Accountants Crowthorne: Having an accountant at hand can be very beneficial to anyone running a business or being self-employed in Crowthorne. Most significantly you will have more time to focus on your core business operations, while your accountant deals with such things as annual tax returns and bookkeeping. This form of financial help is essential for any business, but is particularly helpful for start-up businesses. Having easy access to this type of professional assistance should permit you to develop your Crowthorne business.

Crowthorne accountants come in many forms and types. Locating one that meets your specific needs should be a priority. Yet another decision that you'll have to make is whether to go for an accounting firm or a lone wolf accountant. An accountancy firm will include accountants with varying fields of expertise. The main positions that will be covered by an accountancy practice include: financial accountants, accounting technicians, forensic accountants, investment accountants, costing accountants, bookkeepers, auditors, tax preparation accountants, management accountants, chartered accountants and actuaries.

Therefore you shouldn't go with the first accountant that you find, take care and choose one with the right qualifications. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. Qualified accountants in Crowthorne might cost more but they will do a proper job. Remember that a percentage of your accounting costs can be claimed back on the tax return.

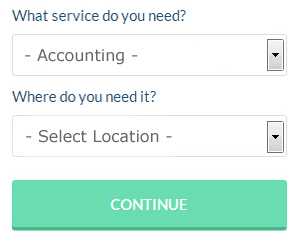

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Crowthorne accountant. You'll be presented with a simple form which can be completed in a minute or two. Your details will be sent out to potential accountants and they will contact you directly with details and prices. At the time of writing this service was totally free.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. It could be that this solution will be more appropriate for you. You still need to do your homework to pick out a company you can trust. The easiest way to do this is by studying online reviews.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are CalCal, 123 e-Filing, Sage, Absolute Topup, Basetax, Capium, Xero, Taxfiler, Ablegatio, Keytime, ACCTAX, Andica, TaxCalc, GoSimple, Gbooks, Taxshield, Nomisma, Taxforward, BTCSoftware, Forbes and Ajaccts. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time. A £100 fine is levied for late self-assessments up to 3 months, more if later.

Payroll Services Crowthorne

A vital part of any business in Crowthorne, big or small, is having a reliable payroll system for its workers. The laws relating to payroll requirements for accuracy and transparency mean that running a business's payroll can be a daunting task for those not trained in this discipline.

A small business may well not have the luxury of an in-house financial expert and the simplest way to cope with staff payrolls is to employ an outside accountant in Crowthorne. Your chosen payroll service company can provide accurate BACS payments to your staff, as well as working with any pension scheme administrators that your business may have, and follow the latest HMRC regulations for NI contributions and deductions.

Abiding by current regulations, a certified payroll accountant in Crowthorne will also present every one of your staff members with a P60 tax form after the end of each fiscal year. A P45 must also be given to any member of staff who finishes working for the business, in accordance with current regulations.

Crowthorne accountants will help with VAT returns, partnership accounts Crowthorne, financial and accounting advice, VAT payer registration, charities Crowthorne, accounting services for start-ups, company formations Crowthorne, business acquisition and disposal, sole traders, debt recovery, accounting support services in Crowthorne, pension forecasts, bookkeeping, accounting services for buy to let property rentals, personal tax in Crowthorne, taxation accounting services, financial planning in Crowthorne, small business accounting, National Insurance numbers, investment reviews in Crowthorne, monthly payroll, business advisory, audit and compliance reports Crowthorne, consultancy and systems advice, consulting services Crowthorne, inheritance tax in Crowthorne, tax investigations, accounting services for the construction sector, cashflow projections Crowthorne, bureau payroll services Crowthorne, company secretarial services, auditing and accounting and other professional accounting services in Crowthorne, Berkshire. Listed are just a few of the activities that are handled by nearby accountants. Crowthorne companies will be happy to inform you of their entire range of accounting services.

Crowthorne Accounting Services

- Crowthorne Self-Assessment

- Crowthorne Bookkeeping

- Crowthorne VAT Returns

- Crowthorne Tax Services

- Crowthorne Payroll Services

- Crowthorne Business Accounting

- Crowthorne Specialist Tax

- Crowthorne Personal Taxation

- Crowthorne Financial Audits

- Crowthorne Tax Refunds

- Crowthorne Forensic Accounting

- Crowthorne Audits

- Crowthorne Tax Advice

- Crowthorne Chartered Accountants

Also find accountants in: Finchampstead, Furze Platt, Chaddleworth, Chieveley, Winkfield Row, Bray, Spital, Twyford, Wraysbury, Cranbourne, Ashampstead, Poyle, North Ascot, Beech Hill, Burchetts Green, Stanford Dingley, Datchet, Englefield, Burleigh, Tilehurst, Burghfield Hill, Cookham Dean, Great Shefford, South Fawley, Sandhurst, Spencers Wood, Crazies Hill, Coln Brook, Littlewick Green, Upton, Pangbourne, Whistley Green, Halfway, Hurley Bottom, Sheffield Bottom and more.

Accountant Crowthorne

Accountant Crowthorne Accountants Near Me

Accountants Near Me Accountants Crowthorne

Accountants CrowthorneMore Berkshire Accountants: Maidenhead, Sunninghill, Ascot, Windsor, Bracknell, Tilehurst, Twyford, Finchampstead, Newbury, Wokingham, Thatcham, Reading, Crowthorne, Sandhurst, Winkfield, Slough and Woodley.

TOP - Accountants Crowthorne - Financial Advisers

Online Accounting Crowthorne - Financial Advice Crowthorne - Financial Accountants Crowthorne - Tax Advice Crowthorne - Self-Assessments Crowthorne - Auditors Crowthorne - Bookkeeping Crowthorne - Tax Return Preparation Crowthorne - Investment Accounting Crowthorne