Accountants Norwich: If you are a sole trader, are running a small business or are otherwise self-employed in Norwich, you will find great advantages to having access your own accountant. Your accountant should at the minimum be able to free up some time for you by handling areas like payroll, self-assessment tax returns and bookkeeping. For those new to business it can be a good idea to do a bit of bookwork yourself but don't be afraid to ask for some help. If you've got plans to expand your Norwich business you'll find an increasing need for expert financial advice.

In your search for an accountant in the Norwich area, you could be confused by the different types that you can choose from. Your aim is to pick one that meets your specific requirements. You might choose to pick one that works independently or one within a practice or company. Having several accounting experts together within a single practice can have many advantages. With an accountancy company you will have a choice of: bookkeepers, actuaries, chartered accountants, accounting technicians, forensic accountants, investment accountants, financial accountants, tax preparation accountants, auditors, costing accountants and management accountants.

It is advisable for you to find an accountant in Norwich who is properly qualified. Smaller businesses and sole traders need only look for an accountant who holds an AAT qualification. You can then have peace of mind knowing that your tax affairs are being handled professionally. It should go without saying that accountants fees are tax deductable. Local Norwich bookkeepers may offer a suitable self-assessment service which is ideal for smaller businesses.

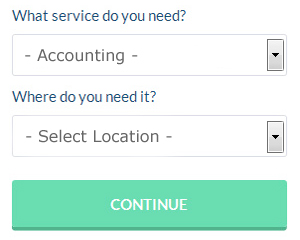

To save yourself a bit of time when searching for a reliable Norwich accountant online, you might like to try a service called Bark. You will quickly be able to complete the form and your search will begin. Within a few hours you should hear from some local accountants who are willing to help you. And the great thing about Bark is that it is completely free to use.

Online tax returns services are the cheapest option, apart from doing your own self-assessment submissions. Nowadays more and more people are using this kind of service. Picking a reputable company is important if you choose to go with this option. A good method for doing this is to check out any available customer reviews and testimonials. Sorry, but we cannot give any recommendations in this respect.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. Larger companies in the Norwich area may choose to use their expert services. You will certainly be hiring the best if you do choose one of these.

In the final analysis you may decide to do your own tax returns. You can take much of the hard graft out of this procedure by using a software program such as Ablegatio, Basetax, 123 e-Filing, Taxfiler, CalCal, Ajaccts, GoSimple, Gbooks, Taxforward, Xero, Keytime, Taxshield, BTCSoftware, Nomisma, TaxCalc, Forbes, Sage, ACCTAX, Andica, Capium or Absolute Topup. If you don't get your self-assessment in on time you will get fined by HMRC.

Forensic Accounting Norwich

You could well notice the term "forensic accounting" when you are looking for an accountant in Norwich, and will possibly be wondering what is the difference between regular accounting and forensic accounting. The clue for this is the word 'forensic', which essentially means "appropriate for use in a court of law." Also called 'financial forensics' or 'forensic accountancy', it uses investigative skills, auditing and accounting to identify irregularities in financial accounts which have contributed to fraud or theft. There are a few larger accountants firms in Norfolk who've got specialised departments for forensic accounting, dealing with tax fraud, professional negligence, bankruptcy, false insurance claims, personal injury claims, insolvency and money laundering. (Tags: Forensic Accountants Norwich, Forensic Accountant Norwich, Forensic Accounting Norwich)

Financial Actuaries Norwich

An actuary is a business specialist who deals with the managing and measurement of uncertainty and risk. These risks can have an impact on both sides of a company balance sheet and call for valuation, liability management and asset management skills. An actuary uses statistics and math concepts to assess the financial impact of uncertainties and help their clients lessen potential risks.

Proper Money Management Tips for Small Business Owners

There are many things you can do in life that are exciting, and one of them is starting up your own online or offline business. You're your own boss and you're in control of how much you make. Well, you're basically in charge of everything! It's a bit scary, isn't it? Although it's exhilarating, putting up your own business is also an intimidating process, especially if you're a complete novice. This is where knowing some simple self improvement techniques, like learning how to properly manage your money, can be quite helpful. So if you wish to know how you can manage your money correctly, keep reading.

Keep separate accounts for your business and personal expenses, as trying to run everything through one account just makes everything confusing. It might seem simple at first but the truth is that in the long run it just makes everything more difficult. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. You'll be able to manage your finances better if you separate the business expenses from the personal expenses.

Try to learn bookkeeping. It's important that you have a system in place for your money -- both for your personal and business finances. For this, you can use a basic spreadsheet or go with software like Quicken. There are also other online tools you can use, like Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. You'll know exactly what's happening to your business and personal finances when you've got your books in order. And if you simply can't afford to hire a bookkeeper at this time, you'll benefit from taking a basic bookkeeping and accounting class.

Track every single penny you bring in. Make sure that you write down the amount from every payment you receive that's business related. With this money management strategy, you can easily keep track of how much money you've got on hand, as well as who has already paid their dues and who hasn't. This money management strategy also makes it a lot easier on you to determine the amount of money you owe in taxes and even how much money you should pay yourself.

There are so many different things that go into helping you properly manage your money. You might think that this is a basic skill and it shouldn't be that complicated, but the truth is that as a small business owner, proper money management is an intricate and often complicated process. Hopefully, the tips we've shared in this article will help you get started in managing your finances better. It's crucial that you stay on top of your business finances.

Small Business Accountants Norwich

Company accounting can be a stress-filled experience for any small business owner in Norwich. A dedicated small business accountant in Norwich will provide you with a stress free approach to keep your annual accounts, VAT and tax returns in the best possible order.

A good small business accountant will see it as their responsibility to help your business to develop, supporting you with good advice, and giving you peace of mind and security concerning your financial situation at all times. A decent accounting firm in Norwich should be able to offer practical small business advice to maximise your tax efficiency while at the same time minimising business costs; critical in the sometimes shadowy world of business taxation.

It is critical that you clarify your company's financial circumstances, your plans for the future and your business structure truthfully to your small business accountant.

Norwich accountants will help with inheritance tax, accounting support services, financial planning, management accounts, debt recovery, contractor accounts Norwich, accounting services for start-ups, business support and planning, capital gains tax in Norwich, HMRC submissions in Norwich, accounting and auditing, consulting services, mergers and acquisitions, accounting services for the construction sector, personal tax, double entry accounting, payroll accounting, pension forecasts Norwich, cash flow, company secretarial services, VAT payer registration in Norwich, payslips, company formations, workplace pensions, tax investigations in Norwich, limited company accounting, tax returns Norwich, corporation tax Norwich, business advisory, small business accounting, litigation support, HMRC submissions and other kinds of accounting in Norwich, Norfolk. These are just a handful of the duties that are conducted by local accountants. Norwich professionals will be happy to tell you about their entire range of services.

With the web as a resource it is quite easy to find plenty of invaluable ideas and information regarding personal tax assistance, accounting for small businesses, accounting & auditing and self-assessment help. For example, with a brief search we found this intriguing article describing how to track down an accountant to complete your income tax return.

Norwich Accounting Services

- Norwich Chartered Accountants

- Norwich Specialist Tax

- Norwich Bookkeeping Healthchecks

- Norwich Bookkeeping

- Norwich Tax Planning

- Norwich Tax Refunds

- Norwich Financial Advice

- Norwich Tax Services

- Norwich Forensic Accounting

- Norwich Personal Taxation

- Norwich Business Accounting

- Norwich Debt Recovery

- Norwich Self-Assessment

- Norwich Tax Advice

Also find accountants in: Happisburgh, Saddle Bow, Drayton, Little Snoring, Horsey, Runham, East Poringland, Little Walsingham, Runcton Holme, Forncett St Peter, Spixworth, High Green, Hellington, Mundham, Attlebridge, St Johns Fen End, Topcroft, West Winch, Barmer, Roudham, Cranwich, East Raynham, East Dereham, Fordham, Stody, Cantley, East Runton, New Houghton, Ashmanhaugh, Tasburgh, Hockwold Cum Wilton, Daffy Green, Aslacton, Flitcham, Silfield and more.

Accountant Norwich

Accountant Norwich Accountants Near Me

Accountants Near Me Accountants Norwich

Accountants NorwichMore Norfolk Accountants: Great Yarmouth, Dereham, Taverham, Kings Lynn, Norwich, Gorleston, Thetford and Wymondham.

TOP - Accountants Norwich - Financial Advisers

Auditing Norwich - Bookkeeping Norwich - Online Accounting Norwich - Financial Advice Norwich - Small Business Accountants Norwich - Tax Advice Norwich - Cheap Accountant Norwich - Tax Preparation Norwich - Investment Accountant Norwich