Accountants Oldbury: Do you seem to get little else but a headache when you're filling in your annual self-assessment form? Many other people in Oldbury have to overcome this very problem. But how straightforward is it to obtain a local Oldbury professional who can do it on your behalf? Maybe self-assessment is just too challenging for you? You should expect to pay out about £200-£300 when using the services of a run-of-the-mill Oldbury accountant or bookkeeper. You'll be able to get it done more cheaply by using one of the many online accounting services.

But exactly what will you need to pay, what standard of service should you expect and where can you locate the right person? The internet seems to be the "in" place to look these days, so that would certainly be a good place to start. But, exactly who can you trust? It is always worth considering that it's possible for practically any Oldbury individual to promote themselves as a bookkeeper or accountant. No formal qualifications are legally required in order to do this.

Finding a properly qualified Oldbury accountant should be your priority. The AAT qualification is the minimum you should look for. Qualified Oldbury accountants might charge a bit more but they may also get you the maximum tax savings. The cost of preparing your self-assessment form can be claimed back as a business expense. Local Oldbury bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

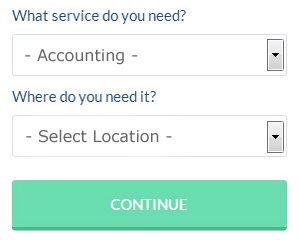

If you want to reach out to a number of local Oldbury accountants, you could always use a service called Bark. You only need to answer a few basic questions and complete a straightforward form. Sometimes in as little as a couple of hours you will hear from prospective Oldbury accountants who are keen to get to work for you.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. For many self-employed people this is a convenient and time-effective solution. Do some homework to single out a company with a good reputation. The easiest way to do this is by studying online reviews.

If you want to use the most qualified person to deal with your finances, a chartered accountant would be the choice. These highly motivated professionals will have all the answers but may be over the top for small businesses. So, at the end of the day the choice is yours.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? Using accounting software like Basetax, Taxfiler, Xero, BTCSoftware, Andica, Keytime, CalCal, Ablegatio, 123 e-Filing, Forbes, Gbooks, GoSimple, Absolute Topup, Taxshield, Capium, TaxCalc, Sage, Taxforward, ACCTAX, Nomisma or Ajaccts will make it even simpler to do yourself. You'll receive a fine if your self-assessment is late.

Forensic Accountant Oldbury

When you happen to be searching for an accountant in Oldbury you'll undoubtedly come across the phrase "forensic accounting" and be curious about what the difference is between a forensic accountant and a standard accountant. The clue for this is the word 'forensic', which essentially means "relating to or denoting the application of scientific methods and techniques for the investigation of a crime." Sometimes also referred to as 'financial forensics' or 'forensic accountancy', it uses auditing, accounting and investigative skills to sift through financial accounts so as to detect fraud and criminal activity. A few of the bigger accounting companies in the Oldbury area could even have specialist forensic accounting divisions with forensic accountants focusing on certain sorts of fraud, and might be dealing with bankruptcy, personal injury claims, tax fraud, professional negligence, money laundering, insurance claims and insolvency.

Payroll Services Oldbury

Staff payrolls can be a stressful area of running a company in Oldbury, irrespective of its size. Controlling staff payrolls demands that all legal requirements regarding their transparency, exactness and timings are observed to the finest detail.

A small business may well not have the advantage of an in-house financial specialist and the simplest way to deal with the issue of employee payrolls is to use an independent accounting company in Oldbury. Working along with HMRC and pension scheme administrators, a managed payroll service accountant will also manage BACS payments to staff, ensuring they are paid on time each month, and that all mandatory deductions are done accurately.

Adhering to current regulations, a decent payroll accountant in Oldbury will also present each of your workers with a P60 after the end of each financial year. They will also provide P45 tax forms at the termination of an employee's contract with your company.

Oldbury accountants will help with contractor accounts, accounting services for buy to let landlords, limited company accounting, audit and auditing, litigation support Oldbury, National Insurance numbers, PAYE, VAT payer registration Oldbury, debt recovery, pension advice, HMRC submissions, tax investigations in Oldbury, small business accounting in Oldbury, sole traders in Oldbury, bookkeeping, employment law, bureau payroll services, assurance services, double entry accounting in Oldbury, business disposal and acquisition, investment reviews, capital gains tax, payroll accounting, management accounts, consulting services, financial planning, cashflow projections Oldbury, tax preparation Oldbury, estate planning in Oldbury, business support and planning, inheritance tax in Oldbury, general accounting services and other accounting related services in Oldbury, West Midlands. These are just a handful of the duties that are handled by local accountants. Oldbury professionals will be delighted to keep you abreast of their full range of accounting services.

Oldbury Accounting Services

- Oldbury Tax Refunds

- Oldbury Business Accounting

- Oldbury Financial Audits

- Oldbury Self-Assessment

- Oldbury Bookkeeping Healthchecks

- Oldbury Tax Services

- Oldbury Payroll Management

- Oldbury Bookkeeping

- Oldbury Tax Planning

- Oldbury Debt Recovery

- Oldbury Personal Taxation

- Oldbury Chartered Accountants

- Oldbury PAYE Healthchecks

- Oldbury Specialist Tax

Also find accountants in: Walsall, Foleshill, Solihull, Clayhanger, Northfield, Moseley, Bickenhill, Princes End, Stoke, Chadwick End, Bentley Heath, Bournbrook, Knowle, Brownhills, Allesley, Meer End, Illey, Rubery, Pensnett, Kineton Green, Pelsall, Dorridge, Quarry Bank, Saltley, Harborne, Kingswinford, Wall Heath, Upper Gornal, Court House Green, Bradley, Shire Oak, Castle Bromwich, Barston, Hall Green, Solihull Lodge and more.

Accountant Oldbury

Accountant Oldbury Accountants Near Me

Accountants Near Me Accountants Oldbury

Accountants OldburyMore West Midlands Accountants: Darlaston, Bloxwich, Aldridge, Willenhall, Wolverhampton, Birmingham, Stourbridge, Dudley, Bilston, Smethwick, Oldbury, Sutton Coldfield, Blackheath, Wednesbury, Coventry, Brierley Hill, Solihull, Sedgley, Brownhills, Kingswinford, Tipton, Coseley, Rowley Regis, West Bromwich, Halesowen, Wednesfield and Walsall.

TOP - Accountants Oldbury - Financial Advisers

Self-Assessments Oldbury - Auditing Oldbury - Investment Accountant Oldbury - Bookkeeping Oldbury - Small Business Accountants Oldbury - Chartered Accountant Oldbury - Financial Accountants Oldbury - Financial Advice Oldbury - Cheap Accountant Oldbury