Accountants Sutton Coldfield: Having a qualified accountant deal with your finances brings several benefits to anyone operating a business in Sutton Coldfield or for that matter anywhere else in Great Britain. At the minimum your accountant can handle important tasks like doing your tax returns and keeping your books up to date, giving you more hours to concentrate on your business. Being able to access professional financial advice is even more important for newer businesses. The wellbeing and prosperity of your business in Sutton Coldfield could be influenced by you getting the appropriate help and advice.

When hunting for an accountant in Sutton Coldfield, you'll find that there are different kinds. Therefore, ensure you choose one that matches your requirements perfectly. It's not unusual for Sutton Coldfield accountants to work independently, others favour being part of a larger accountancy firm. Each field of accounting will have their own experts within an accounting company. You should be able to find an accounting firm offering management accountants, investment accountants, chartered accountants, actuaries, accounting technicians, forensic accountants, financial accountants, auditors, costing accountants, tax accountants and bookkeepers.

Therefore you should check that your chosen Sutton Coldfield accountant has the appropriate qualifications to do the job competently. Ask if they at least have an AAT qualification or higher. You can then have peace of mind knowing that your tax affairs are being handled professionally. It should go without saying that accountants fees are tax deductable. Only larger Limited Companies are actually required by law to use a trained accountant.

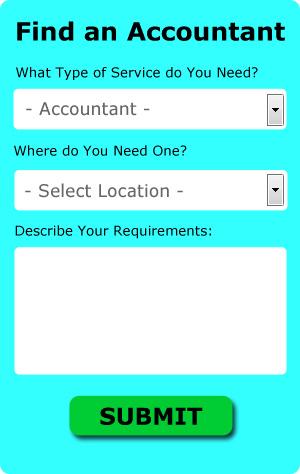

There is an online company called Bark who will do much of the work for you in finding an accountant in Sutton Coldfield. Tick a few boxes on their form and submit it in minutes. Within a few hours you should hear from some local accountants who are willing to help you. Bark do not charge people looking for services.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. This may save time and be more cost-effective for self-employed people in Sutton Coldfield. Don't simply go with the first company you find on Google, take time to do some research. A quick browse through some reviews online should give you an idea of the best and worse services. This is something you need to do yourself as we do not wish to favour any particular service here.

If you are prepared to slash out and really get the best, you would be looking at using a chartered accountant for your finances. Larger companies in the Sutton Coldfield area may choose to use their expert services. Hiring the services of a chartered accountant means you will have the best that money can buy.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example CalCal, Capium, Keytime, Absolute Topup, 123 e-Filing, Basetax, Sage, Ajaccts, ACCTAX, Taxfiler, Forbes, BTCSoftware, Xero, Nomisma, Ablegatio, GoSimple, Taxforward, Taxshield, Gbooks, TaxCalc and Andica. You'll receive a fine if your self-assessment is late.

The Best Money Management Techniques for Business Self Improvement

One of the things that every small business owner struggles with is managing money properly, and this is especially true in the beginning, when you are just trying to find your feet as a business runner and proprietor. Your confidence can plummet if you fail to manage your money properly. If your business experience cash flow problems, you might find yourself thinking about throwing in the towel and going back to your old job. You won't reach the level of success you're aiming to reach when this happens. Below are a few tips that will help manage your business finances better.

Implement a numbering system for your invoices. This may not be that big of a deal to you right now, but you'll thank yourself later on if you implement this tip early on in your business. It makes it easy to track invoices if you have them numbered. You'll be able to easily track who has paid you and who still owes you. It will help you verify claims by clients who insist they've already paid up if you have a numbering system in place for your invoice. Remember, it is possible to make errors and numbering your invoices is a simple way to help find them when they happen.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. How much should you pay yourself? It's up to you. Your salary can be a portion of how much your business brought in for the month or it can be based on how many hours you worked.

Take control of your spending. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. You'll also be able to save money on office supplies if you buy in bulk. For computers, it's better if you spend money on a more expensive, but reliable system that will last for many years and won't need replaced every so often. Avoid spending too much on your entertainment as well; be moderate instead.

When you know the right way to manage your finances, you can expect not just your business to improve but yourself overall as well. Try to implement these tips we've shared because you stand to benefit in the long run. You're in a much better position for business and personal success when you know how to manage your finances better.

Auditors Sutton Coldfield

Auditors are experts who examine the fiscal accounts of organisations and companies to substantiate the validity and legality of their financial records. They sometimes also take on a consultative role to recommend potential risk prevention measures and the implementation of cost efficiency. To act as an auditor, an individual should be approved by the regulatory body for accounting and auditing and have achieved specific qualifications. (Tags: Auditing Sutton Coldfield, Auditor Sutton Coldfield, Auditors Sutton Coldfield)

Payroll Services Sutton Coldfield

An important component of any business enterprise in Sutton Coldfield, big or small, is having an effective payroll system for its employees. The legislation regarding payrolls and the legal obligations for transparency and accuracy means that dealing with a business's payroll can be an intimidating task.

A small business might not have the advantage of a dedicated financial expert and an easy way to cope with employee payrolls is to use an independent payroll company in Sutton Coldfield. A payroll accountant will work alongside HMRC, with pensions schemes and take care of BACS payments to ensure your employees are paid on time, and all required deductions are correct.

A qualified payroll accountant in Sutton Coldfield will also, as outlined by current legislations, provide P60's after the end of the financial year for each of your workers. A P45 form should also be given to any member of staff who finishes working for your company, as outlined by current regulations. (Tags: Company Payrolls Sutton Coldfield, Payroll Accountants Sutton Coldfield, Payroll Services Sutton Coldfield).

Forensic Accountant Sutton Coldfield

Whilst conducting your search for a professional accountant in Sutton Coldfield there's a good chance that you'll stumble upon the phrase "forensic accounting" and be curious about what it is, and how it differs from standard accounting. The word 'forensic' is the thing that gives a clue, meaning literally "appropriate for use in a law court." Also called 'forensic accountancy' or 'financial forensics', it uses auditing, accounting and investigative skills to identify inaccuracies in financial accounts which have contributed to fraud or theft. There are even a few bigger accountants firms in West Midlands who have specialist divisions for forensic accounting, addressing money laundering, professional negligence, insolvency, insurance claims, bankruptcy, tax fraud and personal injury claims.

Sutton Coldfield accountants will help with company formations, limited company accounting Sutton Coldfield, business support and planning, employment law in Sutton Coldfield, management accounts Sutton Coldfield, tax preparation, audit and compliance reporting in Sutton Coldfield, litigation support, self-employed registrations, estate planning, inheritance tax, company secretarial services, tax returns in Sutton Coldfield, National Insurance numbers, debt recovery, workplace pensions Sutton Coldfield, accounting services for the construction sector, payslips, investment reviews, HMRC submissions, bookkeeping, financial planning, pension forecasts, small business accounting Sutton Coldfield, business acquisition and disposal, taxation accounting services, accounting services for media companies in Sutton Coldfield, bureau payroll services Sutton Coldfield, business outsourcing Sutton Coldfield, accounting services for start-ups, PAYE, charities and other kinds of accounting in Sutton Coldfield, West Midlands. Listed are just a selection of the activities that are handled by nearby accountants. Sutton Coldfield professionals will let you know their entire range of accounting services.

You do, of course have the very best resource right at your fingertips in the form of the world wide web. There's such a lot of inspiration and information readily available online for things like auditing & accounting, small business accounting, self-assessment help and personal tax assistance, that you will very quickly be knee-deep in ideas for your accounting needs. A good example may be this compelling article describing 5 tips for locating an excellent accountant.

Sutton Coldfield Accounting Services

- Sutton Coldfield Bookkeeping

- Sutton Coldfield Bookkeeping Healthchecks

- Sutton Coldfield PAYE Healthchecks

- Sutton Coldfield Business Accounting

- Sutton Coldfield Forensic Accounting

- Sutton Coldfield Taxation Advice

- Sutton Coldfield Tax Planning

- Sutton Coldfield Business Planning

- Sutton Coldfield Specialist Tax

- Sutton Coldfield Payroll Services

- Sutton Coldfield Account Management

- Sutton Coldfield Chartered Accountants

- Sutton Coldfield Tax Returns

- Sutton Coldfield Tax Refunds

Also find accountants in: Oxley, Bloxwich, Hay Mills, Knowle, Aldridge, Bradmore, Stourbridge, Kings Heath, Hasbury, Chad Valley, Ettingshall, Solihull, Smethwick, Dudley, Longford, Netherton, Stoke, Erdington, Northfield, Elmdon, Great Barr, Tipton, Old Hill, Tyburn, Four Oaks, Vigo, Walsgrave On Sowe, Moseley, Quinton, Bentley Heath, Wergs, South Yardley, Blakenhall, Bradley, Berkswell and more.

Accountant Sutton Coldfield

Accountant Sutton Coldfield Accountants Near Me

Accountants Near Me Accountants Sutton Coldfield

Accountants Sutton ColdfieldMore West Midlands Accountants: Bloxwich, Kingswinford, Oldbury, Sutton Coldfield, Coseley, Coventry, Sedgley, Wednesbury, Birmingham, Halesowen, West Bromwich, Darlaston, Bilston, Solihull, Dudley, Aldridge, Walsall, Stourbridge, Willenhall, Wednesfield, Brownhills, Blackheath, Wolverhampton, Rowley Regis, Smethwick, Brierley Hill and Tipton.

TOP - Accountants Sutton Coldfield - Financial Advisers

Affordable Accountant Sutton Coldfield - Financial Accountants Sutton Coldfield - Financial Advice Sutton Coldfield - Small Business Accountant Sutton Coldfield - Self-Assessments Sutton Coldfield - Tax Preparation Sutton Coldfield - Bookkeeping Sutton Coldfield - Investment Accounting Sutton Coldfield - Chartered Accountant Sutton Coldfield