounting technicians, actuaries, investment accountants, tax preparation accountants, auditors, bookkeepers, chartered accountants, management accountants, forensic accountants and costing accountants will be available within an accountancy practice of any note.

It should be easy enough to track down an accountant who actually does have the relevant qualifications. Your minimum requirement should be an AAT qualified accountant. Qualified accountants in Bingley might cost more but they will do a proper job. Your accountant will add his/her fees as tax deductable.

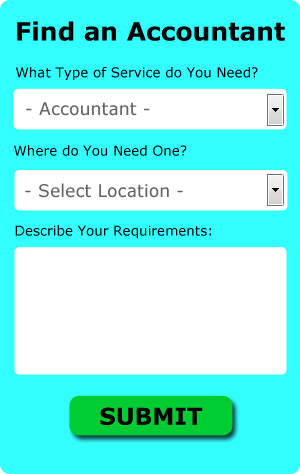

There is a unique online website called Bark which will actually find you a choice of accountants in the Bingley area. Filling in a clear and simple form is all that you need to do to set the process in motion. Your details will be sent out to potential accountants and they will contact you directly with details and prices. You will not be charged for this service.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. Over the last few years many more of these services have been appearing. Do a bit of research to find a reputable company. Study reviews and customer feedback. We feel it is not appropriate to list any individual services here.

Chartered accountants are the most qualified and highly trained individuals within the profession. These people are financial experts and are more commonly used by bigger companies. If you want the best person for your business this might be an option.

If you decide to bite the bullet and tackle the process by yourself there is lots of help on offer. You can take much of the hard graft out of this procedure by using a software program such as Ajaccts, BTCSoftware, Forbes, Absolute Topup, GoSimple, ACCTAX, Taxforward, Ablegatio, Sage, CalCal, Andica, Keytime, 123 e-Filing, Xero, Basetax, Nomisma, Taxfiler, Taxshield, TaxCalc, Capium or Gbooks. You'll receive a fine if your self-assessment is late. If you send in your tax return up to three months late, HMRC will fine you £100, after that it is an additional £10 per day.

Auditors Bingley

Auditors are specialists who examine the accounts of organisations and businesses to ascertain the validity and legality of their financial reports. They may also act in a consultative role to suggest potential the prevention of risk and the introduction of cost savings. For anyone to become an auditor they have to have specific qualifications and be accredited by the regulatory authority for accounting and auditing.

Financial Actuaries Bingley

An actuary assesses, offers advice on and manages financial risks. These risks can affect both sides of the balance sheet and require specialist asset management, valuation and liability management skills. Actuaries deliver reviews of financial security systems, with an emphasis on their mechanisms, their complexity and their mathematics.

Small Business Accountants Bingley

Making sure your accounts are accurate can be a demanding task for any small business owner in Bingley. Employing a small business accountant in Bingley will permit you to operate your business safe in the knowledge that your VAT, tax returns and annual accounts, and various other business tax requirements, are being fully met.

Giving advice, making sure that your business adheres to the best fiscal practices and suggesting strategies to help your business reach its full potential, are just some of the duties of a reputable small business accountant in Bingley. An accountancy firm in Bingley will provide you with a dedicated small business accountant and mentor who will clear the fog that shrouds the world of business taxation, in order to enhance your tax efficiency.

A small business accountant, to do their job properly, will have to know accurate details regarding your current financial situation, business structure and any potential investment that you might be considering, or already have put in place.

Bingley accountants will help with accounting services for start-ups in Bingley, consulting services, management accounts, tax investigations, corporate tax, investment reviews, VAT registrations in Bingley, payslips Bingley, capital gains tax, financial statements Bingley, business planning and support, year end accounts in Bingley, business outsourcing, cashflow projections, bookkeeping, accounting services for buy to let property rentals, assurance services in Bingley, inheritance tax in Bingley, consultancy and systems advice in Bingley, business acquisition and disposal in Bingley, VAT returns, small business accounting in Bingley, self-assessment tax returns Bingley, partnership accounts, mergers and acquisitions Bingley, audit and compliance issues, retirement advice Bingley, employment law in Bingley, financial planning, bureau payroll services Bingley, contractor accounts, accounting and financial advice and other accounting services in Bingley, West Yorkshire. Listed are just a small portion of the tasks that are carried out by nearby accountants. Bingley companies will keep you informed about their full range of accountancy services.

You do, of course have the best resource close at hand in the shape of the net. There's so much information and inspiration readily available online for things like self-assessment help, accounting for small businesses, personal tax assistance and accounting & auditing, that you will very soon be knee-deep in suggestions for your accounting needs. An illustration might be this article detailing how to obtain an accountant to do your yearly tax return.

Bingley Accounting Services

- Bingley Tax Services

- Bingley Bookkeeping Healthchecks

- Bingley Payroll Management

- Bingley Debt Recovery

- Bingley Self-Assessment

- Bingley Tax Advice

- Bingley PAYE Healthchecks

- Bingley Chartered Accountants

- Bingley Specialist Tax

- Bingley Business Accounting

- Bingley Personal Taxation

- Bingley Bookkeepers

- Bingley Tax Returns

- Bingley Tax Planning

Also find accountants in: Carlton, Pool, Grange Moor, Rothwell, Newton, Middleton, East Rigton, Fitzwilliam, Ledston, South Elmsall, Birkenshaw, Todmorden, Robin Hood, Whitwood, Ilkley, Thornhill, Kirkheaton, Cornholme, Castleford, East Ardsley, East Morton, Oakworth, Upperthong, Greetland, Kirkburton, Churwell, Morley, Thorpe On The Hill, Heckmondwike, Ackworth Moor Top, Kiddal Lane End, West Garforth, Holme, New Farnley, Shipley and more.

Accountant Bingley

Accountant Bingley Accountants Near Me

Accountants Near Me Accountants Bingley

Accountants BingleyMore West Yorkshire Accountants: Heckmondwike, Morley, Normanton, Ossett, Garforth, Castleford, Halifax, Holmfirth, Ilkley, Bingley, Huddersfield, Cleckheaton, Todmorden, Otley, Rothwell, Wakefield, Yeadon, Elland, Batley, Liversedge, Mirfield, Leeds, Guiseley, Horsforth, Knottingley, Dewsbury, Bradford, Wetherby, Keighley, Featherstone, Shipley, Brighouse, Baildon, Pudsey and Pontefract.

TOP - Accountants Bingley - Financial Advisers

Small Business Accountant Bingley - Online Accounting Bingley - Self-Assessments Bingley - Tax Preparation Bingley - Affordable Accountant Bingley - Chartered Accountant Bingley - Financial Accountants Bingley - Tax Accountants Bingley - Bookkeeping Bingley