Accountants Aylesford: If you're running a business, are a sole trader or are otherwise self-employed in Aylesford, you will find great advantages to having access your own accountant. By handling key tasks such as payroll, tax returns and bookkeeping your accountant can at the minimum free up some time for you to focus on your core business. The importance of having a qualified accountant by your side cannot be exaggerated. If your Aylesford business is to grow and prosper you'll find this expertise more and more essential.

So, exactly what should you be looking for in an accountant and how much should you pay for this kind of service? An internet search engine will pretty quickly highlight a substantial list of potential candidates in Aylesford. Knowing just who you can trust is of course not quite as easy. The sad truth is that anyone in Aylesford can promote their services as an accountant. They don't need to have any specific qualifications.

Therefore you should check that your chosen Aylesford accountant has the appropriate qualifications to do the job competently. For basic tax returns an AAT qualified accountant should be sufficient. Qualified accountants in Aylesford might cost more but they will do a proper job. Remember that a percentage of your accounting costs can be claimed back on the tax return.

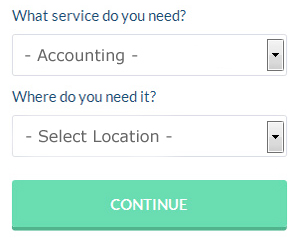

There is a unique online website called Bark which will actually find you a choice of accountants in the Aylesford area. You will quickly be able to complete the form and your search will begin. As soon as this form is submitted, your requirements will be forwarded to local accountants.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. Services like this are convenient and cost effective. There is no reason why this type of service will not prove to be as good as your average High Street accountant. It should be a simple task to find some online reviews to help you make your choice. We feel it is not appropriate to list any individual services here.

If you really want the best you could go with a chartered accountant. These high achievers will hold qualifications like an ACA or an ICAEW. So, these are your possible options.

In the final analysis you may decide to do your own tax returns. To make life even easier there is some intuitive software that you can use. Including Sage, Andica, CalCal, Ajaccts, Taxforward, Keytime, Gbooks, Nomisma, GoSimple, Xero, ACCTAX, Capium, Ablegatio, Forbes, BTCSoftware, Taxshield, Basetax, TaxCalc, 123 e-Filing, Absolute Topup and Taxfiler. You should get paperwork to your accountant promptly so that your tax returns can be prepared with time to spare.

Small Business Accountants Aylesford

Operating a small business in Aylesford is pretty stressful, without having to worry about preparing your accounts and other similar bookkeeping duties. A focused small business accountant in Aylesford will provide you with a hassle-free solution to keep your tax returns, annual accounts and VAT in perfect order.

Giving advice, ensuring that your business adheres to the optimum fiscal practices and suggesting strategies to help your business achieve its full potential, are just a sample of the responsibilities of an experienced small business accountant in Aylesford. The vagaries and sometimes complex world of business taxation will be clearly explained to you in order to minimise your business costs, while at the same time maximising tax efficiency.

You also ought to be offered a dedicated accountancy manager who has a good understanding of your plans for the future, the structure of your business and your company's situation.

Actuary Aylesford

Analysts and actuaries are professionals in the management of risk. Actuaries apply their mathematical expertise to estimate the risk and probability of future happenings and to calculate their impact on a business and it's clients. Actuaries provide evaluations of financial security systems, with a focus on their mathematics, their complexity and their mechanisms.

Auditors Aylesford

An auditor is an individual or company brought in by a firm or organisation to carry out an audit, which is an official inspection of the accounts, usually by an independent entity. They offer businesses from fraud, illustrate inconsistencies in accounting techniques and, now and again, work as consultants, helping organisations to identify ways to boost operational efficiency. To become an auditor, a person has to be accredited by the regulating authority of accounting and auditing or possess certain qualifications.

Boost Your Confidence and Your Business By Learning Better Money Management

Deciding to start your own business is easy, but knowing how to start your own business is hard and actually getting your small business up and running is even harder. It is most difficult to make your business profitable because there are so many things that can take place along the way that will not just negatively affect your business but your confidence level as well. Failing to manage your money properly is one of the things that can contribute to this. In the beginning, you might think that money management isn't something you should focus on because you can easily figure out your earning and expenses. We're sharing a few proper money management tips to help you out because the financial aspect of your business is only going to get more complicated as your business grows.

Avoid combining your business expenses and personal expenses in one account. It might seem simple at first but the truth is that in the long run it just makes everything more difficult. For one, it's a lot harder to prove your income when your business expenses are running through a personal account. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. It's better if you streamline your finances by separating your business expenses from your personal expenses.

It's a good idea to know where exactly every cent goes in both your business and personal life. It's actually helpful when you know where each penny is being spent. With this money management strategy, you can have a clear picture of just what your spending habits are. You wouldn't want to be like those people who wonder where their money went. This can come in handy, especially when you're trying to budget your money because you can see where you can potentially save money. It will also help you streamline things when you need to fill out your tax forms.

Be a prompt tax payer. Typically, small businesses must pay taxes every quarter. When it comes to taxes, you want to make sure you have accurate information, so it's a good idea to consult with someone at the small business center in your town, city, or county or even with someone from the IRS. You can also seek the help of an accountant who specializes in small business accounting. He or she can ensure that you're following all the taxation laws as they relate to small businesses and that you're paying the right amount of taxes on time. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

Not only does learning how to properly manage your money help you improve yourself, it helps improve your business too. These are a few of the tips and tricks that will help you better keep track of your financial situation. When you've got your finances under control, you can expect your business and personal life to be a success.

Aylesford accountants will help with taxation accounting services, HMRC submissions in Aylesford, consultancy and systems advice Aylesford, bureau payroll services, inheritance tax, contractor accounts, accounting services for media companies, small business accounting, corporate tax, workplace pensions in Aylesford, company formations Aylesford, retirement advice, business disposal and acquisition in Aylesford, self-employed registrations, VAT payer registration, financial and accounting advice, general accounting services in Aylesford, payslips, debt recovery Aylesford, VAT returns Aylesford, HMRC submissions, financial statements, business outsourcing, accounting services for the construction sector in Aylesford, accounting support services, partnership accounts, consulting services Aylesford, tax investigations, tax preparation, year end accounts, double entry accounting, annual tax returns and other accounting related services in Aylesford, Kent. These are just a small portion of the tasks that are handled by local accountants. Aylesford providers will be happy to tell you about their entire range of accountancy services.

When you are hunting for advice and inspiration for self-assessment help, accounting & auditing, personal tax assistance and accounting for small businesses, you won't need to look any further than the world wide web to find everything you could need. With such a wide range of painstakingly researched webpages and blog posts on offer, you will soon be overwhelmed with great ideas for your upcoming project. The other day we stumbled across this compelling article outlining five tips for locating a quality accountant.

Aylesford Accounting Services

- Aylesford Payroll Management

- Aylesford Tax Planning

- Aylesford Bookkeeping

- Aylesford Forensic Accounting

- Aylesford Financial Advice

- Aylesford Taxation Advice

- Aylesford Personal Taxation

- Aylesford Business Accounting

- Aylesford Account Management

- Aylesford Chartered Accountants

- Aylesford Tax Services

- Aylesford PAYE Healthchecks

- Aylesford Specialist Tax

- Aylesford Bookkeeping Healthchecks

Also find accountants in: Markbeech, Leybourne, Dymchurch, Wallend, Fordcombe, Boughton Street, Luddesdown, Newenden, Heaverham, Yorkletts, Bekesbourne, West Langdon, West Hougham, Frith, Grafty Green, Kingsnorth Power Station, Hoaden, Maxton, Collier Street, Stelling Minnis, Lenham Heath, Shalmsford Street, Newington, Ridley, Leigh, Canterbury, Small Hythe, Milebush, Milstead, Buckland, Newbarn, Dean Street, Stockbury, Shadoxhurst, Dargate and more.

Accountant Aylesford

Accountant Aylesford Accountants Near Aylesford

Accountants Near Aylesford Accountants Aylesford

Accountants AylesfordMore Kent Accountants: Gravesend, Aylesford, Swanscombe, New Romney, Westerham, Kingsnorth, Meopham, Sturry, Pembury, Northfleet, Sandwich, Margate, Lydd, Paddock Wood, Southborough, Cranbrook, Chatham, Westgate-on-Sea, Deal, Sheerness, Wilmington, Strood, Ramsgate, Herne Bay, Minster, Tenterden, Sittingbourne, Gillingham, Tunbridge Wells, Broadstairs, Swanley, Snodland, Dover, Whitstable, Ashford, Biggin Hill, Sevenoaks, Canterbury, Edenbridge, Hartley, Maidstone, Boxley, East Malling, Folkestone, Faversham, Birchington-on-Sea, Tonbridge, Staplehurst, West Kingsdown, Walmer, Rochester, Dartford and Bearsted.

TOP - Accountants Aylesford - Financial Advisers

Small Business Accountant Aylesford - Financial Advice Aylesford - Tax Advice Aylesford - Bookkeeping Aylesford - Auditing Aylesford - Financial Accountants Aylesford - Chartered Accountant Aylesford - Online Accounting Aylesford - Tax Return Preparation Aylesford