Accountants Gatley: Anybody operating a business in Gatley, Greater Manchester will soon realise that there are many advantages to having an accountant at the end of the phone. Bookkeeping takes up precious time that you cannot afford to waste, so having an accountant deal with this allows you to put more effort into the primary business. The benefits of this type of professional help far overshadows the additional costs involved. You might find that you need this help more as your Gatley business expands.

Gatley accountants are available in many forms and types. Therefore, picking the right one for your company is important. You may have the choice of an accountant who works within a bigger accounting firm or one who works for themselves. Within an accounting practice there will be specialists in distinct areas of accounting. It's likely that bookkeepers, cost accountants, tax preparation accountants, chartered accountants, auditors, forensic accountants, accounting technicians, investment accountants, financial accountants, management accountants and actuaries will be available within an accounting company of any note.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. For basic tax returns an AAT qualified accountant should be sufficient. Qualified accountants in Gatley might cost more but they will do a proper job. Your accountant's fees are tax deductable.

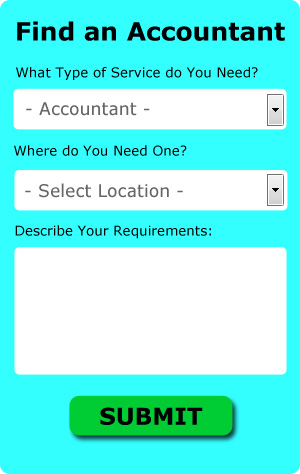

One online service which helps people like you find an accountant is Bark. Little is required other than ticking a few boxes on the search form. As soon as this form is submitted, your requirements will be forwarded to local accountants. Try this free service because you've got nothing to lose.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. Over the last few years many more of these services have been appearing. Make a short list of such companies and do your homework to find the most reputable. Check out some customer testimonials for companies you are considering.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. Software is also available to make doing your self-assessment even easier. Some of the best ones include Forbes, 123 e-Filing, Taxforward, Nomisma, Ablegatio, Absolute Topup, Taxfiler, Capium, Andica, TaxCalc, Sage, Ajaccts, Gbooks, Xero, ACCTAX, CalCal, Taxshield, GoSimple, BTCSoftware, Keytime and Basetax. Getting your self-assessment form submitted on time is the most important thing.

Forensic Accounting Gatley

You could well encounter the phrase "forensic accounting" when you are searching for an accountant in Gatley, and will doubtless be interested to know about the difference between forensic accounting and normal accounting. The hint for this is the actual word 'forensic', which essentially means "relating to or denoting the application of scientific methods and techniques to the investigation of crime." Also known as 'forensic accountancy' or 'financial forensics', it uses auditing, investigative skills and accounting to discover inconsistencies in financial accounts which have lead to fraud or theft. A few of the bigger accounting firms in the Gatley area might even have specialist forensic accounting departments with forensic accountants focusing on certain sorts of fraud, and may be dealing with tax fraud, personal injury claims, bankruptcy, money laundering, insurance claims, professional negligence and insolvency.

How to Manage Your Finances Better If Your a Small Business Owner

Whether you're starting up an online or offline business, it can be one of the most exciting things you'd ever do. When you're a business owner, you're your own boss and in control of your income. It's a bit scary, isn't it? Truly, while exhilarating, starting your own business is also quite intimidating because it can be quite difficult to find your feet. It then pays to be aware of a few self-improvement strategies like knowing how to manage finances the proper way. So if you wish to know how you can manage your money correctly, keep reading.

Find yourself an accountant who's competent. Don't neglect the importance of having an accountant managing your books full time. There are many things that an accountant can help you with, including keeping track of your cash flow, paying yourself, and meeting your tax obligations. You won't need to deal with the paperwork associated with these things; your accountant will deal with that for you. What happens is that you can focus more on building your business, including marketing and getting more clients. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

Offer your clients payment plans. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. Having payments come in regularly even if they aren't in huge amounts is certainly so much better than getting big payments irregularly. When you have reliable income, you're better able to budget, pay your bills, and manage your money overall. This can certainly boost your self-confidence.

If you deal with cash in any capacity, make sure that you deposit that cash every day, as keeping cash on hand is just too tempting. It could be that you need cash when you're out for lunch and you end up getting money from your register and telling yourself you'll return the money later. But it's not hard at all to forget that you "owe" money to your business and if you do this often enough, your books are going to get all screwed up and you'll be wondering why the numbers don't add up. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

When you know the right way to manage your finances, you can expect not just your business to improve but yourself overall as well. You'll benefit a great deal if you remember and put these tips we've shared to use. You're much more likely to experience business and personal success when you have your finances under control.

Small Business Accountants Gatley

Doing the accounts and bookkeeping can be a fairly stressful experience for any small business owner in Gatley. Using the services of a small business accountant in Gatley will permit you to run your business knowing that your tax returns, annual accounts and VAT, amongst many other business tax requirements, are being met.

Offering guidance, ensuring that your business follows the best fiscal practices and providing strategies to help your business achieve its full potential, are just some of the duties of an experienced small business accountant in Gatley. The vagaries and sometimes complex world of business taxation will be clearly laid out for you so as to reduce your business expenses, while maximising tax efficiency.

It is also crucial that you explain your company's circumstances, your future plans and the structure of your business accurately to your small business accountant. (Tags: Small Business Accounting Gatley, Small Business Accountant Gatley, Small Business Accountants Gatley).

Auditors Gatley

An auditor is an individual or a firm appointed by a company or organisation to complete an audit, which is an official examination of the accounts, normally by an impartial entity. They also sometimes act as consultants to suggest possible risk prevention measures and the application of financial savings. Auditors have to be certified by the regulatory authority for auditing and accounting and also have the necessary accounting qualifications.

Actuary Gatley

An actuary manages, measures and advises on financial risks. An actuary uses financial and statistical theories to evaluate the possibility of a certain event happening and the potential monetary ramifications. An actuary uses statistics and mathematics to determine the financial effect of uncertainties and help their clientele minimize potential risks.

Gatley accountants will help with HMRC submissions Gatley, payslips, consultancy and systems advice, tax preparation in Gatley, year end accounts Gatley, limited company accounting Gatley, VAT registrations, partnership registrations Gatley, business advisory in Gatley, financial planning, corporate finance, partnership accounts, accounting and auditing in Gatley, monthly payroll, business outsourcing, accounting services for buy to let rentals Gatley, business support and planning in Gatley, consulting services, mergers and acquisitions, business start-ups, corporation tax Gatley, accounting services for the construction industry, company formations in Gatley, charities, assurance services in Gatley, self-employed registrations Gatley, workplace pensions Gatley, personal tax, accounting support services, small business accounting Gatley, company secretarial services, contractor accounts Gatley and other types of accounting in Gatley, Greater Manchester. These are just an example of the duties that are conducted by local accountants. Gatley specialists will be happy to inform you of their full range of accountancy services.

Gatley Accounting Services

- Gatley Business Accounting

- Gatley Specialist Tax

- Gatley Self-Assessment

- Gatley Account Management

- Gatley Financial Advice

- Gatley VAT Returns

- Gatley Business Planning

- Gatley Payroll Services

- Gatley Tax Services

- Gatley Tax Refunds

- Gatley Debt Recovery

- Gatley Tax Returns

- Gatley Personal Taxation

- Gatley PAYE Healthchecks

Also find accountants in: Harpurhey, Red Rock, Gatley, Romiley, Fishpool, Gathurst, Irlam, Hollins, Offerton, Pendlebury, Flixton, Hollingworth, Marple, Broughton, Syke, Lane Head, Bleak Hey Nook, Heaton Moor, Smallbridge, Sale, Harwood, Prestolee, Mellor, Heyside, Slattocks, Horwich, Heald Green, Whitefield, Delph, Micklehurst, Middleton, Firgrove, Hindley Green, Hale, Rochdale and more.

Accountant Gatley

Accountant Gatley Accountants Near Gatley

Accountants Near Gatley Accountants Gatley

Accountants GatleyMore Greater Manchester Accountants: Leigh, Dukinfield, Stretford, Heywood, Atherton, Hindley, Salford, Urmston, Rochdale, Oldham, Royton, Denton, Swinton, Altrincham, Golborne, Bury, Gatley, Wigan, Eccles, Hyde, Westhoughton, Stalybridge, Manchester, Romiley, Ashton-under-Lyne, Stockport, Middleton, Irlam, Farnworth, Walkden, Sale, Whitefield, Horwich, Droylsden, Chadderton, Bolton, Radcliffe, Ashton-in-Makerfield and Cheadle Hulme.

TOP - Accountants Gatley - Financial Advisers

Financial Accountants Gatley - Auditors Gatley - Online Accounting Gatley - Small Business Accountants Gatley - Chartered Accountant Gatley - Investment Accounting Gatley - Cheap Accountant Gatley - Financial Advice Gatley - Bookkeeping Gatley