Accountants Leamington Spa: Anybody operating a business in Leamington Spa, Warwickshire will pretty quickly realise that there are many advantages to having an accountant at the end of the phone. One of the principal advantages will be that with your accountant handling the routine paperwork and bookkeeping, you should have extra free time to spend on what you do best, the actual operation of your core business. If you're only just getting started in business you will find the help of a professional accountant invaluable.

You'll soon discover that there are various forms of accountant. Choosing one that satisfies your needs exactly should be your objective. You will come to realise that there are accountants who work solo and accountants who work for accounting firms. Accounting practices will typically have different divisions each handling a certain field of accounting. Some of the principal accounting positions include the likes of: management accountants, financial accountants, bookkeepers, actuaries, costing accountants, chartered accountants, auditors, tax accountants, forensic accountants, investment accountants and accounting technicians.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. You don't need a chartered accountant but should get one who is at least AAT qualified. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

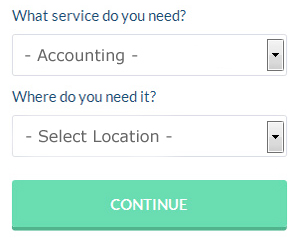

To save yourself a bit of time when searching for a reliable Leamington Spa accountant online, you might like to try a service called Bark. They provide an easy to fill in form that gives an overview of your requirements. Your details will be sent out to potential accountants and they will contact you directly with details and prices. This service is free of charge.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. It could be that this solution will be more appropriate for you. Some of these companies are more reputable than others. Carefully read reviews online in order to find the best available.

At the top of the tree are chartered accountants, these professionals have all the qualifications and are experts in their field. These highly motivated professionals will have all the answers but may be over the top for small businesses. This widens your choice of accountants.

In the final analysis you may decide to do your own tax returns. You could even use a software program like Taxfiler, Taxforward, Nomisma, Taxshield, Ajaccts, TaxCalc, CalCal, Absolute Topup, BTCSoftware, Andica, Xero, Gbooks, Sage, Basetax, Ablegatio, Capium, 123 e-Filing, ACCTAX, Forbes, GoSimple or Keytime to make life even easier. In any event the most important thing is to get your self-assessment set in before the deadline. The standard fine for being up to three months late is £100.

Auditors Leamington Spa

An auditor is a person authorised to assess and validate the reliability of accounts to make sure that businesses or organisations conform to tax laws. Auditors evaluate the financial actions of the firm which employs them and make certain of the unwavering operation of the organisation. To work as an auditor, a person must be accredited by the regulating body of accounting and auditing and possess certain qualifications. (Tags: Auditors Leamington Spa, Auditing Leamington Spa, Auditor Leamington Spa)

Practicing Better Money Management to Help Your Business Succeed

The fact that you get to be completely in charge of your income is one of the good reasons to put up your own business. At the same time, however, many people get overwhelmed when it comes to managing the funds for their business. Lucky for you, there are several things that can help you with this. In this article, we'll share with you some of these things.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. Here's what you can do: every day or every week, take a portion of the payments you receive and then put that in a separate account. This is a good strategy because when your taxes come due every quarter, you've already got money set aside and you won't be forced to take money out from your current earnings. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. All payments you get from selling goods or offering services should go straight to your business account. Every two weeks or every month, write yourself a paycheck and then deposit that to your personal account. How much should you pay yourself? It's up to you. Your salary can be an hourly rate or a portion of your business income.

Keep all of your receipts. These receipts are going to be heaven-sent if the IRS ever come knocking at your door demanding to see proof of what you've been spending and where you've been spending your money on. They're also records of business related expenses. Make sure you keep your receipts together in one place. If you do this, you can easily track transactions or expenses. Keep all your receipts in an accordion file in your desk drawer.

When it comes to improving yourself and your business, proper money management is one of the most essential things you can learn. You've read just three money management tips that you can use to help you manage your finances better. Keep your finances under control and you can look forward to a better, more successful personal life and business life.

Actuaries Leamington Spa

An actuary is a business expert who assesses the measurement and management of uncertainty and risk. They use their in-depth knowledge of economics and business, combined with their understanding of investment theory, statistics and probability theory, to provide commercial, strategic and financial advice. An actuary uses math and statistical concepts to determine the fiscal impact of uncertainties and help clients lessen possible risks.

Small Business Accountants Leamington Spa

Ensuring your accounts are accurate can be a stressful job for any small business owner in Leamington Spa. If your annual accounts are getting on top of you and tax returns and VAT issues are causing sleepless nights, it is advisable to use a decent small business accountant in Leamington Spa.

Helping you expand your business, and giving financial advice relating to your particular circumstances, are just two of the means by which a small business accountant in Leamington Spa can benefit you. The capricious and sometimes complex sphere of business taxation will be clearly explained to you in order to lower your business costs, while maximising tax efficiency.

It is also critical that you clarify your current financial circumstances, your future plans and the structure of your business accurately to your small business accountant.

Leamington Spa accountants will help with accounting services for start-ups in Leamington Spa, business support and planning, self-employed registrations, monthly payroll, workplace pensions, PAYE Leamington Spa, pension planning Leamington Spa, capital gains tax, bookkeeping, accounting services for media companies, estate planning, management accounts, National Insurance numbers Leamington Spa, small business accounting Leamington Spa, taxation accounting services, corporation tax, audit and compliance issues, payslips, accounting services for buy to let landlords, employment law Leamington Spa, accounting and auditing in Leamington Spa, consultancy and systems advice in Leamington Spa, personal tax, general accounting services, debt recovery Leamington Spa, tax preparation, investment reviews, financial planning in Leamington Spa, company formations, VAT payer registration, HMRC submissions, VAT returns and other professional accounting services in Leamington Spa, Warwickshire. These are just an example of the duties that are carried out by nearby accountants. Leamington Spa companies will inform you of their whole range of accounting services.

Leamington Spa Accounting Services

- Leamington Spa Tax Returns

- Leamington Spa Payroll Management

- Leamington Spa Forensic Accounting

- Leamington Spa Business Accounting

- Leamington Spa VAT Returns

- Leamington Spa Bookkeeping

- Leamington Spa Auditing Services

- Leamington Spa Tax Refunds

- Leamington Spa Bookkeeping Healthchecks

- Leamington Spa Specialist Tax

- Leamington Spa Personal Taxation

- Leamington Spa Tax Planning

- Leamington Spa Account Management

- Leamington Spa Taxation Advice

Also find accountants in: Eathorpe, Lighthorne, Harborough Magna, Clifton Upon Dunsmore, Long Marston, Fillongley, Grendon, Temple Grafton, Halford, Polesworth, Chadshunt, Rugby, Coleshill, Red Hill, Astley, Maxstoke, Henley In Arden, Fenny Compton, Northend, Princethorpe, Ardens Grafton, Nuthurst, Ryton On Dunsmore, Welford On Avon, Exhall, Kingsbury, Weddington, Stockton, Nether Whitacre, Ettington, Binton, Barnacle, Ladbroke, Rowington Green, Radway and more.

Accountant Leamington Spa

Accountant Leamington Spa Accountants Near Me

Accountants Near Me Accountants Leamington Spa

Accountants Leamington SpaMore Warwickshire Accountants: Stratford-upon-Avon, Atherstone, Warwick, Leamington Spa, Rugby, Bedworth, Nuneaton, Polesworth and Kenilworth.

TOP - Accountants Leamington Spa - Financial Advisers

Bookkeeping Leamington Spa - Cheap Accountant Leamington Spa - Financial Accountants Leamington Spa - Chartered Accountants Leamington Spa - Tax Preparation Leamington Spa - Auditors Leamington Spa - Tax Accountants Leamington Spa - Small Business Accountant Leamington Spa - Online Accounting Leamington Spa